Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In addition, you may assume that the annual risk - free rate is 5 % . In the following steps we will find the value

In addition, you may assume that the annual riskfree rate is In the following steps we will find the value of this option.

Question

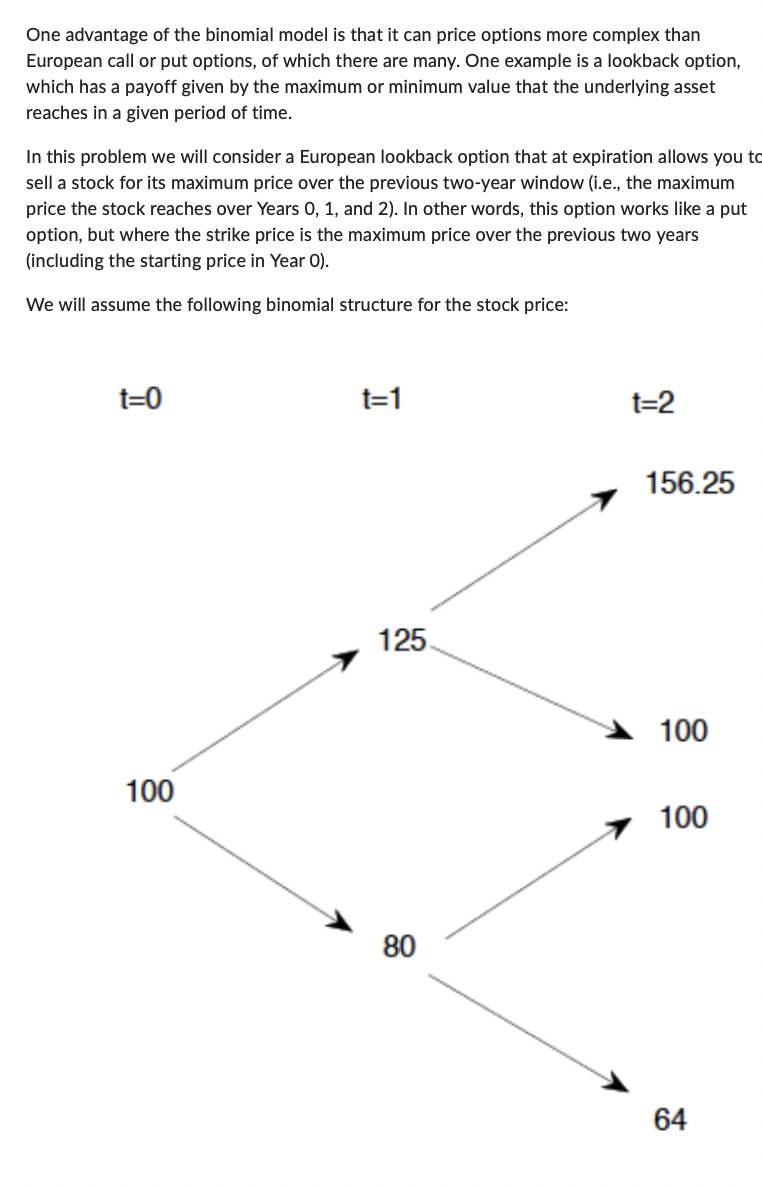

What is the value of this option in Year t in the up state where the stock price is $

Hint: use the replicating portfolio method from lecture.

Please enter your answer in dollars, without the $ sign, with at least two decimals of precision. For example, enter $ as

Your Answer:

Question :

What is the value of this option in Year t in the down state where the stock price is $

Hint: use the replicating portfolio method from lecture.

Please enter your answer in dollars, without the $ sign, with at least two decimals of precision. For example, enter $ as

Your Answer:

Question :

What is the value of this option in Year Note this option will expire pay out in Year

Hint: use the answers to the previous two problems.

Please enter your answer in dollars, without the $ sign, with at least two decimals of precision. For example, enter $ as

Your Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started