Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2023 it is expected/hoped that the London Interbank Offered Rate (LIBOR) will be phased out of use as a benchmark rate in financial

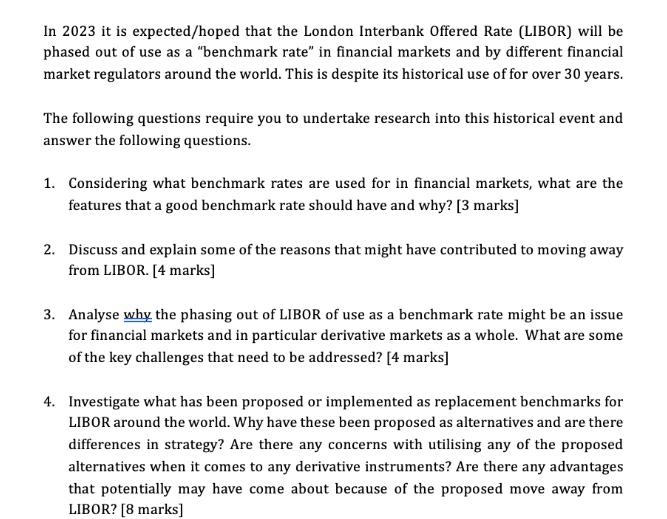

In 2023 it is expected/hoped that the London Interbank Offered Rate (LIBOR) will be phased out of use as a "benchmark rate" in financial markets and by different financial market regulators around the world. This is despite its historical use of for over 30 years. The following questions require you to undertake research into this historical event and answer the following questions. 1. Considering what benchmark rates are used for in financial markets, what are the features that a good benchmark rate should have and why? [3 marks] 2. Discuss and explain some of the reasons that might have contributed to moving away from LIBOR. [4 marks] 3. Analyse why the phasing out of LIBOR of use as a benchmark rate might be an issue for financial markets and in particular derivative markets as a whole. What are some of the key challenges that need to be addressed? [4 marks] 4. Investigate what has been proposed or implemented as replacement benchmarks for LIBOR around the world. Why have these been proposed as alternatives and are there differences in strategy? Are there any concerns with utilising any of the proposed alternatives when it comes to any derivative instruments? Are there any advantages that potentially may have come about because of the proposed move away from LIBOR? [8 marks]

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Features of a good benchmark rate Reliability and stability A good benchmark rate should be based on a robust methodology and have a history of stability and accuracy This ensures that market partic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started