Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed

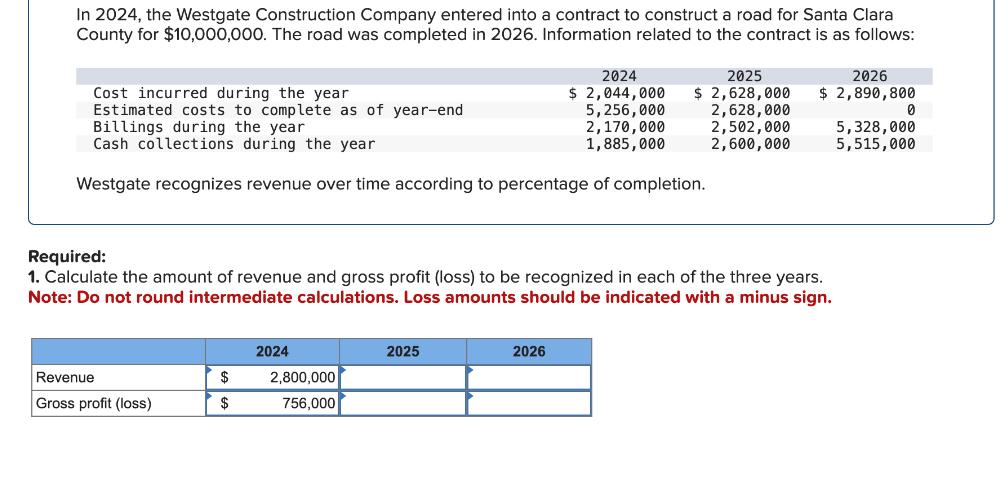

In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year 2024 $ 2,044,000 5,256,000 2,170,000 2025 $ 2,628,000 2,628,000 2,502,000 2026 $ 2,890,800 0 5,328,000 1,885,000 2,600,000 5,515,000 Westgate recognizes revenue over time according to percentage of completion. Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. Note: Do not round intermediate calculations. Loss amounts should be indicated with a minus sign. 2024 2025 Revenue $ 2,800,000 Gross profit (loss) $ 756,000 2026

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the amount of revenue and gross profit loss to be recognized in each of the three years we will use the percentage of completion method T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started