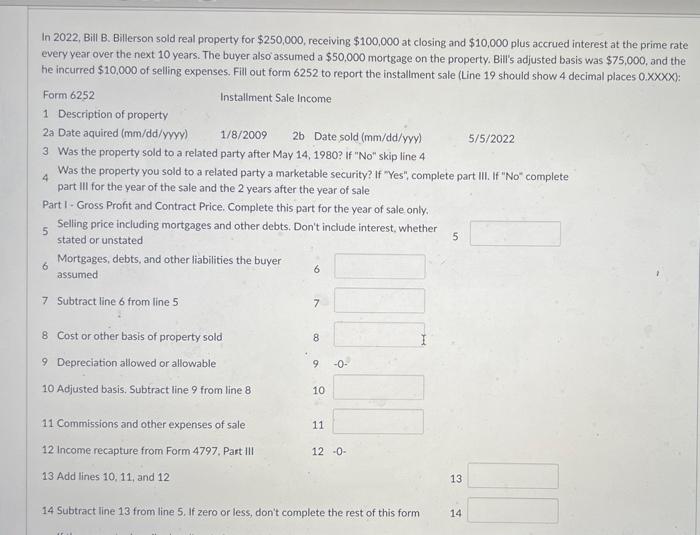

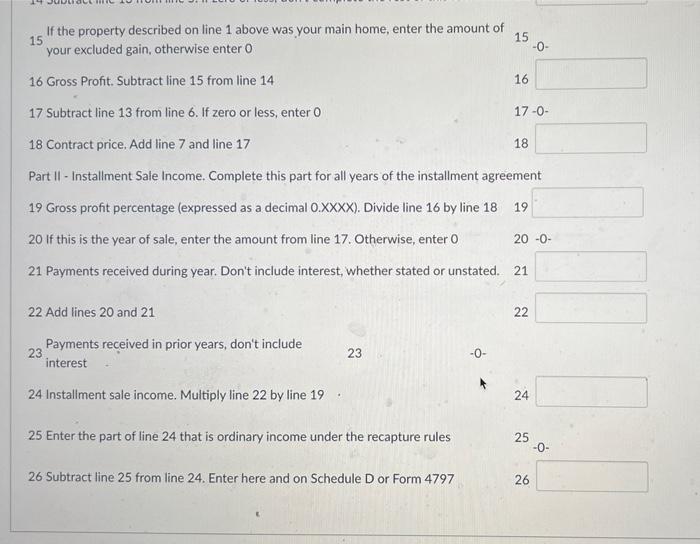

In 2022, Bill B. Billerson sold real property for $250,000, receiving $100,000 at closing and $10,000 plus accrued interest at the prime rate every year over the next 10 years. The buyer also assumed a $50,000 mortgage on the property. Bill's adjusted basis was $75,000, and the he incurred $10,000 of selling expenses. Fill out form 6252 to report the installment sale (Line 19 should show 4 decimal places 0.XXX ): 5/5/2022 - was uie property soia to a reiated party atter May 14, 1980? If "No" skip line 4 Was the property you sold to a related party a marketable security? If "Yes", complete part III. If "No" complete part III for the year of the sale and the 2 years after the year of sale Part I- Gross Profit and Contract Price. Complete this part for the year of sale only. Selling price including mortgages and other debts. Don't include interest, whether stated or unstated 5 Mortgages, debts, and other liabilities the buyer assumed 7 Subtract line 6 from line 5 8 Cost or other basis of property sold 9 Depreciation allowed or allowable 6 10 Adjusted basis. Subtract line 9 from line 8 11 Commissions and other expenses of sale 11 12 Income recapture from Form 4797. Part ill 12 - 0 - 13 Add lines 10, 11, and 12 13 14 Subtract line 13 from line 5. If zero or less, don't complete the rest of this form 14 15 If the property described on line 1 above was your main home, enter the amount of your excluded gain, otherwise enter 0 16 Gross Profit. Subtract line 15 from line 14 17 Subtract line 13 from line 6 . If zero or less, enter 0 150 18 Contract price, Add line 7 and line 17 16 Part II - Installment Sale Income. Complete this part for all years of the installment agreement 19 Gross profit percentage (expressed as a decimal 0.XXXX ). Divide line 16 by line 1819 20 If this is the year of sale, enter the amount from line 17. Otherwise, enter 0200 - 21 Payments received during year. Don't include interest, whether stated or unstated. 21 22 Add lines 20 and 21 25 23 Payments received in prior years, don't include interest 23 0 24 Installment sale income. Multiply line 22 by line 19 24 25 Enter the part of line 24 that is ordinary income under the recapture rules 25 26 Subtract line 25 from line 24. Enter here and on Schedule D or Form 4797 26 In 2022, Bill B. Billerson sold real property for $250,000, receiving $100,000 at closing and $10,000 plus accrued interest at the prime rate every year over the next 10 years. The buyer also assumed a $50,000 mortgage on the property. Bill's adjusted basis was $75,000, and the he incurred $10,000 of selling expenses. Fill out form 6252 to report the installment sale (Line 19 should show 4 decimal places 0.XXX ): 5/5/2022 - was uie property soia to a reiated party atter May 14, 1980? If "No" skip line 4 Was the property you sold to a related party a marketable security? If "Yes", complete part III. If "No" complete part III for the year of the sale and the 2 years after the year of sale Part I- Gross Profit and Contract Price. Complete this part for the year of sale only. Selling price including mortgages and other debts. Don't include interest, whether stated or unstated 5 Mortgages, debts, and other liabilities the buyer assumed 7 Subtract line 6 from line 5 8 Cost or other basis of property sold 9 Depreciation allowed or allowable 6 10 Adjusted basis. Subtract line 9 from line 8 11 Commissions and other expenses of sale 11 12 Income recapture from Form 4797. Part ill 12 - 0 - 13 Add lines 10, 11, and 12 13 14 Subtract line 13 from line 5. If zero or less, don't complete the rest of this form 14 15 If the property described on line 1 above was your main home, enter the amount of your excluded gain, otherwise enter 0 16 Gross Profit. Subtract line 15 from line 14 17 Subtract line 13 from line 6 . If zero or less, enter 0 150 18 Contract price, Add line 7 and line 17 16 Part II - Installment Sale Income. Complete this part for all years of the installment agreement 19 Gross profit percentage (expressed as a decimal 0.XXXX ). Divide line 16 by line 1819 20 If this is the year of sale, enter the amount from line 17. Otherwise, enter 0200 - 21 Payments received during year. Don't include interest, whether stated or unstated. 21 22 Add lines 20 and 21 25 23 Payments received in prior years, don't include interest 23 0 24 Installment sale income. Multiply line 22 by line 19 24 25 Enter the part of line 24 that is ordinary income under the recapture rules 25 26 Subtract line 25 from line 24. Enter here and on Schedule D or Form 4797 26