Question

In 2022, Red Corp., a C corporation, donated shares of stock to a qualified charitable organization. The shares had a fair market value of

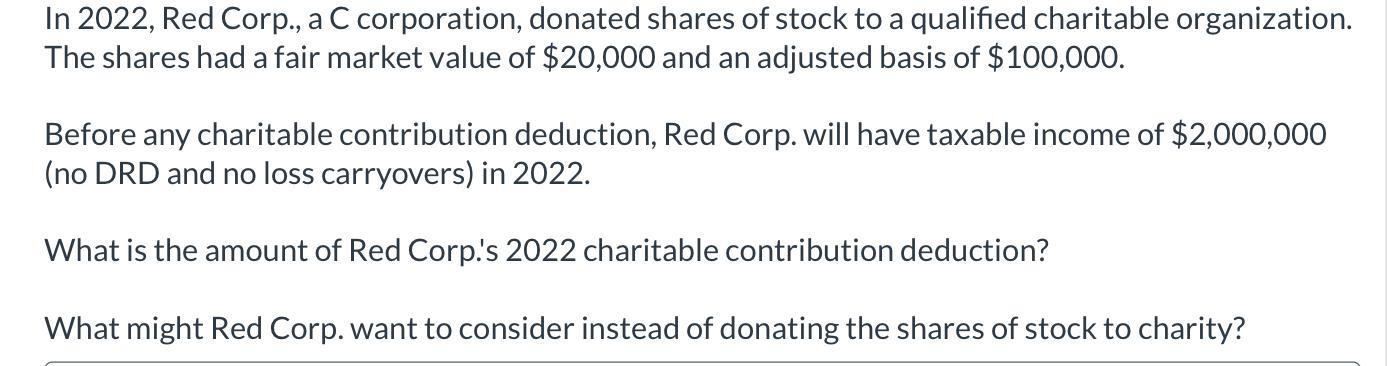

In 2022, Red Corp., a C corporation, donated shares of stock to a qualified charitable organization. The shares had a fair market value of $20,000 and an adjusted basis of $100,000. Before any charitable contribution deduction, Red Corp. will have taxable income of $2,000,000 (no DRD and no loss carryovers) in 2022. What is the amount of Red Corp!'s 2022 charitable contribution deduction? What might Red Corp. want to consider instead of donating the shares of stock to charity?

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been developed in a clear step by step manner Step 1 Answer Contributi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2017 Comprehensive

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

40th Edition

1305874161, 978-1305874169

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App