Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In a tax period, a state owned enterprise has made the following transactions: - Exported 15,000 products N at FOB price of $5 each. The

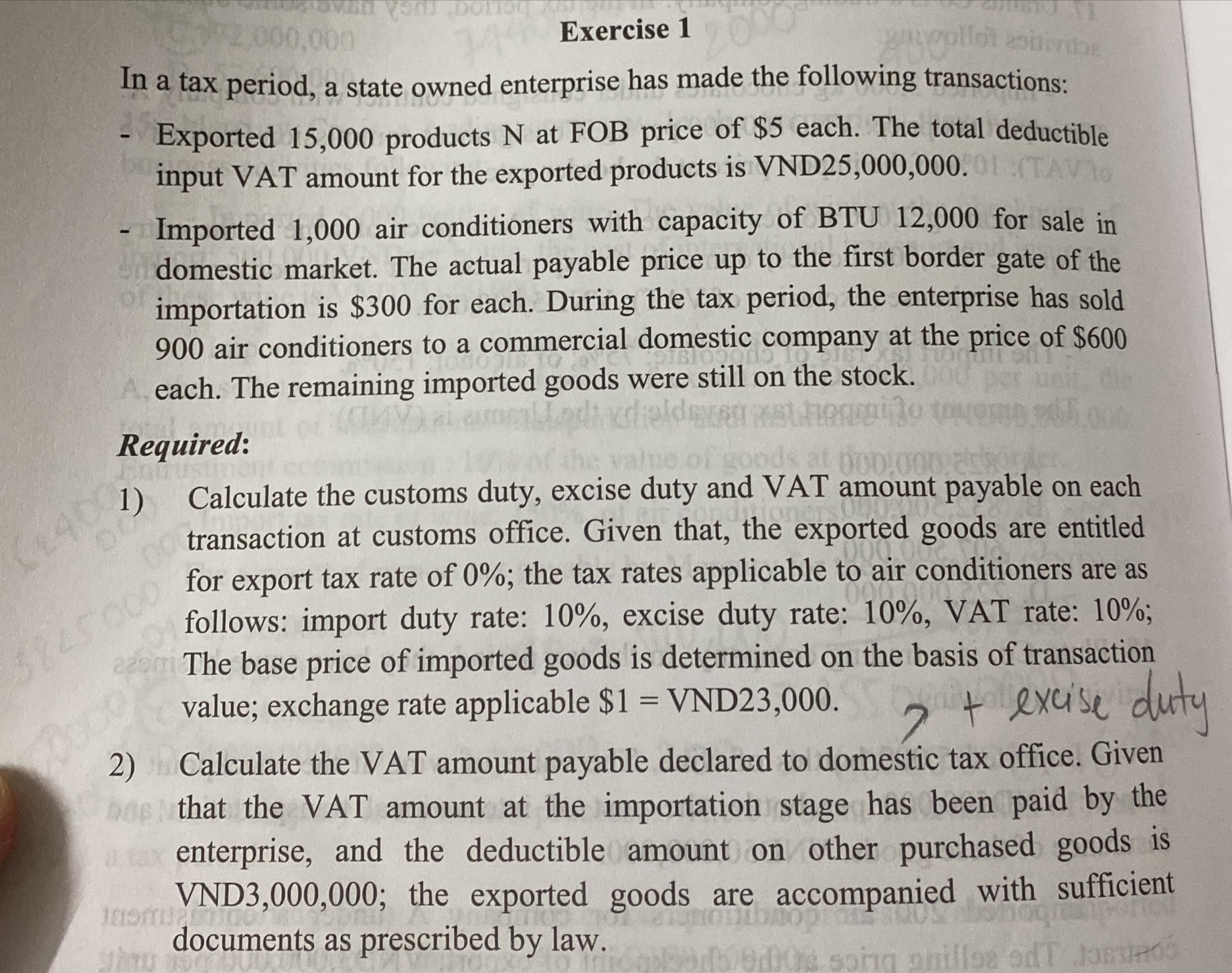

In a tax period, a state owned enterprise has made the following transactions: - Exported 15,000 products N at FOB price of $5 each. The total deductible input VAT amount for the exported products is VND25,000,000. - Imported 1,000 air conditioners with capacity of BTU 12,000 for sale in domestic market. The actual payable price up to the first border gate of the importation is $300 for each. During the tax period, the enterprise has sold 900 air conditioners to a commercial domestic company at the price of $600 each. The remaining imported goods were still on the stock. Required: 1) Calculate the customs duty, excise duty and VAT amount payable on each transaction at customs office. Given that, the exported goods are entitled for export tax rate of 0%; the tax rates applicable to air conditioners are as follows: import duty rate: 10%, excise duty rate: 10%, VAT rate: 10%; The base price of imported goods is determined on the basis of transaction value; exchange rate applicable $1=VND23,000. 2) Calculate the VAT amount payable declared to domestic tax office. Given that the VAT amount at the importation stage has been paid by the enterprise, and the deductible amount on other purchased goods is VND3,000,000; the exported goods are accompanied with sufficient documents as prescribed by law

In a tax period, a state owned enterprise has made the following transactions: - Exported 15,000 products N at FOB price of $5 each. The total deductible input VAT amount for the exported products is VND25,000,000. - Imported 1,000 air conditioners with capacity of BTU 12,000 for sale in domestic market. The actual payable price up to the first border gate of the importation is $300 for each. During the tax period, the enterprise has sold 900 air conditioners to a commercial domestic company at the price of $600 each. The remaining imported goods were still on the stock. Required: 1) Calculate the customs duty, excise duty and VAT amount payable on each transaction at customs office. Given that, the exported goods are entitled for export tax rate of 0%; the tax rates applicable to air conditioners are as follows: import duty rate: 10%, excise duty rate: 10%, VAT rate: 10%; The base price of imported goods is determined on the basis of transaction value; exchange rate applicable $1=VND23,000. 2) Calculate the VAT amount payable declared to domestic tax office. Given that the VAT amount at the importation stage has been paid by the enterprise, and the deductible amount on other purchased goods is VND3,000,000; the exported goods are accompanied with sufficient documents as prescribed by law Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started