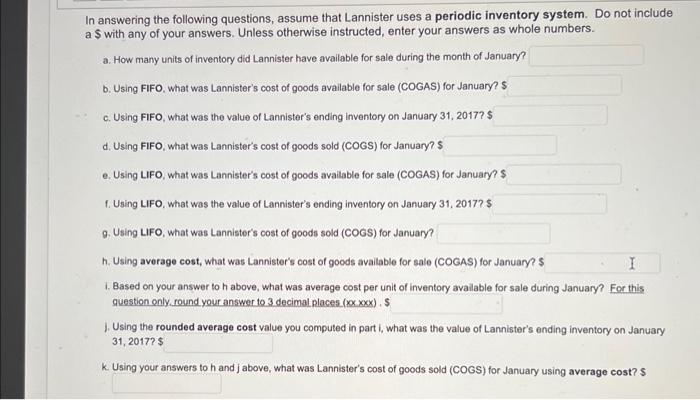

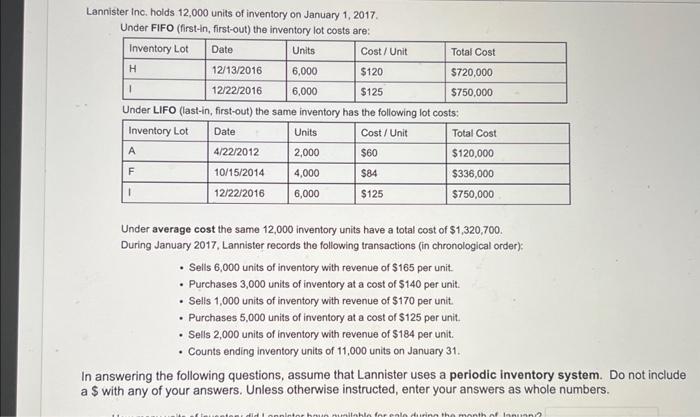

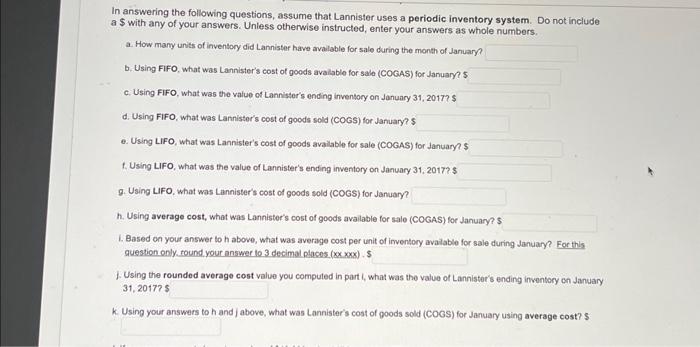

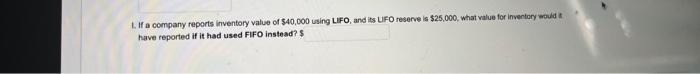

In answering the following questions, assume that Lannister uses a periodic inventory system. Do not include a \$ with any of your answers. Unless otherwise instructed, enter your answers as whole numbers. a. How many units of inventory did Lannister have available for sale during the month of January? b. Using FIFO, what was Lannister's cost of goods available for sale (COGAS) for January? c. Using FIFO, what was the value of Lannister's ending inventory on January 31, 2017? $ d. Using FIFO, what was Lannister's cost of goods sold (COGS) for January? \$ e. Using LIFO, what was Lannister's cost of goods available for sale (COGAS) for January? f. Using LIFO, what was the value of Lannister's ending inventory on January 31, 2017? \$ 9. Using LIFO, what was Lannister's cost of goods sold (COGS) for January? h. Using average cost, what was Lannister's cost of goods available for sale (COGAS) for January? : 1. Based on your answer to h above, what was average cost per unit of inventory available for sale during January? For this guestion only, found your answer to 3 decimal places ( x0xxx), $ 1. Using the rounded average cost value you computed in part i, what was the value of Lannister's ending inventory on January 31,2017?$ k. Using your answers to h and j above, what was Lannister's cost of goods sold (COGS) for January using average cost? $ Lannister inc. holds 12,000 units of inventory on January 1,2017. Under FIFO (first-in, first-out) the inventory lot costs are: Under LIFO (last-in, first-out) the same inventory has the following lot costs: Under average cost the same 12,000 inventory units have a total cost of $1,320,700. During January 2017, Lannister records the following transactions (in chronological order): - Sells 6,000 units of inventory with revenue of $165 per unit. - Purchases 3,000 units of inventory at a cost of $140 per unit. - Sells 1,000 units of inventory with revenue of $170 per unit. - Purchases 5,000 units of inventory at a cost of $125 per unit. - Sells 2,000 units of inventory with revenue of $184 per unit. - Counts ending inventory units of 11,000 units on January 31. In answering the following questions, assume that Lannister uses a periodic inventory system. Do not include a $ with any of your answers. Unless otherwise instructed, enter your answers as whole numbers. In answering the following questions, assume that Lannister uses a periodic inventory system. Do not include a $ with any of your answers. Uniess otherwise instructed, enter your answers as whole numbers. a. How many units of inventory did Lannister have available for sale during the month of Januaryn b. Using FIFO, what was Lannister's cost of goods avalable for sale (COGAS) for January? c. Using FIFO, what was the value of Lannister's ending inventory on January 31, 2017? $ d. Using FIFO, what was Lannister's cost of goods sold (COGS) for January?s e. Using LIFO, what was Lannister's cost of goods available for sale (COGAS) for Januaryn! f. Using LIFO, what was the value of Lannister's ending inventory on January 31, 2017? 4 g. Using LIFO, what was Lannister's cost of goods sold (COGS) for January? h. Using average cost, what was Lannister's cost of goods available for sale (COGAS) for January? $ 1. Based on your answer to h above, what was average cost per unit of inventory avalable for sale during January? For thls question only tound your answer to 3 decimal places (xxx8) if 1. Using the rounded average cost value you computed in part 1, what was the value of Lannister's ending inventory cn Janwary 31,201775 k. Using your answers to h and j above, what was Lannister's cost of goods sold (COGS) for January using average cost? 5 L. If a company reperts inventory value of $40,000 usina LIFO, and its UFO reserve is $2.,000, what value for invertory would i have reported if it had used FIFO instead? 4