Question

In 20x4, Tom Depuis moved 2874 kilometers from Anytown, Province-1 to Newtown, Province-2 to assume the position of manager for his company at the Newtown

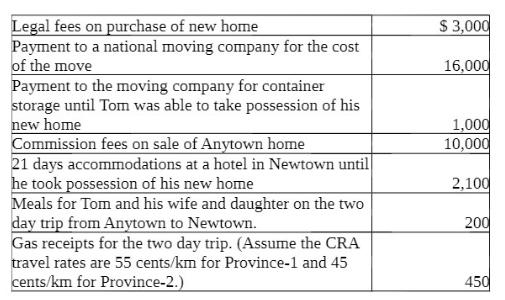

In 20x4, Tom Depuis moved 2874 kilometers from Anytown, Province-1 to Newtown, Province-2 to assume the position of manager for his company at the Newtown head office. Tom began his new job on October 1st. He receives a salary of $5,100 per month at his new job and received $4,500 per month in his former position. Tom has provided you with the following information pertaining to his moving costs:

Tom received a reimbursement of $15,000 from his employer.

Required:

A. Calculate the maximum amount of moving expenses that Tom can deduct on his 20x4 tax return.

B. Will the moving expenses have any effect on Tom's 20x5 tax return?

Legal fees on purchase of new home Payment to a national moving company for the cost of the move Payment to the moving company for container storage until Tom was able to take possession of his new home Commission fees on sale of Anytown home 21 days accommodations at a hotel in Newtown until he took possession of his new home Meals for Tom and his wife and daughter on the two day trip from Anytown to Newtown. Gas receipts for the two day trip. (Assume the CRA travel rates are 55 cents/km for Province-1 and 45 $ 3,000 16,000 1,000 10,000 2,100 200 cents/km for Province-2.) 450

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

A Legal fees on purchase of new home 3000 Payment to a national moving co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started