Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In a context of perfect capital mobility, consider a simplified small open economy (for this economy we consider foreign GDP (Y), foreign price level

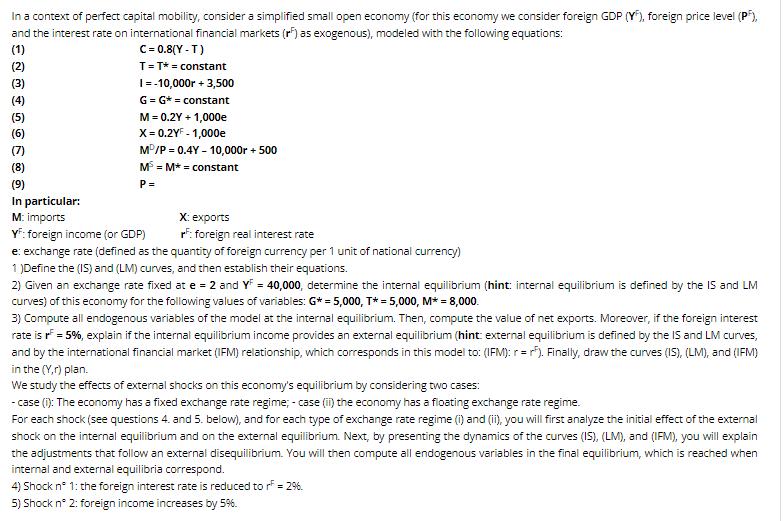

In a context of perfect capital mobility, consider a simplified small open economy (for this economy we consider foreign GDP (Y), foreign price level (PF), and the interest rate on international financial markets (r) as exogenous), modeled with the following equations: C = 0.8(Y-T) T = T* = constant |=-10,000r + 3,500 G = G* = constant M = 0.2Y + 1,000e X = 0.2YF -1,000e (1) (2) (3) (4) (5) (6) (7) (8) (9) P = In particular: M: imports YF: foreign income (or GDP) MP/P = 0.4Y-10,000r + 500 M M* constant X: exports r: foreign real interest rate e: exchange rate (defined as the quantity of foreign currency per 1 unit of national currency) 1)Define the (IS) and (LM) curves, and then establish their equations. 2) Given an exchange rate fixed at e = 2 and YF = 40,000, determine the internal equilibrium (hint: internal equilibrium is defined by the IS and LM curves) of this economy for the following values of variables: G*= 5,000, T* = 5,000, M* = 8,000. 3) Compute all endogenous variables of the model at the internal equilibrium. Then, compute the value of net exports. Moreover, if the foreign interest rate is r = 5%, explain if the internal equilibrium income provides an external equilibrium (hint: external equilibrium is defined by the IS and LM curves, and by the international financial market (IFM) relationship, which corresponds in this model to: (IFM): r = rf). Finally, draw the curves (IS), (LM), and (IFM) in the (Y,r) plan. We study the effects of external shocks on this economy's equilibrium by considering two cases: -case (i): The economy has a fixed exchange rate regime; - case (ii) the economy has a floating exchange rate regime. For each shock (see questions 4. and 5. below), and for each type of exchange rate regime (i) and (ii), you will first analyze the initial effect of the external shock on the internal equilibrium and on the external equilibrium. Next, by presenting the dynamics of the curves (IS), (LM), and (IFM), you will explain the adjustments that follow an external disequilibrium. You will then compute all endogenous variables in the final equilibrium, which is reached when internal and external equilibria correspond. 4) Shock n 1: the foreign interest rate is reduced to r = 296. 5) Shock n 2: foreign income increases by 5%.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to derive the IS curve LM curve and the international financial market IFM relationship based on the given equations The...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started