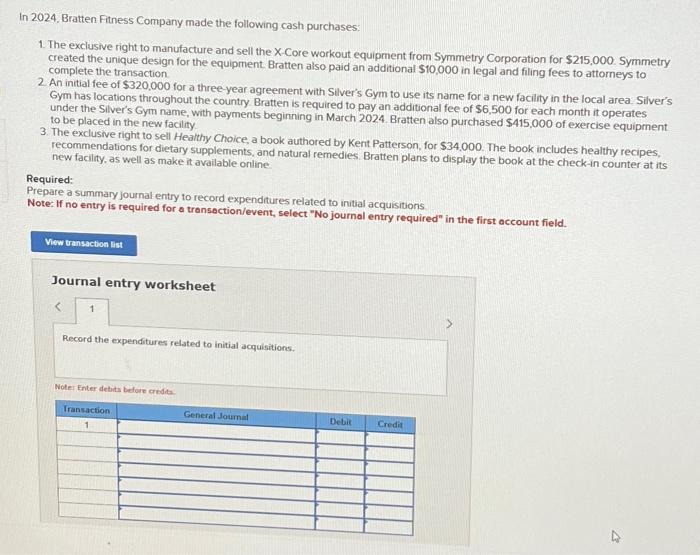

In 2024. Bratten Fitness Company made the following cash purchases: 1. The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for $215,000.5ymmetry created the unique design for the equipment. Bratten also paid an additional $10,000 in legal and filing fees to attorneys to complete the transaction. 2 An initial fee of $320,000 for a three-year agreement with Silver's Gym to use its name for a new facility in the local area. Silver's Gym has locations throughout the country Bratten is required to pay an additional fee of $6,500 for each month it operates under the Siver's Gym name, with payments beginning in March 2024. Bratten also purchased $415,000 of exercise equipment to be placed in the new facility. 3. The exclusive right to sell Healthy Choice, a book authored by Kent Patterson, for $34,000. The book includes healthy recipes, recommendations for dietary supplements, and natural remedies. Bratten plans to display the book at the check-in counter at its new facility, as well as make it available online Required: Prepare a summary journal entry to record expenditures related to initial acquisitions Note: If no entry is required for a transection/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the expenditures related to initial acquisitions. Noler Enter debita before credita. In 2024. Bratten Fitness Company made the following cash purchases: 1. The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for $215,000.5ymmetry created the unique design for the equipment. Bratten also paid an additional $10,000 in legal and filing fees to attorneys to complete the transaction. 2 An initial fee of $320,000 for a three-year agreement with Silver's Gym to use its name for a new facility in the local area. Silver's Gym has locations throughout the country Bratten is required to pay an additional fee of $6,500 for each month it operates under the Siver's Gym name, with payments beginning in March 2024. Bratten also purchased $415,000 of exercise equipment to be placed in the new facility. 3. The exclusive right to sell Healthy Choice, a book authored by Kent Patterson, for $34,000. The book includes healthy recipes, recommendations for dietary supplements, and natural remedies. Bratten plans to display the book at the check-in counter at its new facility, as well as make it available online Required: Prepare a summary journal entry to record expenditures related to initial acquisitions Note: If no entry is required for a transection/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the expenditures related to initial acquisitions. Noler Enter debita before credita