Answered step by step

Verified Expert Solution

Question

1 Approved Answer

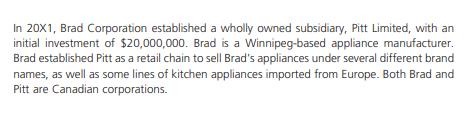

In 20X1, Brad Corporation established a wholly owned subsidiany, Pitt Limited, with an initial investment of $20,000,000. Brad is a Winnipeg-based appliance manufacturer. Brad

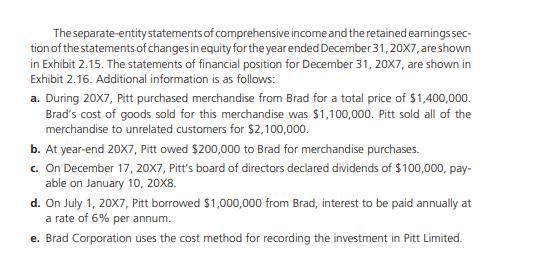

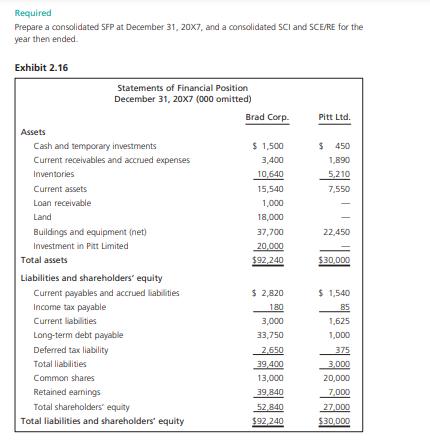

In 20X1, Brad Corporation established a wholly owned subsidiany, Pitt Limited, with an initial investment of $20,000,000. Brad is a Winnipeg-based appliance manufacturer. Brad established Pitt as a retail chain to sell Brad's appliances under several different brand names, as well as some lines of kitchen appliances imported from Europe. Both Brad and Pitt are Canadian corporations. The separate-entitystatements of comprehensive income and the retained earnings sec- tion of the statements of changes in equity for the yearended December 31,20X7, are shown in Exhibit 2.15. The statements of financial position for December 31, 20X7, are shown in Exhibit 2.16. Additional information is as follows: a. During 20X7, Pitt purchased merchandise from Brad for a total price of $1,400,000. Brad's cost of goods sold for this merchandise was $1,100,000. Pitt sold all of the merchandise to unrelated customers for $2,100,000. b. At year-end 20X7, Pitt owed $200,000 to Brad for merchandise purchases. c. On December 17, 20X7, Pitt's board of directors declared dividends of $100,000, pay- able on January 10, 20X8. d. On July 1, 20X7, Pitt borrowed $1,000,000 from Brad, interest to be paid annually at a rate of 6% per annum. e. Brad Corporation uses the cost method for recording the investment in Pitt Limited. Exhibit 2.15 Statements of Comprehensive Income Year Ended December 31, 20X7 (000 omitted) Brad Corp. Pitt Ltd. Revenue Sales revenue $ 7,100 $3,400 Other income 235 840 Total revenue 7.335 4240 Operating expenses Cost of goods sold Selling expenses 4,175 1,900 435 560 General and administrative expenses 995 770 Interest and other expenses 1,015 30 Total operating expenses Earnings before income taxes 6,620 3.260 715 980 Income tax expense 215 290 Net earnings $ 500 $ 690 Statements of Changes in Equity-Retained Earnings Section Year Ended December 31, 20X7 (000 omitted) Retained earnings, December 31, 20X6 $39,500 $6,410 Net earnings 500 690 Dividends declared (160) (100) Retained earnings, December 31, 20X7 $39,840 $7,000 Required Prepare a consolidated SFP at December 31, 20X7, and a consolidated SCI and SCE/RE for the year then ended. Exhibit 2.16 Statements of Financial Position December 31, 20x7 (000 omitted) Brad Corp. Pitt Ltd. Assets Cash and temporary investments $ 1,500 $ 450 Current receivables and accrued expenses 3,400 1,890 Inventories 10,640 5,210 Current assets 15,540 7,550 Loan receivable 1,000 Land 18,000 Buildings and equipment (net) 37,700 22,450 20,000 $92,240 Investment in Pitt Limited Total assets $30,000 Liabilities and shareholders' equity Current payables and accrued liabilities $ 2,820 $ 1,540 Income tax payable 180 85 Current liabilities 3,000 1,625 Long-term debt payable 33,750 1,000 Deferred tax liability 2.650 375 Total liabilities 39,400 3,000 Common shares 13,000 20,000 Retained earnings 39,840 7,000 Total shareholders equity 52,840 27,000 Total liabilities and shareholders' equity $92,240 $30,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Consolidated Statement of Financial Position at December 31 20X7 Brad Corp Pitt Ltd Eliminations Consolidated Assets Cash and temporary 1500 45...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started