Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sime Darby IOI Properties Group Berhad (IOIPG) is one of Malaysia's leading public- listed property developers. It has built a solid reputation as the

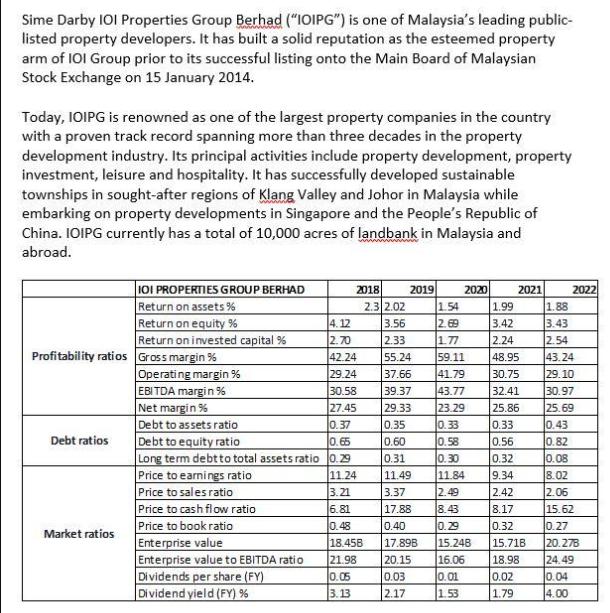

Sime Darby IOI Properties Group Berhad ("IOIPG") is one of Malaysia's leading public- listed property developers. It has built a solid reputation as the esteemed property arm of IOI Group prior to its successful listing onto the Main Board of Malaysian Stock Exchange on 15 January 2014. Today, IOIPG is renowned as one of the largest property companies in the country with a proven track record spanning more than three decades in the property development industry. Its principal activities include property development, property investment, leisure and hospitality. It has successfully developed sustainable townships in sought-after regions of Klang Valley and Johor in Malaysia while embarking on property developments in Singapore and the People's Republic of China. IOIPG currently has a total of 10,000 acres of landbank in Malaysia and abroad. Debt ratios IOI PROPERTIES GROUP BERHAD Return on assets % Return on equity % Return on invested capital % Profitability ratios Gross margin % Market ratios 4.12 2.70 42.24 29.24 30.58 EBITDA margin% Net margin % 27.45 Debt to assets ratio 0.37 Debt to equity ratio 0.65 Long term debt to total assets ratio 0.29 11.24 Operating margin % Price to earnings ratio Price to sales ratio Price to cash flow ratio Price to book ratio 2018 Enterprise value Enterprise value to EBITDA ratio Dividends per share (FY) Dividend yield (FY) % 2.3 2.02 2019 2020 1.54 3.56 2.69 2.33 1.77 55.24 59.11 37.66 41.79 39.37 43.77 29.33 23.29 0.35 0.33 0.60 0.58 0.31 0.30 11.49 11.84 3.37 2.49 17.88 8.43 0.40 0.29 15.248 15.718 16.06 18.98 0.01 1.53 3.21 6.81 0.48 18.458 17.89B 21.98 20.15 0.05 0.03 3.13 2.17 2021 1.99 3.42 2.24 48.95 30.75 32.41 25.86 0.33 0.56 0.32 9.34 2.42 8.17 0.32 0.02 1.79 2022 1.88 3.43 2.54 43.24 29.10 30.97 25.69 0.43 0.82 0.08 8.02 2.06 15.62 0.27 20.278 24.49 0.04 4.00 1. Analysis of the companies' profitability ratios; 2. Analysis of the companies' debt ratios; 3. Analysis of the companies' market ratios; 4. Expectation of the companies' financial position for year 2023 5. Comment on the companies' financial performance from the viewpoint of a prospective investor

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 From the given data it can be seen that IOI Properties Group Berhad has a higher gross margin oper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started