Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In a bid to raise additional financing to support an expansion in operations, Soca Ltd issued a 5% $22 million convertible loan note on

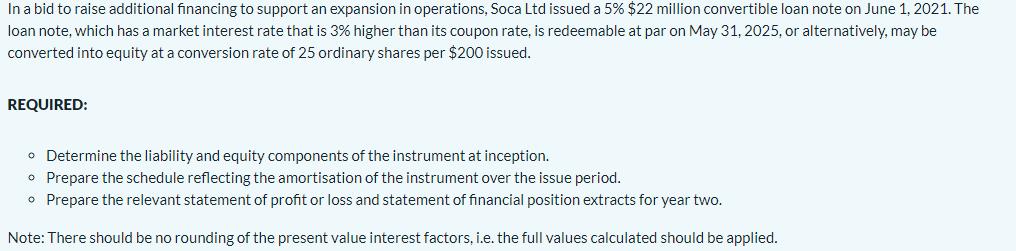

In a bid to raise additional financing to support an expansion in operations, Soca Ltd issued a 5% $22 million convertible loan note on June 1, 2021. The loan note, which has a market interest rate that is 3% higher than its coupon rate, is redeemable at par on May 31, 2025, or alternatively, may be converted into equity at a conversion rate of 25 ordinary shares per $200 issued. REQUIRED: o Determine the liability and equity components of the instrument at inception. Prepare the schedule reflecting the amortisation of the instrument over the issue period. Prepare the relevant statement of profit or loss and statement of financial position extracts for year two. Note: There should be no rounding of the present value interest factors, i.e. the full values calculated should be applied.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Determination of Liability and Equity Components In order to determine the liability and equity components of the instrument we need to first calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started