Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2022, Zach and his wife, Katie, had combined income of $118,000 before their investment transactions (below). and they file a joint tax return.

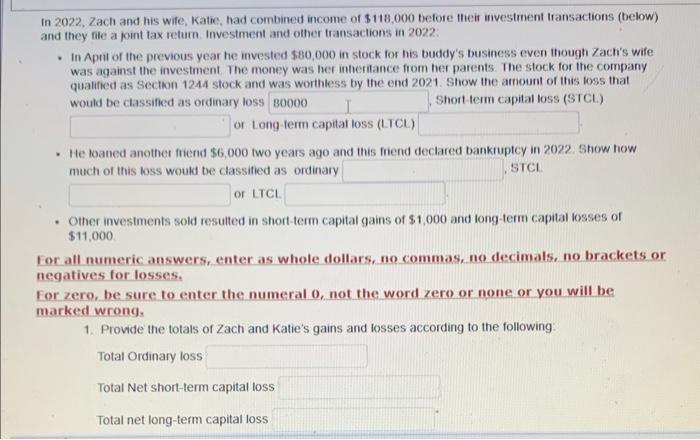

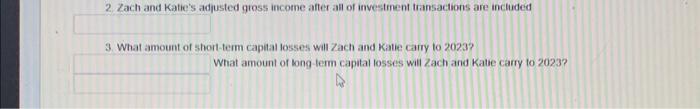

In 2022, Zach and his wife, Katie, had combined income of $118,000 before their investment transactions (below). and they file a joint tax return. Investment and other transactions in 2022 In April of the previous year he invested $80,000 in stock for his buddy's business even though Zach's wife was against the investment. The money was her inheritance from her parents. The stock for the company qualified as Section 1244 stock and was worthless by the end 2021. Show the amount of this loss that would be classified as ordinary loss 80000 Short-term capital loss (STCL) or Long-term capital loss (LTCL) He loaned another friend $6,000 two years ago and this friend declared bankruptcy in 2022. Show how much of this loss would be classified as ordinary STCL or LTCL Other investments sold resulted in short-term capital gains of $1,000 and long-term capital losses of $11,000 For all numeric answers, enter as whole dollars, no commas, no decimals, no brackets or negatives for losses. For zero, be sure to enter the numeral 0, not the word zero or none or you will be marked wrong. 1. Provide the totals of Zach and Katie's gains and losses according to the following: Total Ordinary loss Total Net short-term capital loss Total net long-term capital loss. 2. Zach and Katie's adjusted gross income after all of investment transactions are included 3. What amount of short-term capital losses will Zach and Katie carry to 2023? What amount of long-term capital losses will Zach and Katie carry to 2023?

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started