Question

In a market experiencing a cap rate of 8%, a hotel is valued at 100 mi. A 30-year, monthly amortizing fixed rate mortgage at

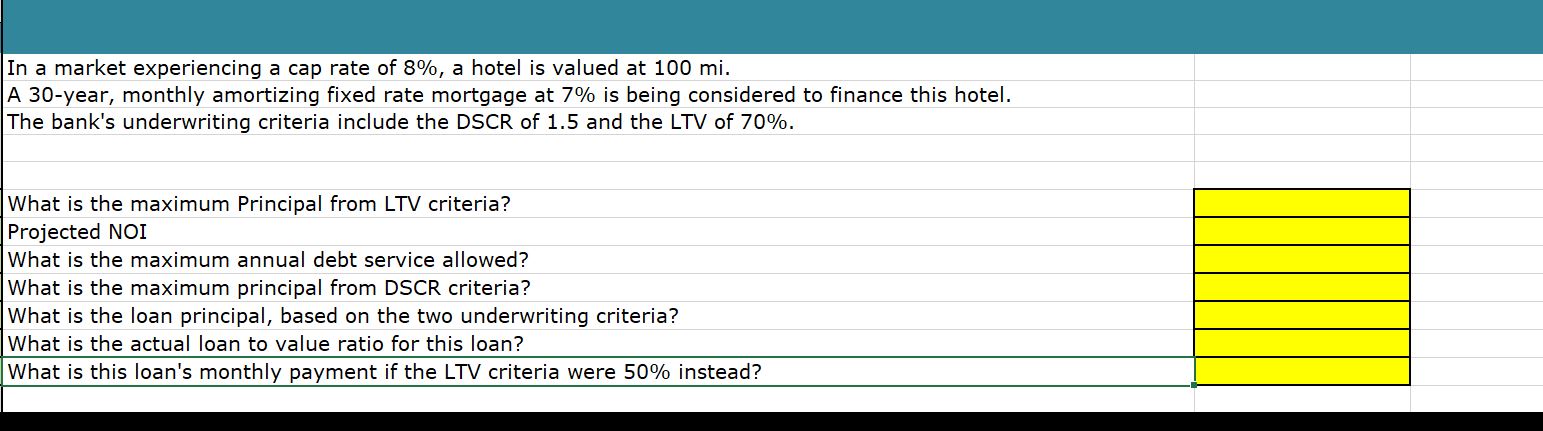

In a market experiencing a cap rate of 8%, a hotel is valued at 100 mi. A 30-year, monthly amortizing fixed rate mortgage at 7% is being considered to finance this hotel. The bank's underwriting criteria include the DSCR of 1.5 and the LTV of 70%. What is the maximum Principal from LTV criteria? Projected NOI What is the maximum annual debt service allowed? What is the maximum principal from DSCR criteria? What is the loan principal, based on the two underwriting criteria? What is the actual loan to value ratio for this loan? What is this loan's monthly payment if the LTV criteria were 50% instead?

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the various components based on the given information 1 Maximum Principal from LTV Crit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting Foundations and Evolutions

Authors: Michael R. Kinney, Cecily A. Raiborn

8th Edition

9781439044612, 1439044619, 978-1111626822

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App