in C please!

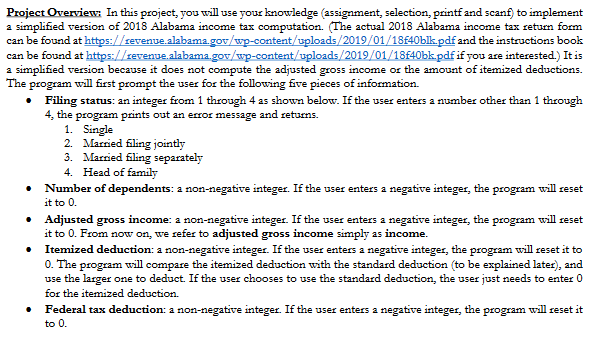

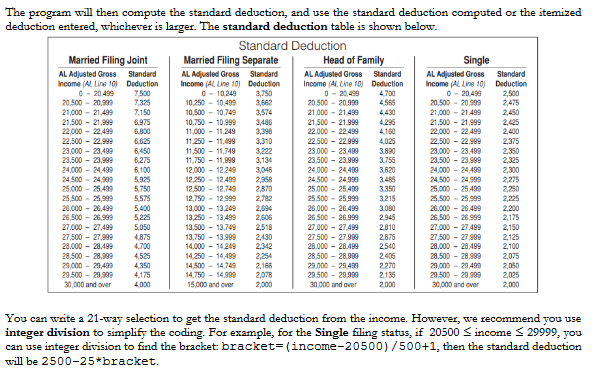

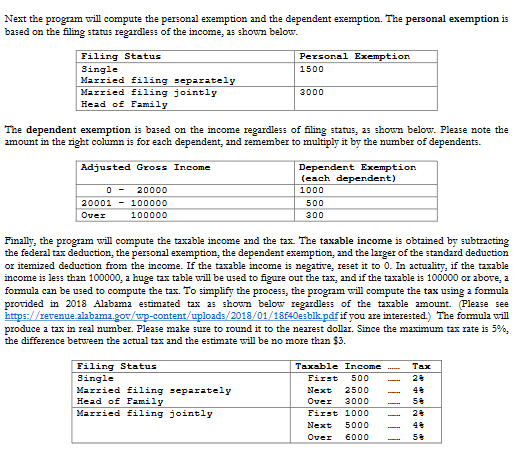

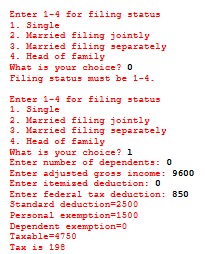

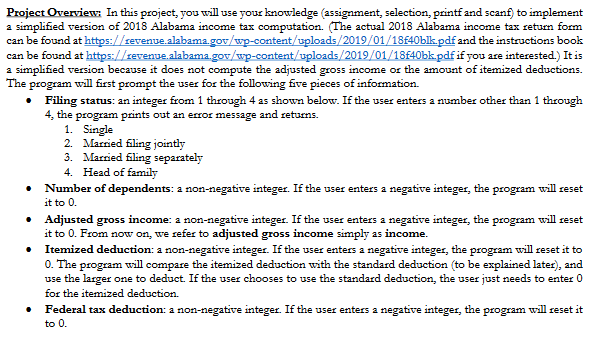

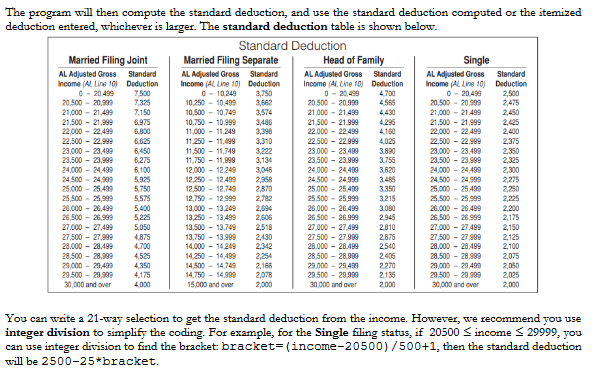

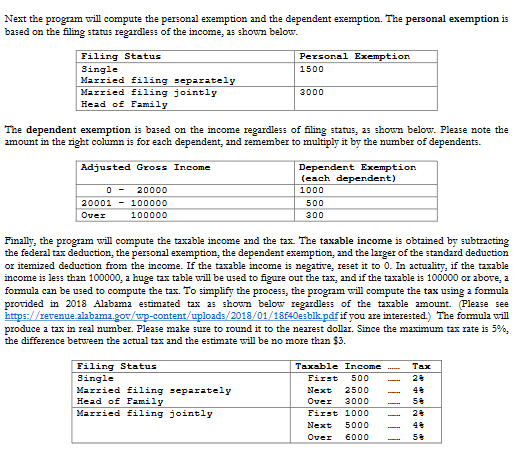

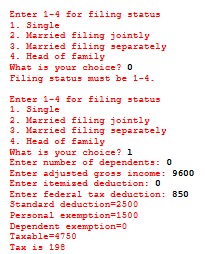

Project Oyervie In this project, yo will use your knowledge (assignment, selection, printf and scanf) to implement a simplified version of 2018 Alabama income tax computation. (The actual 2018 Alabama income tax return form can be found at httos://revenue.alabamagov/wp-content/uploads/2019/01/18f40blkpdf and the instuctions book can be found at https://revenue.alabamagov/wp-content/uploads/2019/01/18f40bk pdf if ou are interested.) It is a simplified version because it does not compute the adjusted gross income or the amount of itemized deductions. The pzogram will first prompt the user for the following ive pieces of information Filing status: an integer from 1 through 4 as shown below. If the user enters a number other than 1 through 4, the * e program prints out an error mes 1. Single 2. Married fling jointly 3. Marnied fling separately 4. Head of family * Number of dependents: a non-negative integer. If the user enters a negative integer, the program will reset * Adjusted gross income: a non-negative integer. If the user enters a negative integer, the program will reset * Itemized deduction: a non-negative integer. If the user enters a negative integer, the program will reset it to 1t to 0. it to 0. From now on, we refer to adjusted gross income simply as income. 0. The program will compare use the larger one to deduct If the user chooses to use the standard deduction, the user just needs to enter 0 for the itemized deduction. the itemized deduction with the standard deduction (to be * Federal tax deduction: a non-negative integex If the user enters a negative integer, the pxogram will reset it to 0 The program will then compute the standard deduction, and use the standard deduction computed or the itemized deduction entered, whichever is larger. The standard deduction table is shown below Standard Deduction 2 You can waite a 21-way selection to get the standard deduction from the income. However, we recommend you use integer division to simplify the coding. For example, for the Single filing status, if 20500 income 29999, you can use integer division to find the bracket bracket= ( income-20500 ) / 500+1, then te standard deduction will be 2500-25*bracket. Next the program will compute the personal exemption and the dependent exemption. The personal exemption is based on the filing status regardless of the in come, as shown below Filing Status Bingle Personal Exemption. 1500 Married filing jointly Head of Famil 3000 The dependent exemption is based on the income regardless of filing status, as shoum below. Please note the mount in the right column is for each dependent, and remember to multiply it by the number of dependents. Adjusted Gross Income Dependent Exemption (each deperndent) 0-20000 20001 -100000 100000 1000 500 300 Over Finally, the program will compute the taxable income and the tax. The taxable income is obtained by subtracting the federal tax deduction, the personal exemption, the dependent exemption, and the larger of the standard deduction or itemized deduction from the income. If the taxable income is ne atre. Ieset it to 0. In actualitr.f the taxable imcome is less than 100000, a huge tax table will be used to figure out the tax, and if the taxable is 100000 or abore, a formula can be used to compute the tax. To simplify the process, the program wwill compute the tax using a formula provided in 2018 Alabama estimated tax as shoun below regardless of the taxable amount. (Please see https://rerenue alabama.go/wp-content /uploads/2018/01/18640esblk.pdfif you are interested.) The fomulawil produce a tax in real number. Please make sure to round it to the nearest dollar. Since the maximum tax rate is 5%, the difference between the actual tax and the estimate will be no more than $3. Tax Filing Status ingle Married filing separately Taxable Income 500 Next 2500- Over 3000 Hed of Famil 5a Married filing jointly Next 5000-4 Over 6000 Enter 1-4 for filing ,tatus 1. Single 2. Married filing jointly 3. Married filing separately 4. Head of family What is your choice? 0 Filing status must be 1-4 Enter 1-4 for filing ,tatus 1. Single 2. Married filing jointly 3. Maxried filing separately 4. Head of family What is your Enter number of dependents: 0 Enter adiusted gross income: 9600 Enter itemized deduction: 0 Enter feder 1 tax deduction : 850 tandard deduction 2500 Personal exemption 1500 Dependent exemption Taxable=4750 choice? 1 Project Oyervie In this project, yo will use your knowledge (assignment, selection, printf and scanf) to implement a simplified version of 2018 Alabama income tax computation. (The actual 2018 Alabama income tax return form can be found at httos://revenue.alabamagov/wp-content/uploads/2019/01/18f40blkpdf and the instuctions book can be found at https://revenue.alabamagov/wp-content/uploads/2019/01/18f40bk pdf if ou are interested.) It is a simplified version because it does not compute the adjusted gross income or the amount of itemized deductions. The pzogram will first prompt the user for the following ive pieces of information Filing status: an integer from 1 through 4 as shown below. If the user enters a number other than 1 through 4, the * e program prints out an error mes 1. Single 2. Married fling jointly 3. Marnied fling separately 4. Head of family * Number of dependents: a non-negative integer. If the user enters a negative integer, the program will reset * Adjusted gross income: a non-negative integer. If the user enters a negative integer, the program will reset * Itemized deduction: a non-negative integer. If the user enters a negative integer, the program will reset it to 1t to 0. it to 0. From now on, we refer to adjusted gross income simply as income. 0. The program will compare use the larger one to deduct If the user chooses to use the standard deduction, the user just needs to enter 0 for the itemized deduction. the itemized deduction with the standard deduction (to be * Federal tax deduction: a non-negative integex If the user enters a negative integer, the pxogram will reset it to 0 The program will then compute the standard deduction, and use the standard deduction computed or the itemized deduction entered, whichever is larger. The standard deduction table is shown below Standard Deduction 2 You can waite a 21-way selection to get the standard deduction from the income. However, we recommend you use integer division to simplify the coding. For example, for the Single filing status, if 20500 income 29999, you can use integer division to find the bracket bracket= ( income-20500 ) / 500+1, then te standard deduction will be 2500-25*bracket. Next the program will compute the personal exemption and the dependent exemption. The personal exemption is based on the filing status regardless of the in come, as shown below Filing Status Bingle Personal Exemption. 1500 Married filing jointly Head of Famil 3000 The dependent exemption is based on the income regardless of filing status, as shoum below. Please note the mount in the right column is for each dependent, and remember to multiply it by the number of dependents. Adjusted Gross Income Dependent Exemption (each deperndent) 0-20000 20001 -100000 100000 1000 500 300 Over Finally, the program will compute the taxable income and the tax. The taxable income is obtained by subtracting the federal tax deduction, the personal exemption, the dependent exemption, and the larger of the standard deduction or itemized deduction from the income. If the taxable income is ne atre. Ieset it to 0. In actualitr.f the taxable imcome is less than 100000, a huge tax table will be used to figure out the tax, and if the taxable is 100000 or abore, a formula can be used to compute the tax. To simplify the process, the program wwill compute the tax using a formula provided in 2018 Alabama estimated tax as shoun below regardless of the taxable amount. (Please see https://rerenue alabama.go/wp-content /uploads/2018/01/18640esblk.pdfif you are interested.) The fomulawil produce a tax in real number. Please make sure to round it to the nearest dollar. Since the maximum tax rate is 5%, the difference between the actual tax and the estimate will be no more than $3. Tax Filing Status ingle Married filing separately Taxable Income 500 Next 2500- Over 3000 Hed of Famil 5a Married filing jointly Next 5000-4 Over 6000 Enter 1-4 for filing ,tatus 1. Single 2. Married filing jointly 3. Married filing separately 4. Head of family What is your choice? 0 Filing status must be 1-4 Enter 1-4 for filing ,tatus 1. Single 2. Married filing jointly 3. Maxried filing separately 4. Head of family What is your Enter number of dependents: 0 Enter adiusted gross income: 9600 Enter itemized deduction: 0 Enter feder 1 tax deduction : 850 tandard deduction 2500 Personal exemption 1500 Dependent exemption Taxable=4750 choice? 1