+ In 2021, a firm signed a lease for 6 years with annual payments of $6,009 to be remitted at the end of each

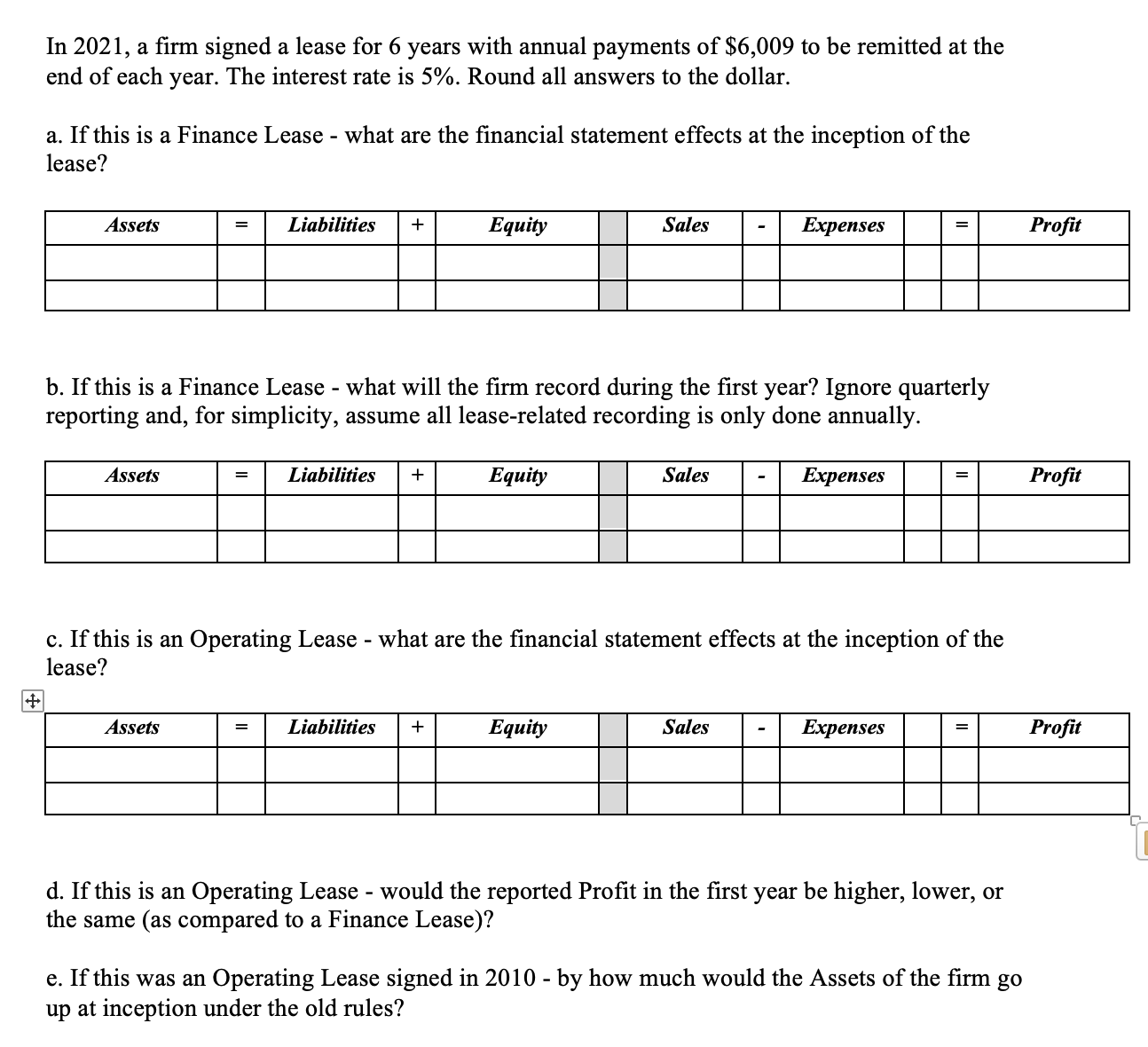

+ In 2021, a firm signed a lease for 6 years with annual payments of $6,009 to be remitted at the end of each year. The interest rate is 5%. Round all answers to the dollar. a. If this is a Finance Lease - what are the financial statement effects at the inception of the lease? Assets = Liabilities + Equity Sales Expenses = Profit b. If this is a Finance Lease - what will the firm record during the first year? Ignore quarterly reporting and, for simplicity, assume all lease-related recording is only done annually. Assets = Liabilities + Equity Sales Expenses = Profit c. If this is an Operating Lease - what are the financial statement effects at the inception of the lease? Assets Liabilities + Equity Sales - Expenses = Profit d. If this is an Operating Lease - would the reported Profit in the first year be higher, lower, or the same (as compared to a Finance Lease)? e. If this was an Operating Lease signed in 2010 - by how much would the Assets of the firm go up at inception under the old rules? C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started