Answered step by step

Verified Expert Solution

Question

1 Approved Answer

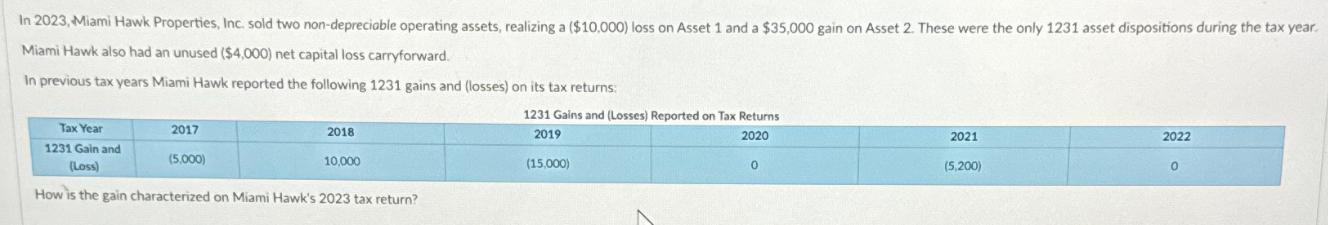

In 2023, Miami Hawk Properties, Inc. sold two non-depreciable operating assets, realizing a ($10,000) loss on Asset 1 and a $35,000 gain on Asset

In 2023, Miami Hawk Properties, Inc. sold two non-depreciable operating assets, realizing a ($10,000) loss on Asset 1 and a $35,000 gain on Asset 2. These were the only 1231 asset dispositions during the tax year. Miami Hawk also had an unused ($4,000) net capital loss carryforward. In previous tax years Miami Hawk reported the following 1231 gains and (losses) on its tax returns: Tax Year 1231 Gain and 2017 2018 1231 Gains and (Losses) Reported on Tax Returns 2019 2020 2021 2022 (5,000) 10,000 (Loss) (15,000) 0 (5,200) 0 How is the gain characterized on Miami Hawk's 2023 tax return?

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer To determine how the gain is characterized on Miami Hawks 2023 tax return we need to consider ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dd21052a43_961885.pdf

180 KBs PDF File

663dd21052a43_961885.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started