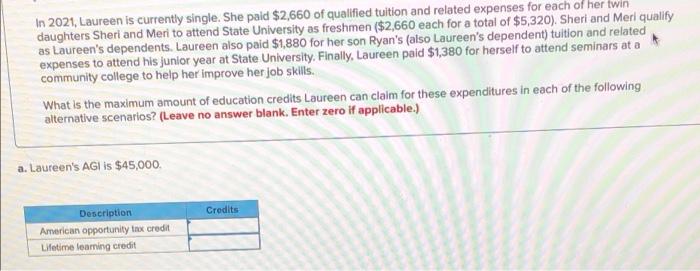

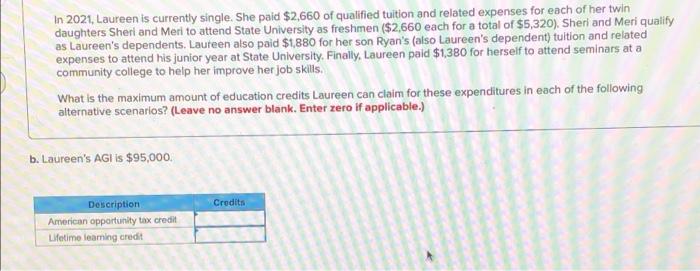

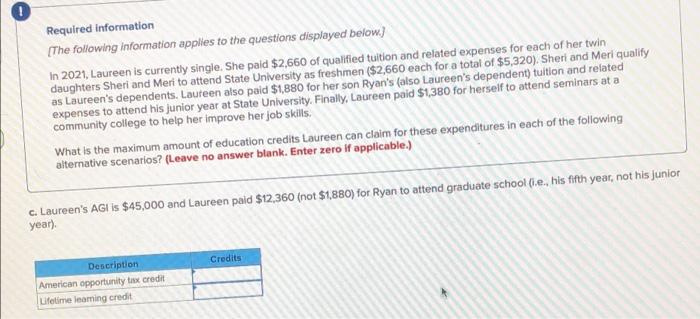

In 2021, Laureen is currently single. She paid $2,660 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,660 each for a total of $5,320). Sheri and Meri qualify as Laureen's dependents. Laureen also paid $1,880 for her son Ryan's (also Laureen's dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid $1,380 for herself to attend seminars at a community college to help her improve her job skills. What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.) a. Laureen's AGI is $45,000. Description Credits American opportunity tax credit Lifetime learning credit In 2021, Laureen is currently single. She paid $2,660 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,660 each for a total of $5,320). Sheri and Meri qualify as Laureen's dependents. Laureen also paid $1,880 for her son Ryan's (also Laureen's dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid $1,380 for herself to attend seminars at a community college to help her improve her job skills. What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.) b. Laureen's AGI is $95,000. Description Credits American opportunity tax credit Lifetime learning credit Required information [The following information applies to the questions displayed below.] In 2021, Laureen is currently single. She paid $2,660 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,660 each for a total of $5,320). Sheri and Meri qualify as Laureen's dependents. Laureen also paid $1,880 for her son Ryan's (also Laureen's dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid $1,380 for herself to attend seminars at a community college to help her improve her job skills. What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.) c. Laureen's AGI is $45,000 and Laureen paid $12,360 (not $1,880) for Ryan to attend graduate school (i.e., his fifth year, not his junior year). Description Credits American opportunity tax credit Lifetime leaming credit