Question

In 2023, Skylar sold equipment for $38,600 cash and a $386,000 note due in two years. Skylar's cost of the property was $308,800, and

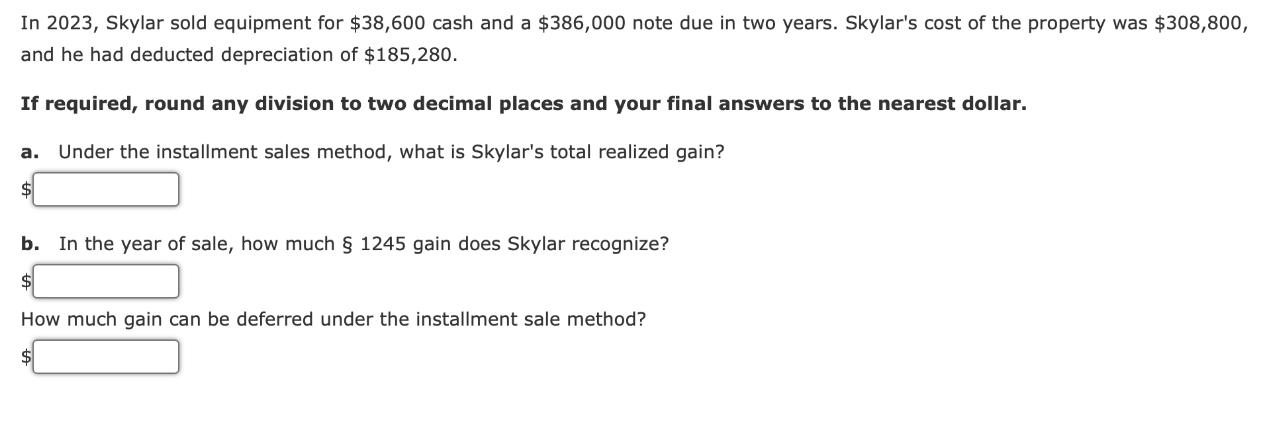

In 2023, Skylar sold equipment for $38,600 cash and a $386,000 note due in two years. Skylar's cost of the property was $308,800, and he had deducted depreciation of $185,280. If required, round any division to two decimal places and your final answers to the nearest dollar. Under the installment sales method, what is Skylar's total realized gain? b. In the year of sale, how much 1245 gain does Skylar recognize? $ How much gain can be deferred under the installment sale method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation Individual Income Taxes 2017

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young, Nellen

40th Edition

1337074748, 130587398X, 9781337074742, 978-1305873988

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App