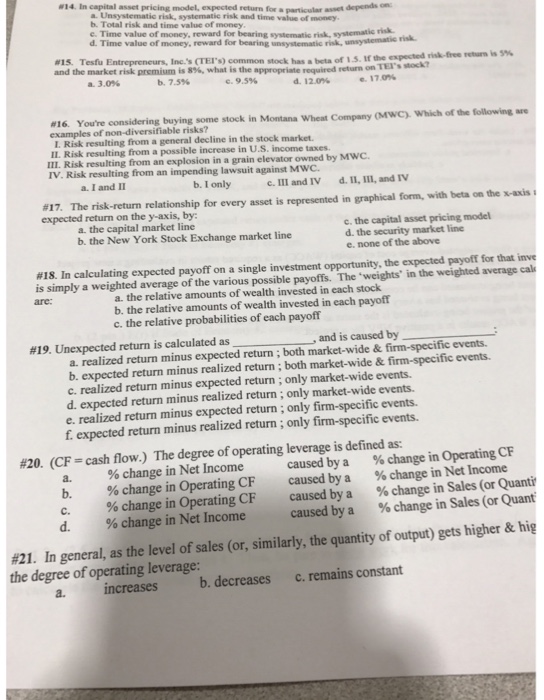

In capital asset pricing model, expected return for a particular asset depends on: a. Unsystematic risk, systematic risk and time value of money. b. Total risk and time value of money. c. Time value of money, reward for bearing systematic risk, systematic risk. d. Time value of money, reward for bearing unsystematic risk, unsystematic risk. Tesfu Entrepreneurs, Inc. 's (TEI's) common stock has a beta of 1.5. If the expected risk-free return is 5% and the market risk premium is 8%, what is the appropriate required return on TEI's stock? a. 3.0% b. 7.5% c. 9.5% d. 12.0% e. 17.0% You're considering buying some stock in Montana Wheat Company (MWC). Which of the following are examples of non-diversifiable risks? I. Risk resulting from a general decline in the stock market II. Risk resulting from a possible increase in U.S. income taxes III. Risk resulting from an explosion in a grain elevator owned by MWC. IV. Risk resulting from an impending lawsuit against MWC. a. I and II b. I only c. III and IV d. II, III, and IV The risk-return relationship for every asset is represented in graphical form, with beta on the x-axis expected return on the y-axis. by: a. the capital market line b. the New York Stock Exchange market line c. the capital asset pricing model d. the security market line e. none of the above. In calculating expected payoff on a single investment opportunity, the expected payoff for that investment is simply a weighted average of the various possible payoffs. The 'weights" in the weighted avenge are: a. the relative amounts of wealth invested in each stock b. the relative amounts of wealth invested in each payoff c. the relative probabilities of each payoff Unexpected return is calculated as, and is caused by. a. realized return minus expected return; both market-wide & firm-specific events. b. expected return minus realized return; both market-wide & firm-specific events c. realized return minus expected return; only market-wide events. d. expected return minus realized return; only market-wide events. e. realized return minus expected return; only firm-specific events. f. expected return minus realized return; only firm-specific events. (CF = cash flow.) The degree of operating leverage is defined as: a. % change in Net Income caused by a % change in Operating CF b. % change in Operating CF caused by a % change in Net Income c. % change in Operating CF caused by a % change in Sales (or Quantity) d. % change in Net Income caused by a % change in Sales (or Quantity) In general, as the level of sales (or, similarly, the quantity of output) gets higher & highest the degree of operating leverage: a increases b. decreases c. remains constant