Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In a random sample of 49 audited estate tax returns, it was determined that the mean amount of additional tax owed was $3488 with

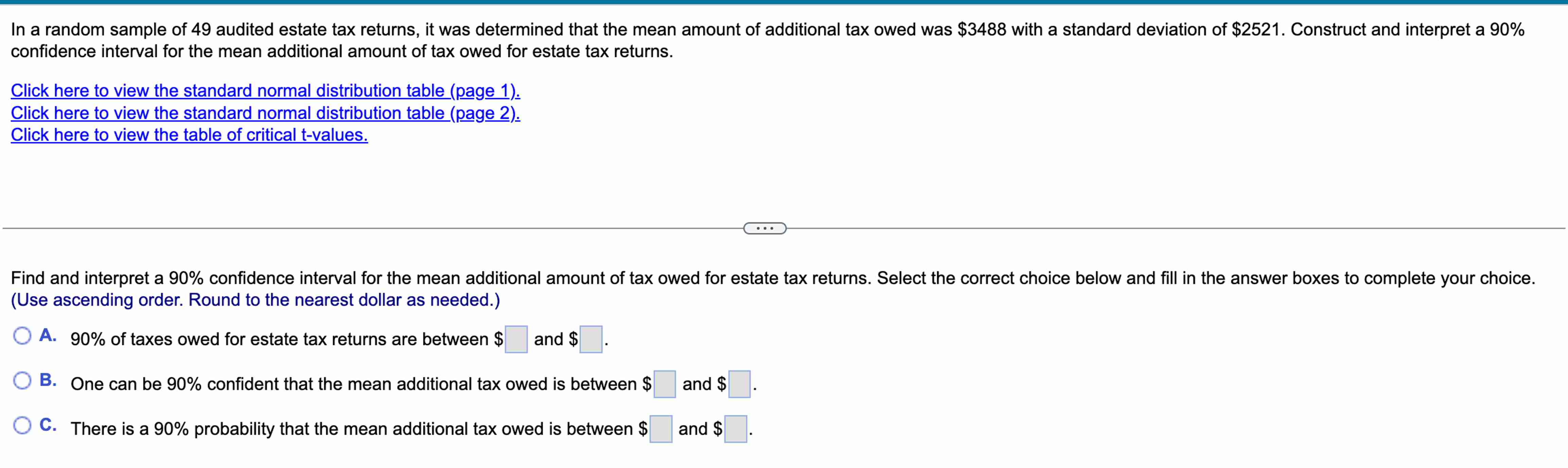

In a random sample of 49 audited estate tax returns, it was determined that the mean amount of additional tax owed was $3488 with a standard deviation of $2521. Construct and interpret a 90% confidence interval for the mean additional amount of tax owed for estate tax returns. Click here to view the standard normal distribution table (page 1). Click here to view the standard normal distribution table (page 2). Click here to view the table of critical t-values. Find and interpret a 90% confidence interval for the mean additional amount of tax owed for estate tax returns. Select the correct choice below and fill in the answer boxes to complete your choice. (Use ascending order. Round to the nearest dollar as needed.) O A. 90% of taxes owed for estate tax returns are between $ and $ OB. One can be 90% confident that the mean additional tax owed is between $ C. There is a 90% probability that the mean additional tax owed is between $ and $ and $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started