Answered step by step

Verified Expert Solution

Question

1 Approved Answer

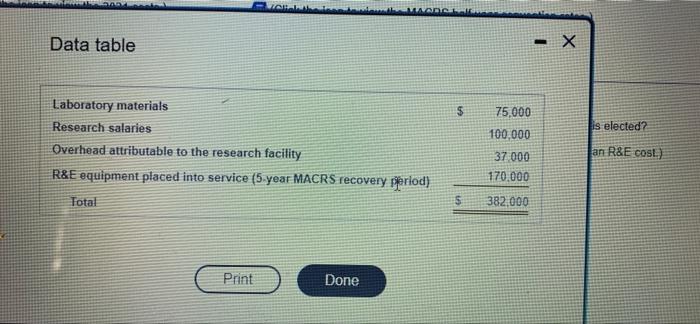

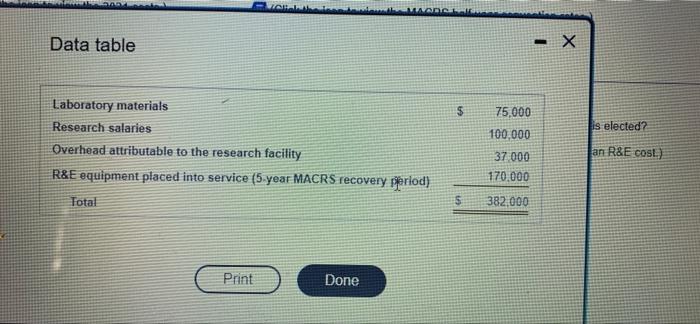

In 2021, Forever corporation acquires a new research facility and hires several scientists to develop new products. No new products are developed until 2022, although

In 2021, Forever corporation acquires a new research facility and hires several scientists to develop new products. No new products are developed until 2022, although the following expeditures were incurred in 2021.

please answer part a and b. i will rate.

please see requirements photo as that is the questions that need to be answered. part a and b

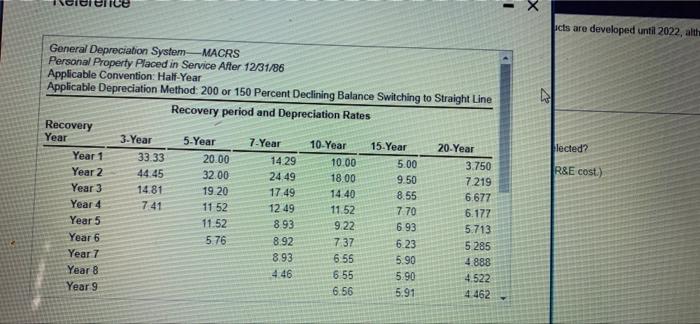

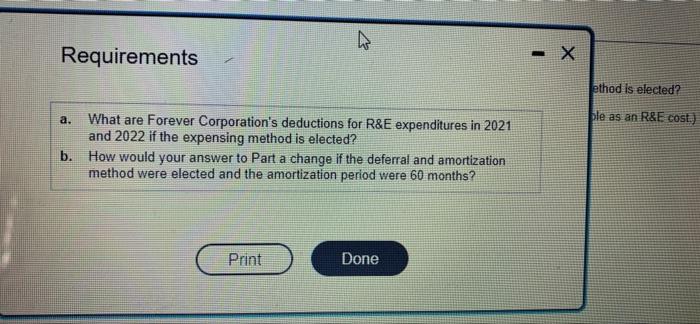

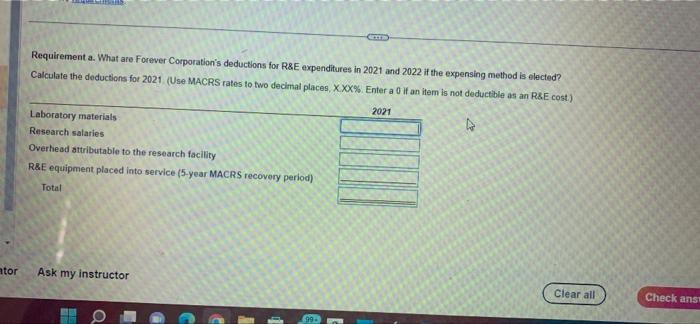

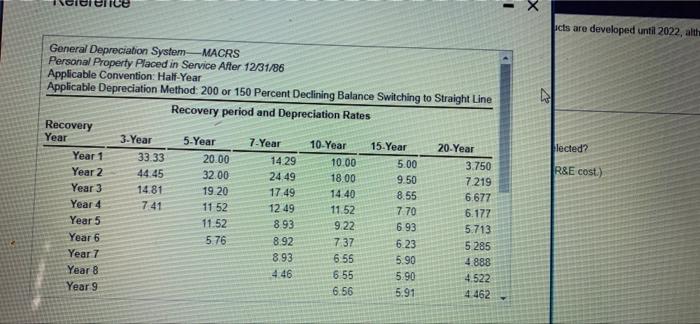

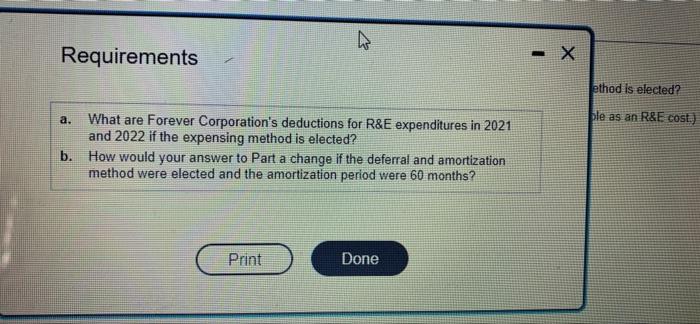

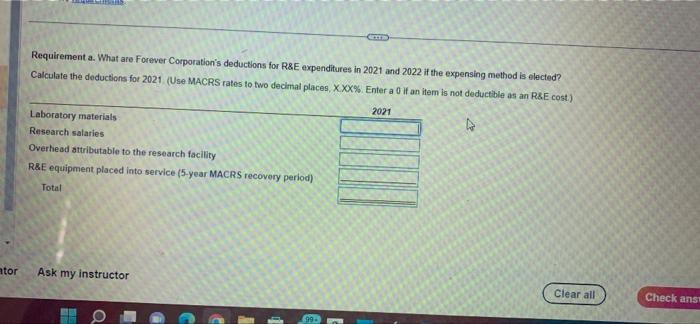

Data table icts are developed until 2022, alth General Depreciabion System-MACRS Persanal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switchina tn Strainht I imn athod is elected? a. What are Forever Corporation's deductions for R\&E expenditures in 2021 le as an R\&E cost.) and 2022 if the expensing method is elected? b. How would your answer to Part a change if the deferral and amortization method were elected and the amortization period were 60 months? Requirement a. What are Forever Corporation's deductions for R\&E expenditures in 2021 and 2022 it the expensing method is elected? Calculate the deductions for 2021 . (Use MACRS rates to two decimat places, XXX\%. Enter a 0 if an item is not deductible as an R.EE cost. Data table icts are developed until 2022, alth General Depreciabion System-MACRS Persanal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switchina tn Strainht I imn athod is elected? a. What are Forever Corporation's deductions for R\&E expenditures in 2021 le as an R\&E cost.) and 2022 if the expensing method is elected? b. How would your answer to Part a change if the deferral and amortization method were elected and the amortization period were 60 months? Requirement a. What are Forever Corporation's deductions for R\&E expenditures in 2021 and 2022 it the expensing method is elected? Calculate the deductions for 2021 . (Use MACRS rates to two decimat places, XXX\%. Enter a 0 if an item is not deductible as an R.EE cost Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started