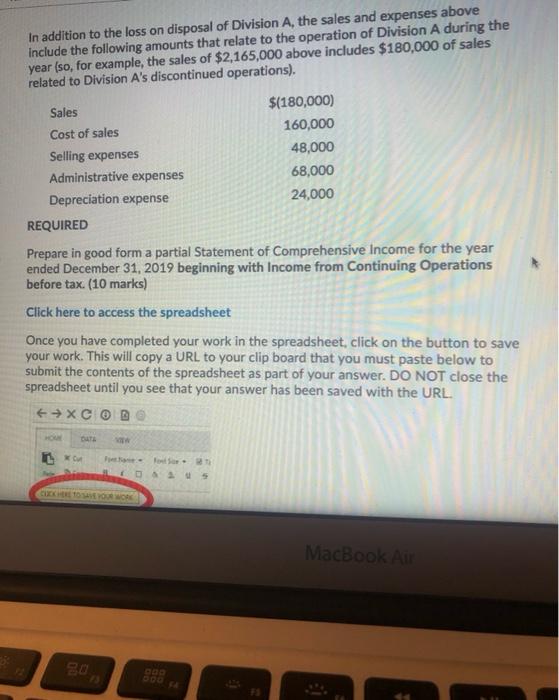

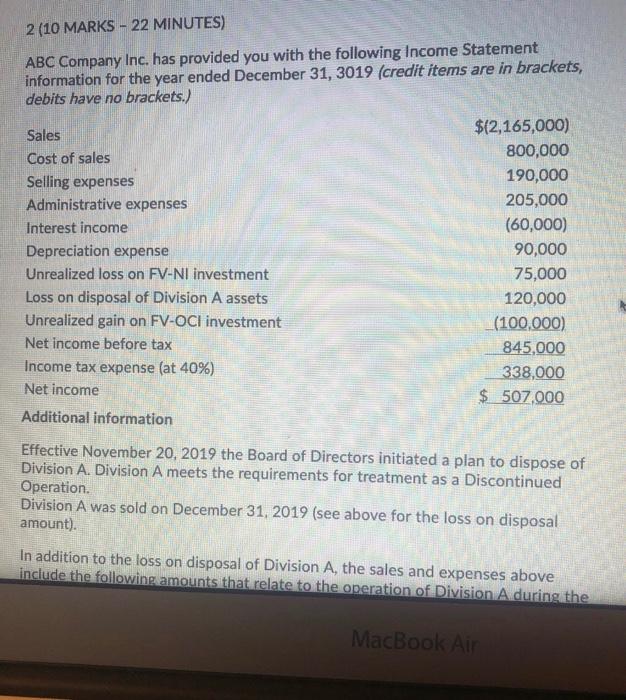

In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the year (so, for example, the sales of $2,165,000 above includes $180,000 of sales related to Division A's discontinued operations). Sales $(180,000) Cost of sales 160,000 Selling expenses 48,000 Administrative expenses 68,000 Depreciation expense 24,000 REQUIRED Prepare in good form a partial Statement of Comprehensive Income for the year ended December 31, 2019 beginning with Income from Continuing Operations before tax. (10 marks) Click here to access the spreadsheet Once you have completed your work in the spreadsheet, click on the button to save your work. This will copy a URL to your clip board that you must paste below to submit the contents of the spreadsheet as part of your answer. DO NOT close the spreadsheet until you see that your answer has been saved with the URL xe @ IL KO MacBook Air 30 2 (10 MARKS - 22 MINUTES) ABC Company Inc. has provided you with the following Income Statement information for the year ended December 31, 3019 (credit items are in brackets, debits have no brackets.) Sales Cost of sales Selling expenses Administrative expenses Interest income Depreciation expense Unrealized loss on FV-NI investment Loss on disposal of Division A assets Unrealized gain on FV-OCI investment Net income before tax Income tax expense (at 40%) Net income $(2,165,000) 800,000 190,000 205,000 (60,000) 90,000 75,000 120,000 (100,000) 845,000 338,000 $ 507.000 Additional information Effective November 20, 2019 the Board of Directors initiated a plan to dispose of Division A. Division A meets the requirements for treatment as a Discontinued Operation. Division A was sold on December 31, 2019 (see above for the loss on disposal amount). In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the MacBook Air In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the year (so, for example, the sales of $2,165,000 above includes $180,000 of sales related to Division A's discontinued operations). Sales $(180,000) Cost of sales 160,000 Selling expenses 48,000 Administrative expenses 68,000 Depreciation expense 24,000 REQUIRED Prepare in good form a partial Statement of Comprehensive Income for the year ended December 31, 2019 beginning with Income from Continuing Operations before tax. (10 marks) Click here to access the spreadsheet Once you have completed your work in the spreadsheet, click on the button to save your work. This will copy a URL to your clip board that you must paste below to submit the contents of the spreadsheet as part of your answer. DO NOT close the spreadsheet until you see that your answer has been saved with the URL xe @ IL KO MacBook Air 30 2 (10 MARKS - 22 MINUTES) ABC Company Inc. has provided you with the following Income Statement information for the year ended December 31, 3019 (credit items are in brackets, debits have no brackets.) Sales Cost of sales Selling expenses Administrative expenses Interest income Depreciation expense Unrealized loss on FV-NI investment Loss on disposal of Division A assets Unrealized gain on FV-OCI investment Net income before tax Income tax expense (at 40%) Net income $(2,165,000) 800,000 190,000 205,000 (60,000) 90,000 75,000 120,000 (100,000) 845,000 338,000 $ 507.000 Additional information Effective November 20, 2019 the Board of Directors initiated a plan to dispose of Division A. Division A meets the requirements for treatment as a Discontinued Operation. Division A was sold on December 31, 2019 (see above for the loss on disposal amount). In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the MacBook Air