Question

In 2024, the Pretax financial income was $825,000, which includes $30,000 of municipal bond income. On June 1, 2024, an unexpected tax rate change

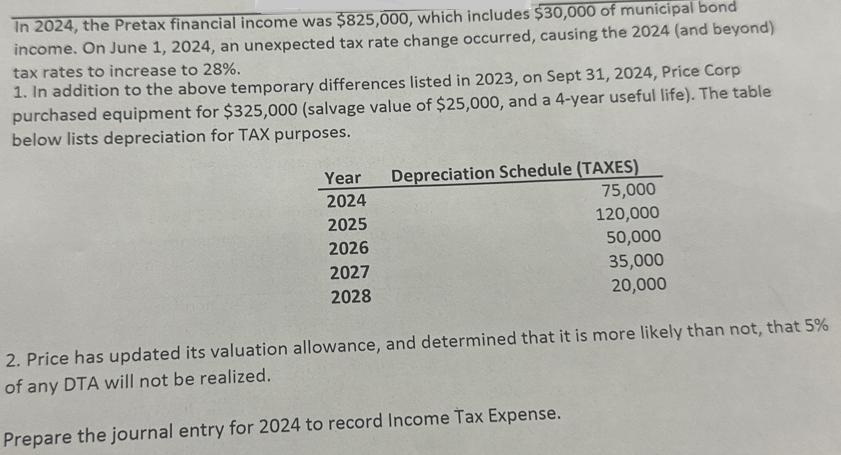

In 2024, the Pretax financial income was $825,000, which includes $30,000 of municipal bond income. On June 1, 2024, an unexpected tax rate change occurred, causing the 2024 (and beyond) tax rates to increase to 28%. 1. In addition to the above temporary differences listed in 2023, on Sept 31, 2024, Price Corp purchased equipment for $325,000 (salvage value of $25,000, and a 4-year useful life). The table below lists depreciation for TAX purposes. Year Depreciation Schedule (TAXES) 2024 75,000 2025 120,000 2026 50,000 2027 35,000 2028 20,000 2. Price has updated its valuation allowance, and determined that it is more likely than not, that 5% of any DTA will not be realized. Prepare the journal entry for 2024 to record Income Tax Expense.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting principles and analysis

Authors: Terry d. Warfield, jerry j. weygandt, Donald e. kieso

2nd Edition

471737933, 978-0471737933

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App