Answered step by step

Verified Expert Solution

Question

1 Approved Answer

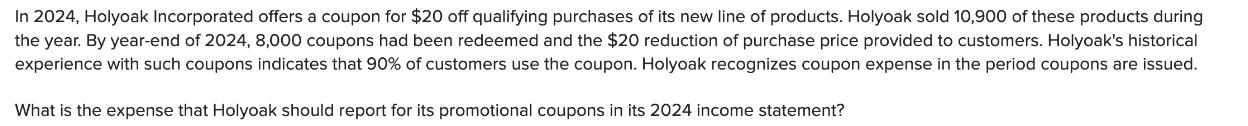

In 2024, Holyoak Incorporated offers a coupon for $20 off qualifying purchases of its new line of products. Holyoak sold 10,900 of these products

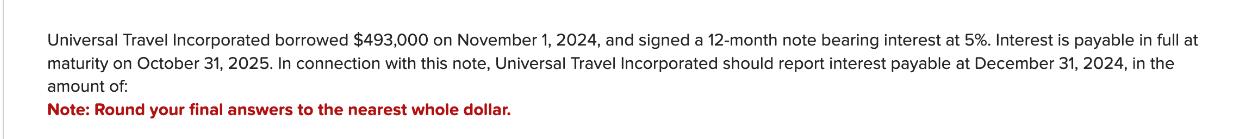

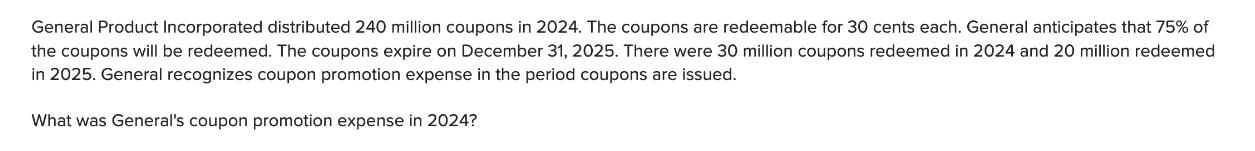

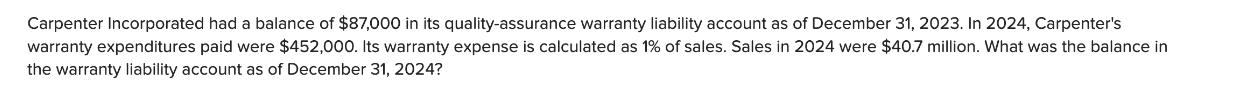

In 2024, Holyoak Incorporated offers a coupon for $20 off qualifying purchases of its new line of products. Holyoak sold 10,900 of these products during the year. By year-end of 2024, 8,000 coupons had been redeemed and the $20 reduction of purchase price provided to customers. Holyoak's historical experience with such coupons indicates that 90% of customers use the coupon. Holyoak recognizes coupon expense in the period coupons are issued. What is the expense that Holyoak should report for its promotional coupons in its 2024 income statement? Universal Travel Incorporated borrowed $493,000 on November 1, 2024, and signed a 12-month note bearing interest at 5%. Interest is payable in full at maturity on October 31, 2025. In connection with this note, Universal Travel Incorporated should report interest payable at December 31, 2024, in the amount of: Note: Round your final answers to the nearest whole dollar. General Product Incorporated distributed 240 million coupons in 2024. The coupons are redeemable for 30 cents each. General anticipates that 75% of the coupons will be redeemed. The coupons expire on December 31, 2025. There were 30 million coupons redeemed in 2024 and 20 million redeemed in 2025. General recognizes coupon promotion expense in the period coupons are issued. What was General's coupon promotion expense in 2024? Carpenter Incorporated had a balance of $87,000 in its quality-assurance warranty liability account as of December 31, 2023. In 2024, Carpenter's warranty expenditures paid were $452,000. Its warranty expense is calculated as 1% of sales. Sales in 2024 were $40.7 million. What was the balance in the warranty liability account as of December 31, 2024?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started