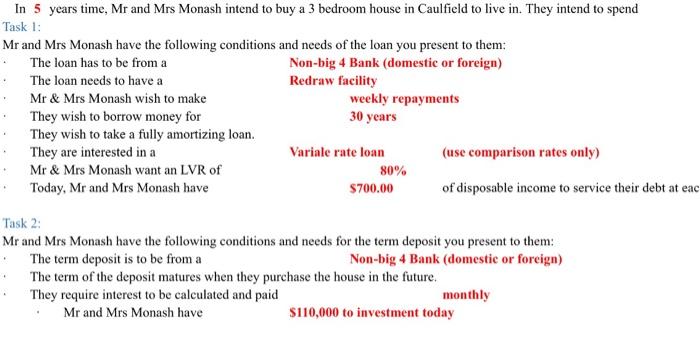

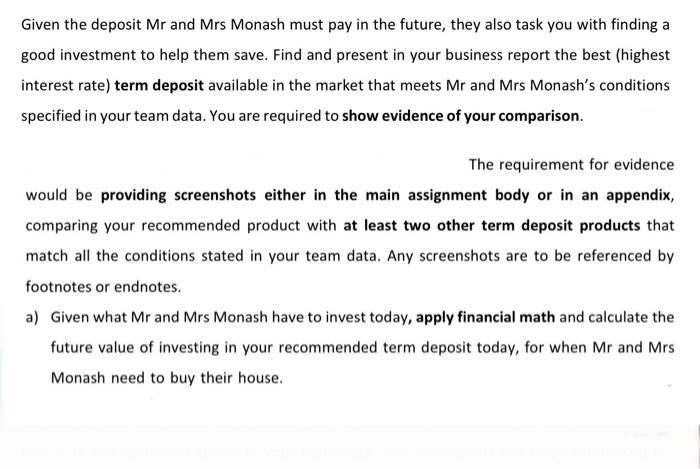

In 5 years time, Mr and Mrs Monash intend to buy a 3 bedroom house in Caulfield to live in. They intend to spend Task 1: Mr and Mrs Monash have the following conditions and needs of the loan you present to them: The loan has to be from a Non-big 4 Bank (domestic or foreign) The loan needs to have a Redraw facility Mr & Mrs Monash wish to make weekly repayments They wish to borrow money for 30 years They wish to take a fully amortizing loan. They are interested in a Variale rate loan (use comparison rates only) Mr & Mrs Monash want an LVR of 80% Today, Mr and Mrs Monash have $700.00 of disposable income to service their debt at eac Task 2: Mr and Mrs Monash have the following conditions and needs for the term deposit you present to them: The term deposit is to be from a Non-big 4 Bank (domestic or foreign) The term of the deposit matures when they purchase the house in the future. They require interest to be calculated and paid monthly Mr and Mrs Monash have $110,000 to investment today Given the deposit Mr and Mrs Monash must pay in the future, they also task you with finding a good investment to help them save. Find and present in your business report the best (highest interest rate) term deposit available in the market that meets Mr and Mrs Monash's conditions specified in your team data. You are required to show evidence of your comparison. The requirement for evidence would be providing screenshots either in the main assignment body or in an appendix, comparing your recommended product with at least two other term deposit products that match all the conditions stated in your team data. Any screenshots are to be referenced by footnotes or endnotes. a) Given what Mr and Mrs Monash have to invest today, apply financial math and calculate the future value of investing in your recommended term deposit today, for when Mr and Mrs Monash need to buy their house. In 5 years time, Mr and Mrs Monash intend to buy a 3 bedroom house in Caulfield to live in. They intend to spend Task 1: Mr and Mrs Monash have the following conditions and needs of the loan you present to them: The loan has to be from a Non-big 4 Bank (domestic or foreign) The loan needs to have a Redraw facility Mr & Mrs Monash wish to make weekly repayments They wish to borrow money for 30 years They wish to take a fully amortizing loan. They are interested in a Variale rate loan (use comparison rates only) Mr & Mrs Monash want an LVR of 80% Today, Mr and Mrs Monash have $700.00 of disposable income to service their debt at eac Task 2: Mr and Mrs Monash have the following conditions and needs for the term deposit you present to them: The term deposit is to be from a Non-big 4 Bank (domestic or foreign) The term of the deposit matures when they purchase the house in the future. They require interest to be calculated and paid monthly Mr and Mrs Monash have $110,000 to investment today Given the deposit Mr and Mrs Monash must pay in the future, they also task you with finding a good investment to help them save. Find and present in your business report the best (highest interest rate) term deposit available in the market that meets Mr and Mrs Monash's conditions specified in your team data. You are required to show evidence of your comparison. The requirement for evidence would be providing screenshots either in the main assignment body or in an appendix, comparing your recommended product with at least two other term deposit products that match all the conditions stated in your team data. Any screenshots are to be referenced by footnotes or endnotes. a) Given what Mr and Mrs Monash have to invest today, apply financial math and calculate the future value of investing in your recommended term deposit today, for when Mr and Mrs Monash need to buy their house