Question

The Savannah Shirt Company makes two types of T-shirts: basic and custom. Basic shirts are plain shirts without any screen printing on them. Custom shirts

The Savannah Shirt Company makes two types of T-shirts: basic and custom. Basic shirts are plain shirts without any screen printing on them. Custom shirts are created using the basic shirts and then adding a custom screen printing design.

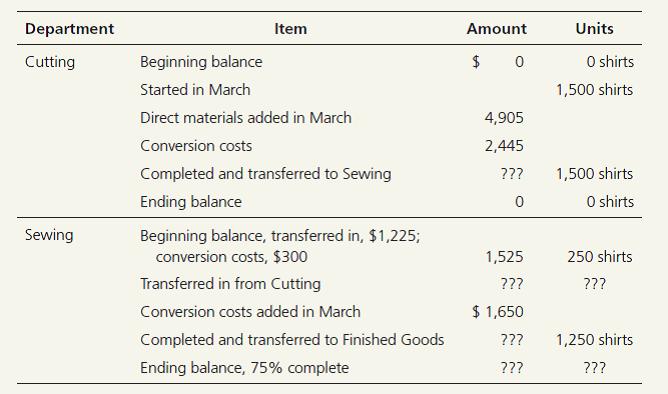

The company buys cloth in various colors and then makes the basic shirts in two departments, Cutting and Sewing. The company uses a process costing system (weighted-average method) to determine the production cost of the basic shirts. In the Cutting Department, direct materials (cloth) are added at the beginning of the process and conversion costs are added evenly through the process. In the Sewing Department, no direct materials are added. The only additional material, thread, is considered an indirect material because it cannot be easily traced to the finished product. Conversion costs are added evenly throughout the process in the Sewing Department. The finished basic shirts are sold to retail stores or are sent to the Custom Design Department for custom screen printing.

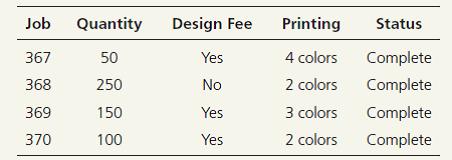

The Custom Design Department creates custom shirts by adding screen printing to the basic shirt. The department creates a design based on the customer’s request and then prints the design using up to four colors. Because these shirts have the custom printing added, which is unique for each order, the additional cost incurred is determined using job order costing, with each custom order considered a separate job.

For March 2016, the Savannah Shirt Company compiled the following data for the Cutting and Sewing Departments:

For the same time period, the Savannah Shirt Company compiled the following data for the Custom Design Department:

The Savannah Shirt Company has previously determined that creating and programming the design cost $75 per design. This is a one-time charge. If a customer places another order with the same design, the customer is not charged a second time. Additionally, the cost to print is $0.50 per color per shirt.

Requirements

1. Complete a production cost report for the Cutting Department and the Sewing Department. What is the cost of one basic shirt?

2. Determine the total cost and the average cost per shirt for jobs 367, 368, 369, and 370. If the company set the sales price at 160% of the total cost, determine the total sales price of each job.

3. In addition to the custom jobs, the Savannah Shirt Company sold 1,250 basic shirts (assume the beginning balance in Finished Goods Inventory is sufficient to make these sales, and the unit cost of the basic shirts in Finished Goods Inventory is the same as the unit cost incurred this month). If the company set the sales price at 140% of the cost, determine the sales price per unit, total sales revenue, and the total cost of goods sold for the basic shirts.

4. Calculate the total revenue and total cost of goods sold for all sales, basic and custom.

5. Assume the company sold only basic shirts (no custom designs) and incurred fixed costs of $1,403 per month.

a. Calculate the contribution margin per unit, contribution margin ratio, required sales in units to break even, and required sales in dollars to break even.

b. Determine the margin of safety in units and dollars.

c. Graph Savannah Shirt Company’s CVP relationships. Show the breakeven point, the sales revenue line, the fixed cost line, the total cost line, the operating loss area, and the operating income area.

d. Suppose the Savannah Shirt Company wants to earn an operating income of $4,100 per month. Compute the required sales in units and dollars to achieve this profit goal.

6. The Savannah Shirt Company is considering adding a new product line, a cloth shopping bag with custom screen printing that will be sold to grocery stores. If the current market price of cloth shopping bags is $1.25 and the company desires a net profit of 40%, what is the target cost? The company estimates the full product cost of the cloth bags will be $0.60. Should the company manufacture the cloth bags? Why or why not?

Department Item Amount Units Cutting Beginning balance $ O shirts Started in March 1,500 shirts Direct materials added in March 4,905 Conversion costs 2,445 Completed and transferred to Sewing ??? 1,500 shirts Ending balance O shirts Sewing Beginning balance, transferred in, $1,225; conversion costs, $300 1,525 250 shirts Transferred in from Cutting ??? ??? Conversion costs added in March $ 1,650 Completed and transferred to Finished Goods ??? 1,250 shirts Ending balance, 75% complete ??? ???

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Determine the sales price per unit total sales revenue an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started