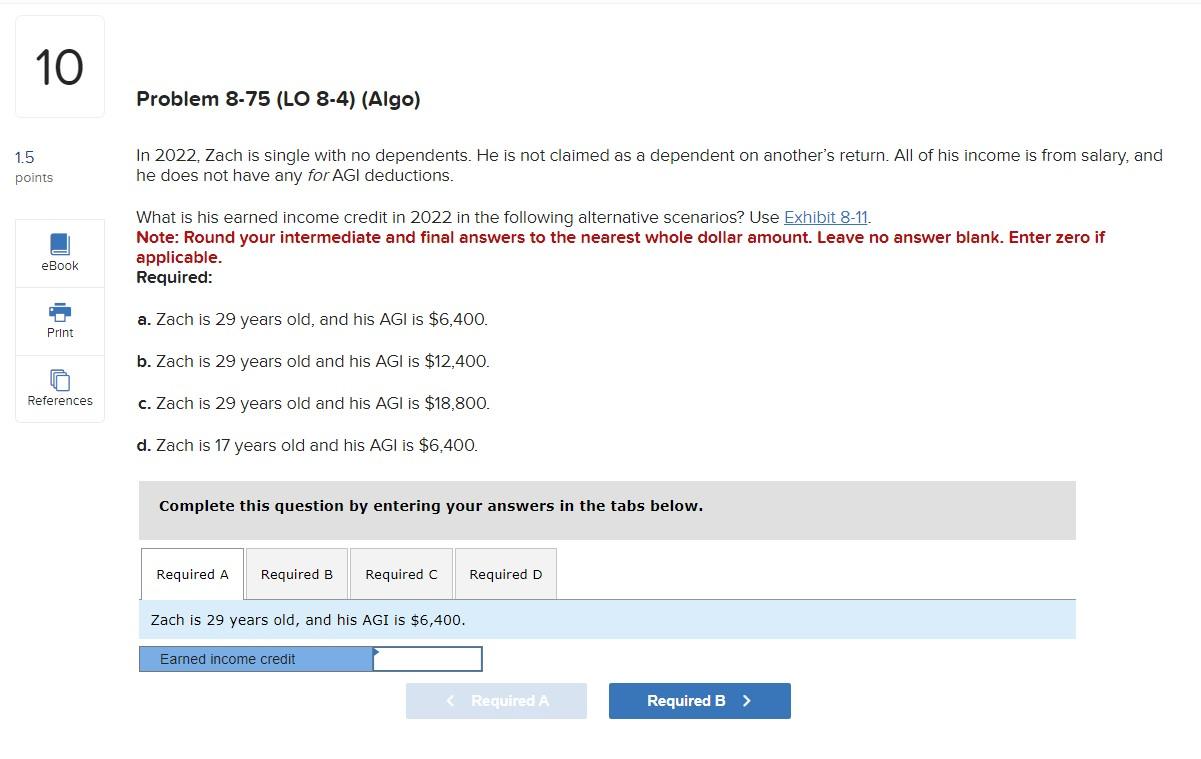

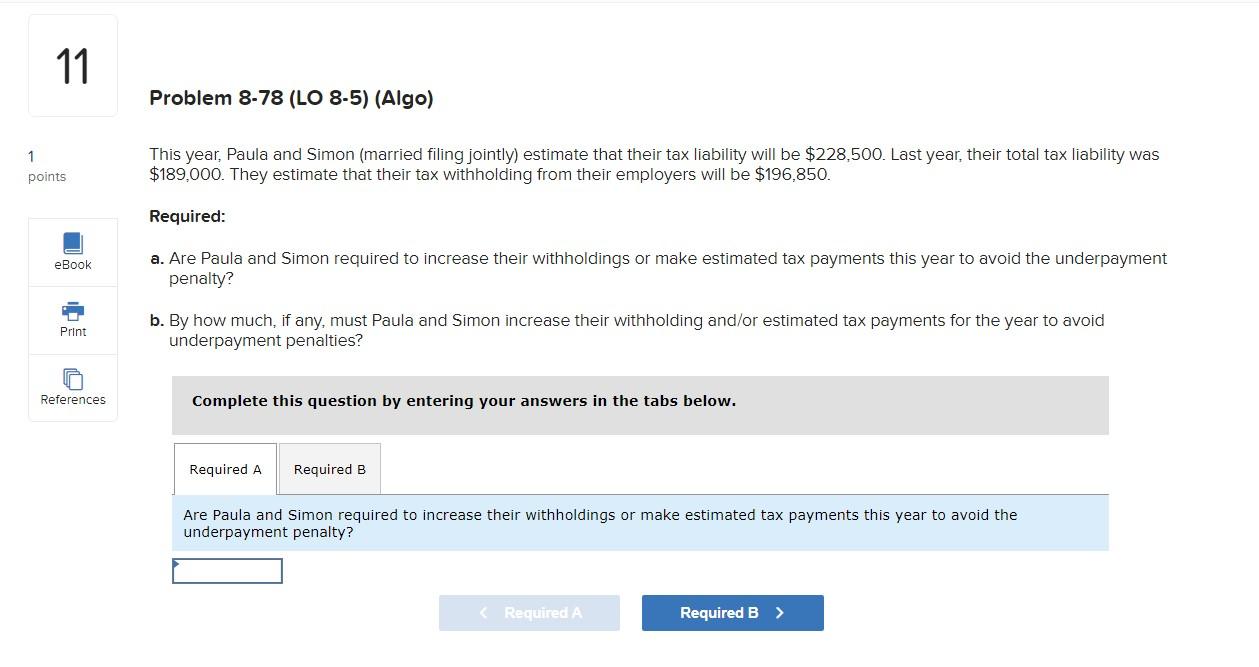

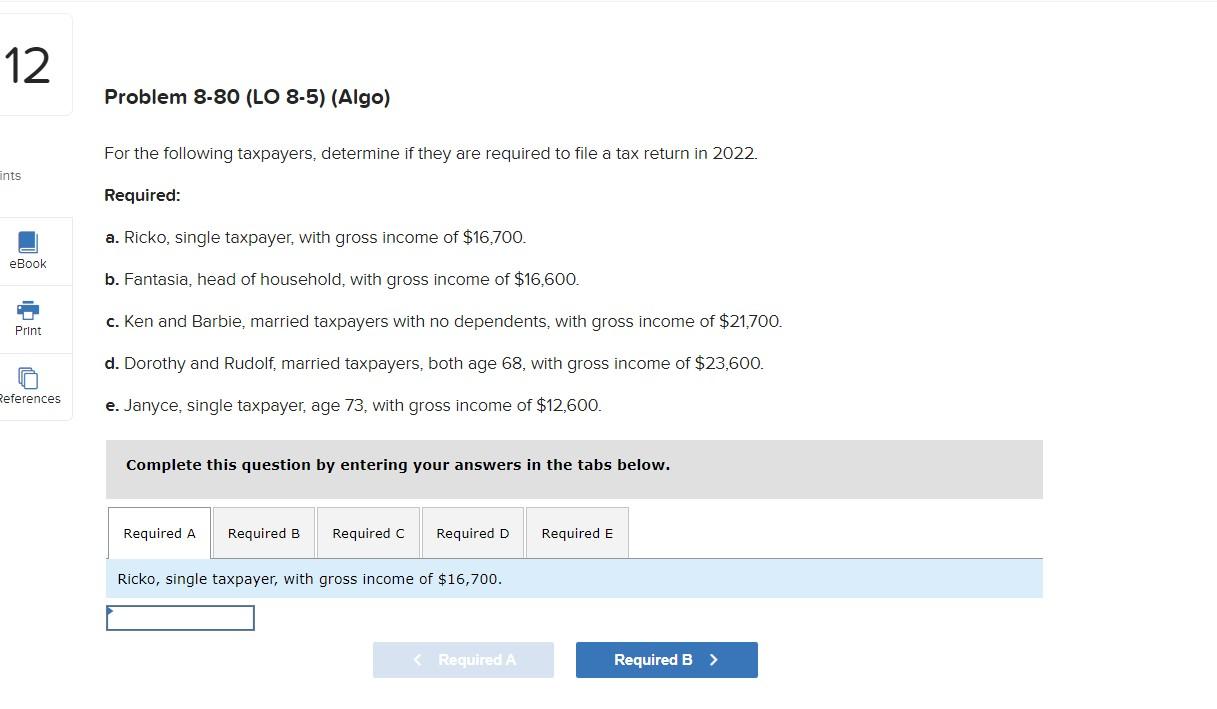

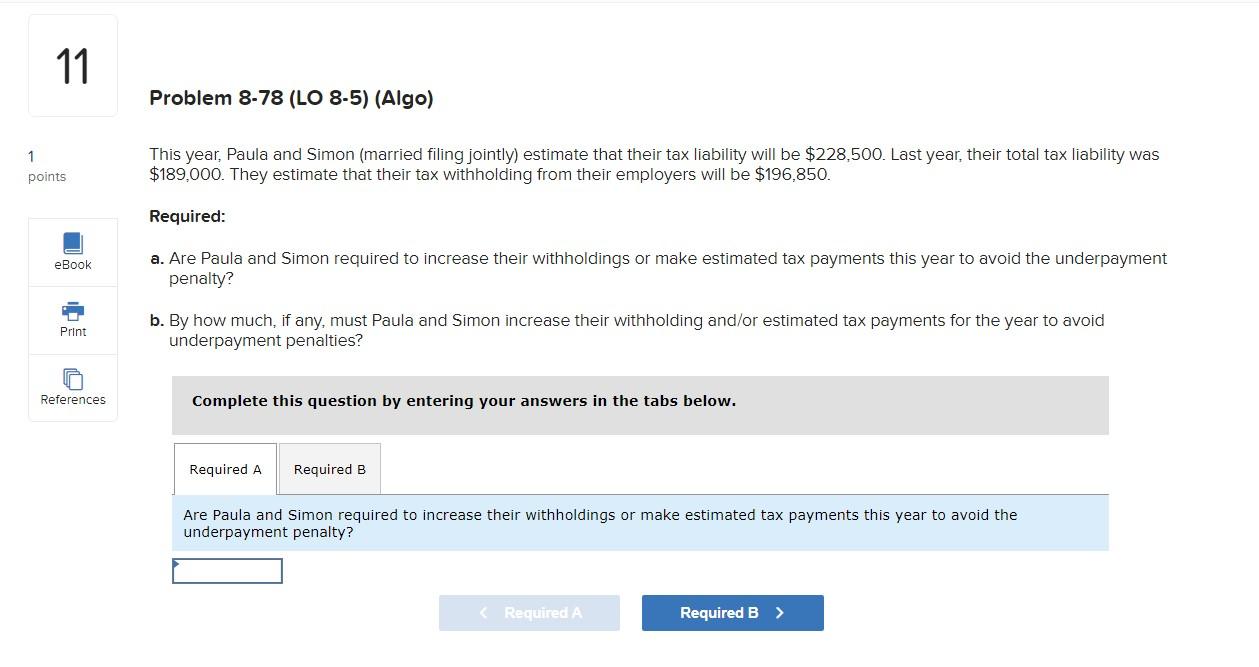

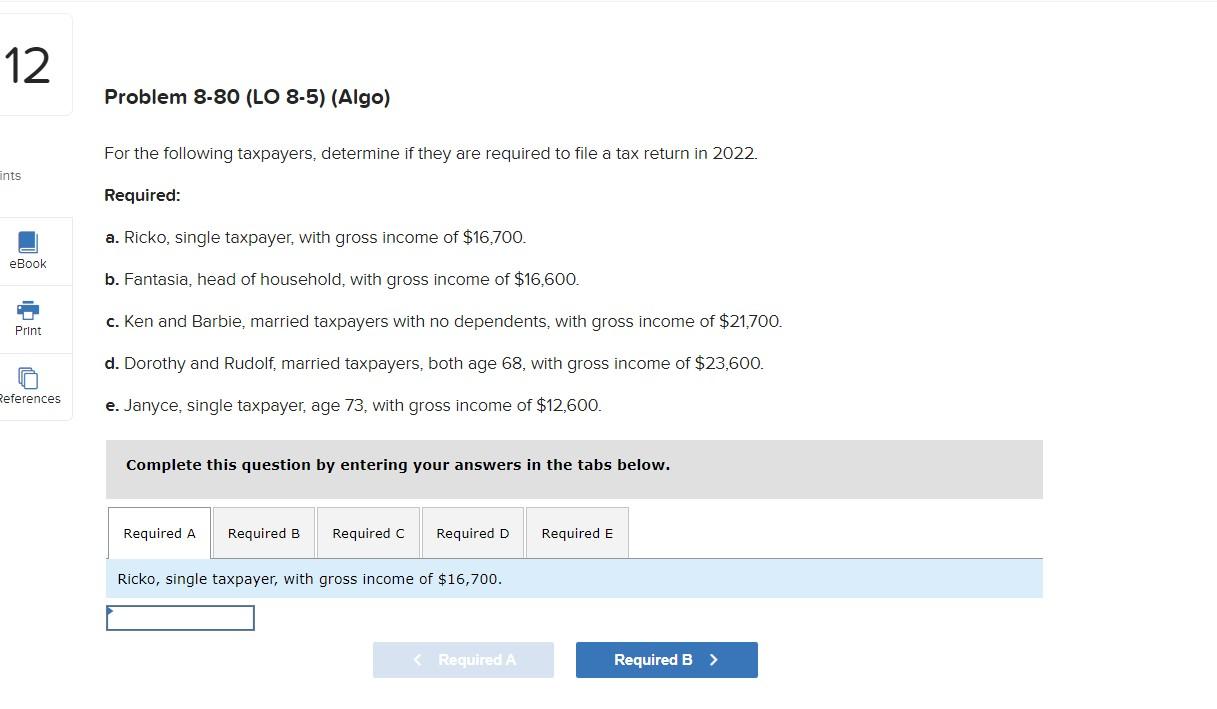

In 2022, Zach is single with no dependents. He is not claimed as a dependent on another's return. All of his income is from salary, ano he does not have any for AGI deductions. What is his earned income credit in 2022 in the following alternative scenarios? Use Exhibit 8-11. Note: Round your intermediate and final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable. Required: a. Zach is 29 years old, and his AGI is $6,400. b. Zach is 29 years old and his AGI is $12,400. c. Zach is 29 years old and his AGI is $18,800. d. Zach is 17 years old and his AGI is $6,400. Complete this question by entering your answers in the tabs below. Zach is 29 years old, and his AGI is $6,400. This year, Paula and Simon (married filing jointly) estimate that their tax liability will be $228,500. Last year, their total tax liability was $189,000. They estimate that their tax withholding from their employers will be $196,850. Required: a. Are Paula and Simon required to increase their withholdings or make estimated tax payments this year to avoid the underpayment penalty? b. By how much, if any, must Paula and Simon increase their withholding and/or estimated tax payments for the year to avoid underpayment penalties? Complete this question by entering your answers in the tabs below. Are Paula and Simon required to increase their withholdings or make estimated tax payments this year to avoid the underpayment penalty? For the following taxpayers, determine if they are required to file a tax return in 2022. Required: a. Ricko, single taxpayer, with gross income of $16,700. b. Fantasia, head of household, with gross income of $16,600. c. Ken and Barbie, married taxpayers with no dependents, with gross income of $21,700. d. Dorothy and Rudolf, married taxpayers, both age 68 , with gross income of $23,600. e. Janyce, single taxpayer, age 73 , with gross income of $12,600. Complete this question by entering your answers in the tabs below. Ricko, single taxpayer, with gross income of $16,700. In 2022, Zach is single with no dependents. He is not claimed as a dependent on another's return. All of his income is from salary, ano he does not have any for AGI deductions. What is his earned income credit in 2022 in the following alternative scenarios? Use Exhibit 8-11. Note: Round your intermediate and final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable. Required: a. Zach is 29 years old, and his AGI is $6,400. b. Zach is 29 years old and his AGI is $12,400. c. Zach is 29 years old and his AGI is $18,800. d. Zach is 17 years old and his AGI is $6,400. Complete this question by entering your answers in the tabs below. Zach is 29 years old, and his AGI is $6,400. This year, Paula and Simon (married filing jointly) estimate that their tax liability will be $228,500. Last year, their total tax liability was $189,000. They estimate that their tax withholding from their employers will be $196,850. Required: a. Are Paula and Simon required to increase their withholdings or make estimated tax payments this year to avoid the underpayment penalty? b. By how much, if any, must Paula and Simon increase their withholding and/or estimated tax payments for the year to avoid underpayment penalties? Complete this question by entering your answers in the tabs below. Are Paula and Simon required to increase their withholdings or make estimated tax payments this year to avoid the underpayment penalty? For the following taxpayers, determine if they are required to file a tax return in 2022. Required: a. Ricko, single taxpayer, with gross income of $16,700. b. Fantasia, head of household, with gross income of $16,600. c. Ken and Barbie, married taxpayers with no dependents, with gross income of $21,700. d. Dorothy and Rudolf, married taxpayers, both age 68 , with gross income of $23,600. e. Janyce, single taxpayer, age 73 , with gross income of $12,600. Complete this question by entering your answers in the tabs below. Ricko, single taxpayer, with gross income of $16,700