Question

In a single-factor market, the SML relationship of both the CAPM and the APT states that the risk premium on any security is proportional to

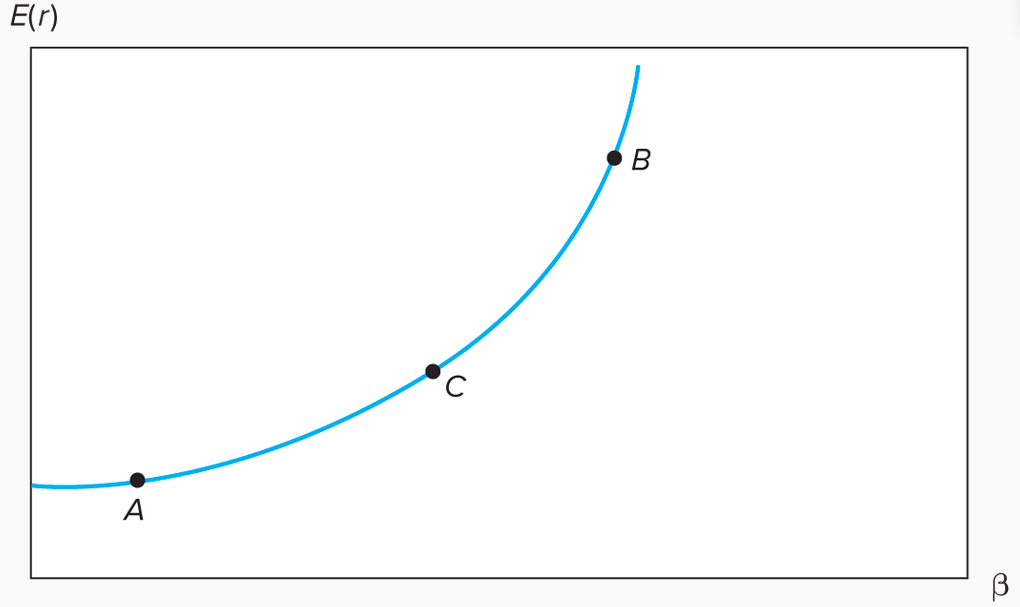

In a single-factor market, the SML relationship of both the CAPM and the APT states that the risk premium on any security is proportional to beta, or equivalently, that the security's expected return must be a linear function of beta. Suppose this is not the case, specifically, that expected return rises more than proportionately with beta as in the following figure.

a. How could you construct a positive-alpha security in the context of the CAPM, or an arbitrage portfolio in the context of the APT?

b. Could this figure be an accurate depiction of the mean-beta relationship in the market equilibrium? Hint: Consider the return on a combination of portfolios A and B constructed to match the beta of portfolio C.

c. Some researchers have examined the relationship between average returns on diversified portfolios and the and ^2 of those portfolios. What should they have discovered about the effect of ^2 on portfolio return?

E(r)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started