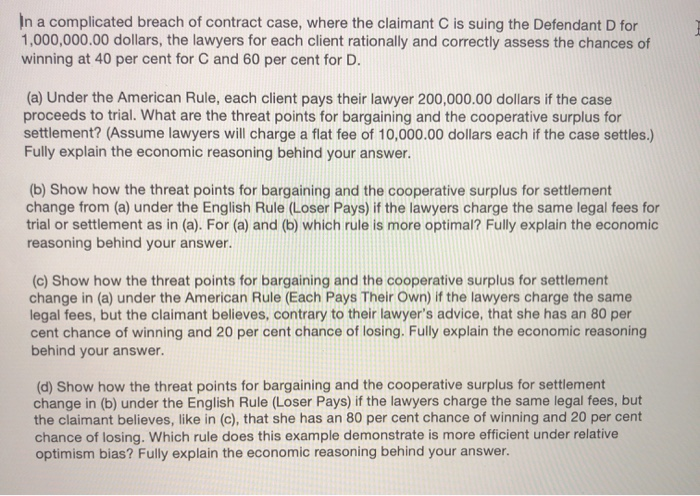

In a complicated breach of contract case, where the claimant C is suing the Defendant D for 1,000,000.00 dollars, the lawyers for each client rationally and correctly assess the chances of winning at 40 per cent for C and 60 per cent for D. (a) Under the American Rule, each client pays their lawyer 200,000.00 dollars if the case proceeds to trial. What are the threat points for bargaining and the cooperative surplus for settlement? (Assume lawyers will charge a flat fee of 10,000.00 dollars each if the case settles.) Fully explain the economic reasoning behind your answer. (b) Show how the threat points for bargaining and the cooperative surplus for settlement change from (a) under the English Rule (Loser Pays) if the lawyers charge the same legal fees for trial or settlement as in (a). For (a) and (b) which rule is more optimal? Fully explain the economic reasoning behind your answer. (c) Show how the threat points for bargaining and the cooperative surplus for settlement change in (a) under the American Rule (Each Pays Their Own) if the lawyers charge the same legal fees, but the claimant believes, contrary to their lawyer's advice, that she has an 80 per cent chance of winning and 20 per cent chance of losing. Fully explain the economic reasoning behind your answer. (d) Show how the threat points for bargaining and the cooperative surplus for settlement change in (b) under the English Rule (Loser Pays) if the lawyers charge the same legal fees, but the claimant believes, like in (c), that she has an 80 per cent chance of winning and 20 per cent chance of losing. Which rule does this example demonstrate is more efficient under relative optimism bias? Fully explain the economic reasoning behind your answer. In a complicated breach of contract case, where the claimant C is suing the Defendant D for 1,000,000.00 dollars, the lawyers for each client rationally and correctly assess the chances of winning at 40 per cent for C and 60 per cent for D. (a) Under the American Rule, each client pays their lawyer 200,000.00 dollars if the case proceeds to trial. What are the threat points for bargaining and the cooperative surplus for settlement? (Assume lawyers will charge a flat fee of 10,000.00 dollars each if the case settles.) Fully explain the economic reasoning behind your answer. (b) Show how the threat points for bargaining and the cooperative surplus for settlement change from (a) under the English Rule (Loser Pays) if the lawyers charge the same legal fees for trial or settlement as in (a). For (a) and (b) which rule is more optimal? Fully explain the economic reasoning behind your answer. (c) Show how the threat points for bargaining and the cooperative surplus for settlement change in (a) under the American Rule (Each Pays Their Own) if the lawyers charge the same legal fees, but the claimant believes, contrary to their lawyer's advice, that she has an 80 per cent chance of winning and 20 per cent chance of losing. Fully explain the economic reasoning behind your answer. (d) Show how the threat points for bargaining and the cooperative surplus for settlement change in (b) under the English Rule (Loser Pays) if the lawyers charge the same legal fees, but the claimant believes, like in (c), that she has an 80 per cent chance of winning and 20 per cent chance of losing. Which rule does this example demonstrate is more efficient under relative optimism bias? Fully explain the economic reasoning behind your