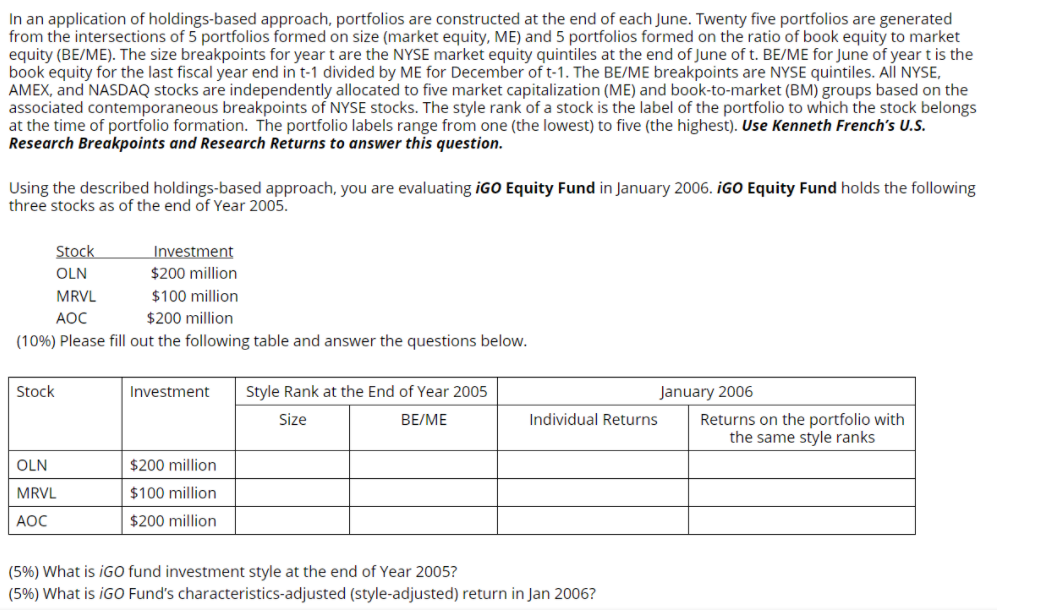

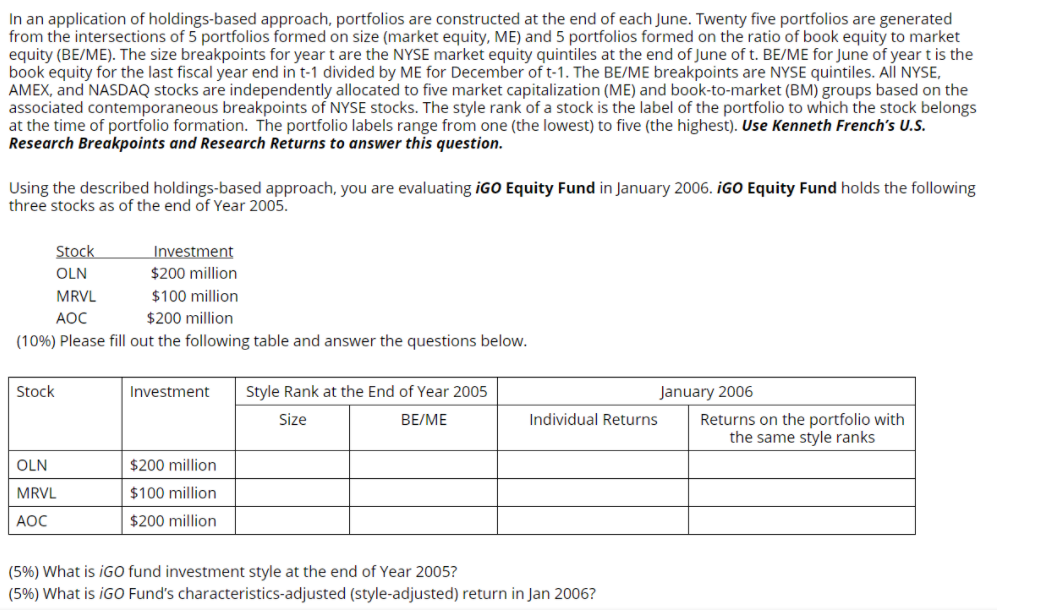

In an application of holdings-based approach, portfolios are constructed at the end of each June. Twenty five portfolios are generated from the intersections of 5 portfolios formed on size (market equity, ME) and 5 portfolios formed on the ratio of book equity to market equity (BE/ME). The size breakpoints for year t are the NYSE market equity quintiles at the end of June of t.BE/ME for June of yeart is the book equity for the last fiscal year end in t-1 divided by ME for December of t-1. The BE/ME breakpoints are NYSE quintiles. All NYSE, AMEX, and NASDAQ stocks are independently allocated to five market capitalization (ME) and book-to-market (BM) groups based on the associated contemporaneous breakpoints of NYSE stocks. The style rank of a stock is the label of the portfolio to which the stock belongs at the time of portfolio formation. The portfolio labels range from one (the lowest) to five (the highest). Use Kenneth French's U.S. Research Breakpoints and Research Returns to answer this question. Using the described holdings-based approach, you are evaluating iGO Equity Fund in January 2006. iGO Equity Fund holds the following three stocks as of the end of Year 2005. Stock Investment OLN $200 million MRVL $100 million AOC $200 million (10%) Please fill out the following table and answer the questions below. Stock Investment Style Rank at the End of Year 2005 Size BE/ME January 2006 Individual Returns Returns on the portfolio with the same style ranks OLN $200 million $100 million MRVL AOC $200 million (5%) What is iGO fund investment style at the end of Year 2005? (5%) What is iGO Fund's characteristics-adjusted (style-adjusted) return in Jan 2006? In an application of holdings-based approach, portfolios are constructed at the end of each June. Twenty five portfolios are generated from the intersections of 5 portfolios formed on size (market equity, ME) and 5 portfolios formed on the ratio of book equity to market equity (BE/ME). The size breakpoints for year t are the NYSE market equity quintiles at the end of June of t.BE/ME for June of yeart is the book equity for the last fiscal year end in t-1 divided by ME for December of t-1. The BE/ME breakpoints are NYSE quintiles. All NYSE, AMEX, and NASDAQ stocks are independently allocated to five market capitalization (ME) and book-to-market (BM) groups based on the associated contemporaneous breakpoints of NYSE stocks. The style rank of a stock is the label of the portfolio to which the stock belongs at the time of portfolio formation. The portfolio labels range from one (the lowest) to five (the highest). Use Kenneth French's U.S. Research Breakpoints and Research Returns to answer this question. Using the described holdings-based approach, you are evaluating iGO Equity Fund in January 2006. iGO Equity Fund holds the following three stocks as of the end of Year 2005. Stock Investment OLN $200 million MRVL $100 million AOC $200 million (10%) Please fill out the following table and answer the questions below. Stock Investment Style Rank at the End of Year 2005 Size BE/ME January 2006 Individual Returns Returns on the portfolio with the same style ranks OLN $200 million $100 million MRVL AOC $200 million (5%) What is iGO fund investment style at the end of Year 2005? (5%) What is iGO Fund's characteristics-adjusted (style-adjusted) return in Jan 2006