In both problems, use a market risk premium of 5.5% Problem 1 Terck Inc., a leading pharmaceutical company, currently has a balance sheet that

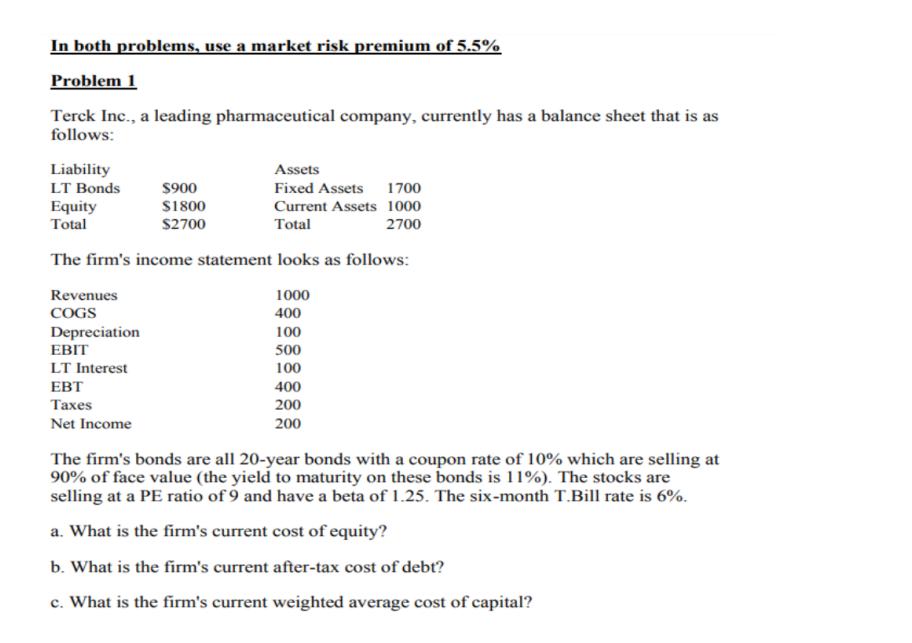

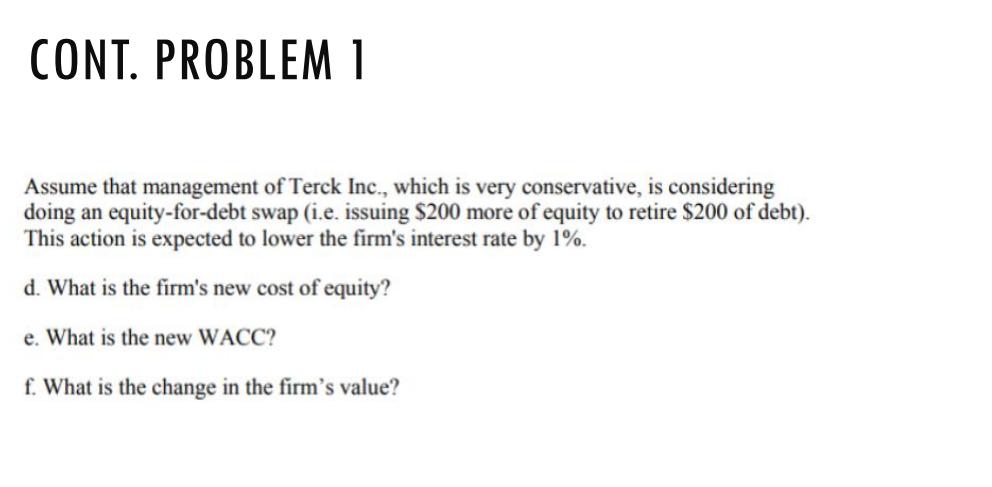

In both problems, use a market risk premium of 5.5% Problem 1 Terck Inc., a leading pharmaceutical company, currently has a balance sheet that is as follows: Assets Fixed Assets 1700 Current Assets 1000 2700 Total The firm's income statement looks as follows: 1000 400 100 500 100 Liability LT Bonds Equity Total Revenues COGS Depreciation EBIT LT Interest EBT Taxes Net Income $900 $1800 $2700 400 200 200 The firm's bonds are all 20-year bonds with a coupon rate of 10% which are selling at 90% of face value (the yield to maturity on these bonds is 11%). The stocks are selling at a PE ratio of 9 and have a beta of 1.25. The six-month T.Bill rate is 6%. a. What is the firm's current cost of equity? b. What is the firm's current after-tax cost of debt? c. What is the firm's current weighted average cost of capital? CONT. PROBLEM 1 Assume that management of Terck Inc., which is very conservative, is considering doing an equity-for-debt swap (i.e. issuing $200 more of equity to retire $200 of debt). This action is expected to lower the firm's interest rate by 1%. d. What is the firm's new cost of equity? e. What is the new WACC? f. What is the change in the firm's value?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a What is the firms current cost of equity ANSWER r Rf RM Rf r 6 12511 6 r 1125 Thus the firms curre...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started