Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In calculating ending AAA, why do we not consider officers' life insurance proceeds (100,000) and premium paid for officers' life insurance (3,600). why do we

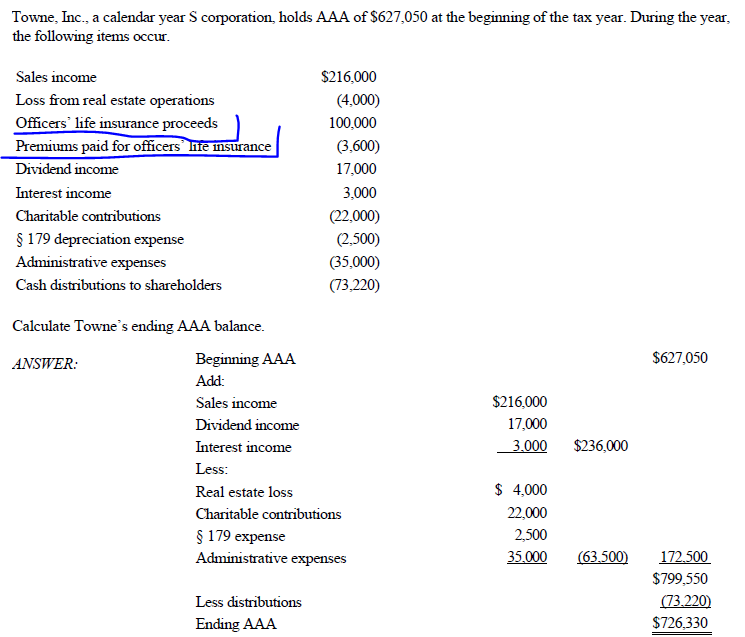

In calculating ending AAA, why do we not consider officers' life insurance proceeds (100,000) and premium paid for officers' life insurance (3,600). why do we not add or subtract them?

Towne, Inc., a calendar year S corporation, holds AAA of $627,050 at the beginning of the tax year. During the year, the following items occur. Sales income Loss from real estate operations Officers' life insurance proceeds Premiums paid for officers' life insurance Dividend income Interest income Charitable contributions $ 179 depreciation expense Administrative expenses Cash distributions to shareholders $216,000 (4,000) 100,000 (3.600) 17,000 3,000 (22,000) (2.500) (35,000) (73,220) Calculate Towne's ending AAA balance. $627,050 ANSWER: Beginning AAA Add: Sales income Dividend income Interest income $216,000 17,000 3,000 $236,000 Less: Real estate loss Charitable contributions $ 179 expense Administrative expenses $ 4,000 22,000 2.500 35,000 63,500) Less distributions Ending AAA 172.500 $799,550 (73.220) $726,330Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started