Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2021, Margaret and John Murphy (age 66 and 68, respectively) are married taxpayers who file a joint tax return with AGl of $27,254. During

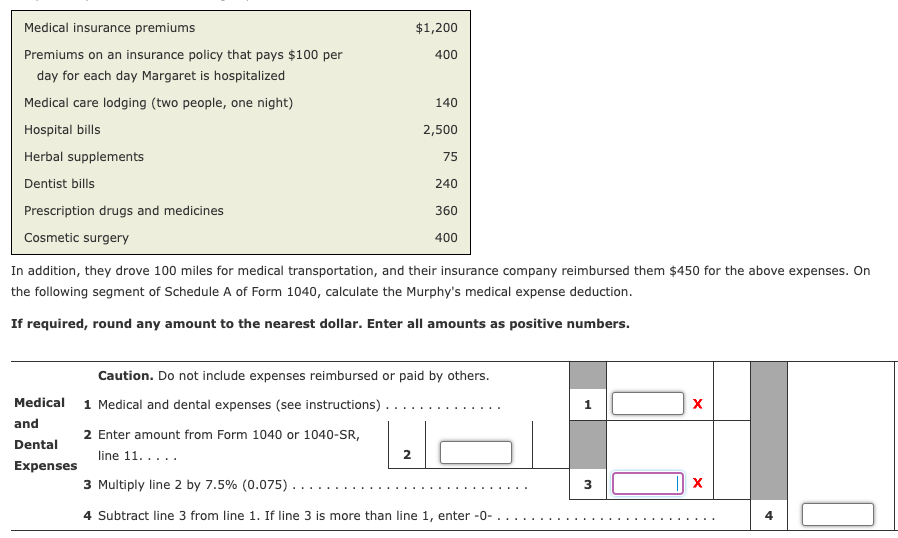

In 2021, Margaret and John Murphy (age 66 and 68, respectively) are married taxpayers who file a joint tax return with AGl of $27,254. During the year they incurred the following expenses:

Medical insurance premiums $1,200 Premiums on an insurance policy that pays $100 per 400 day for each day Margaret is hospitalized Medical care lodging (two people, one night) 140 Hospital bills 2,500 Herbal supplements 75 Dentist bills 240 Prescription drugs and medicines 360 Cosmetic surgery 400 In addition, they drove 100 miles for medical transportation, and their insurance company reimbursed them $450 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy's medical expense deduction. If required, round any amount to the nearest dollar. Enter all amounts as positive numbers. Caution. Do not include expenses reimbursed or paid by others. Medical 1 Medical and dental expenses (see instructions) . .... and 2 Enter amount from Form 1040 or 1040-SR, line 11..... Dental 2 Expenses 3 Multiply line 2 by 7.5% (0.075).. X 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- 4 Medical insurance premiums $1,200 Premiums on an insurance policy that pays $100 per 400 day for each day Margaret is hospitalized Medical care lodging (two people, one night) 140 Hospital bills 2,500 Herbal supplements 75 Dentist bills 240 Prescription drugs and medicines 360 Cosmetic surgery 400 In addition, they drove 100 miles for medical transportation, and their insurance company reimbursed them $450 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy's medical expense deduction. If required, round any amount to the nearest dollar. Enter all amounts as positive numbers. Caution. Do not include expenses reimbursed or paid by others. Medical 1 Medical and dental expenses (see instructions) . .... and 2 Enter amount from Form 1040 or 1040-SR, line 11..... Dental 2 Expenses 3 Multiply line 2 by 7.5% (0.075).. X 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- 4 Medical insurance premiums $1,200 Premiums on an insurance policy that pays $100 per 400 day for each day Margaret is hospitalized Medical care lodging (two people, one night) 140 Hospital bills 2,500 Herbal supplements 75 Dentist bills 240 Prescription drugs and medicines 360 Cosmetic surgery 400 In addition, they drove 100 miles for medical transportation, and their insurance company reimbursed them $450 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy's medical expense deduction. If required, round any amount to the nearest dollar. Enter all amounts as positive numbers. Caution. Do not include expenses reimbursed or paid by others. Medical 1 Medical and dental expenses (see instructions) . .... and 2 Enter amount from Form 1040 or 1040-SR, line 11..... Dental 2 Expenses 3 Multiply line 2 by 7.5% (0.075).. X 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- 4 Medical insurance premiums $1,200 Premiums on an insurance policy that pays $100 per 400 day for each day Margaret is hospitalized Medical care lodging (two people, one night) 140 Hospital bills 2,500 Herbal supplements 75 Dentist bills 240 Prescription drugs and medicines 360 Cosmetic surgery 400 In addition, they drove 100 miles for medical transportation, and their insurance company reimbursed them $450 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy's medical expense deduction. If required, round any amount to the nearest dollar. Enter all amounts as positive numbers. Caution. Do not include expenses reimbursed or paid by others. Medical 1 Medical and dental expenses (see instructions) . .... and 2 Enter amount from Form 1040 or 1040-SR, line 11..... Dental 2 Expenses 3 Multiply line 2 by 7.5% (0.075).. X 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- 4

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Medical and dental expense particulars Amount Amount Amount 1 medical and dent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started