Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In Chapter 16, Problem 2IC about sporer the financial analyst, I'm just after some further clarification. In Q4, how do you know the coupon price

In Chapter 16, Problem 2IC about sporer the financial analyst, I'm just after some further clarification.

In Chapter 16, Problem 2IC about sporer the financial analyst, I'm just after some further clarification.

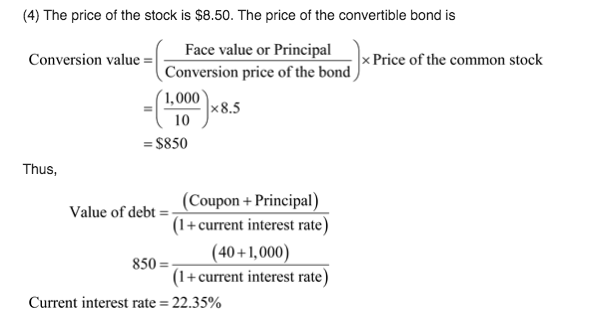

In Q4, how do you know the coupon price is 40, to find the interest rate of 22%? Wouldn't each bond have a different current interest rate? I'm just after further explanation please

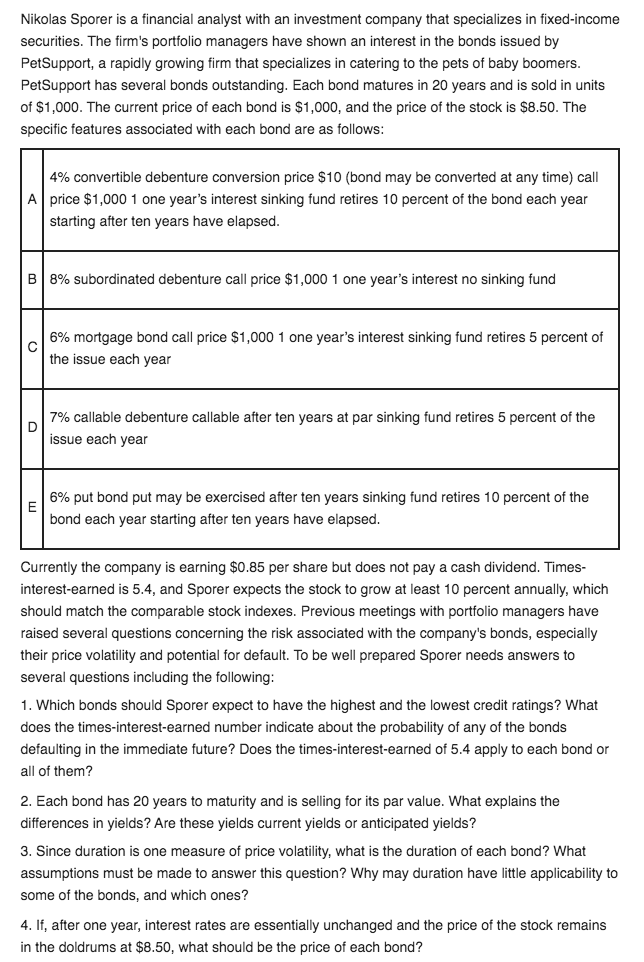

Nikolas Sporer is a financial analyst with an investment company that specializes in fixed-income securities. The firm's portfolio managers have shown an interest in the bonds issued by PetSupport, a rapidly growing firm that specializes in catering to the pets of baby boomers. Pet Support has several bonds outstanding. Each bond matures in 20 years and is sold in units of $1,000. The current price of each bond is $1,000, and the price of the stock is $8.50. The specific features associated with each bond are as follows: 4% convertible debenture conversion price $10 (bond may be converted at any time) call A price $1,000 1 one year's interest sinking fund retires 10 percent of the bond each year starting after ten years have elapsed. B 8% subordinated debenture call price $1,000 1 one year's interest no sinking fund percent of 6% mortgage bond call price $1,000 1 one year's interest sinking fund retires the issue each year D 7% callable debenture callable after ten years at par sinking fund retires 5 percent of the issue each year E 6% put bond put may be exercised after ten years sinking fund retires 10 percent of the bond each year starting after ten years have elapsed. Currently the company is earning $0.85 per share but does not pay a cash dividend. Times- interest-earned is 5.4, and Sporer expects the stock to grow at least 10 percent annually, which should match the comparable stock indexes. Previous meetings with portfolio managers have raised several questions concerning the risk associated with the company's bonds, especially their price volatility and potential for default. To be well prepared Sporer needs answers to several questions including the following: 1. Which bonds should Sporer expect to have the highest and the lowest credit ratings? What does the times-interest-earned number indicate about the probability of any of the bonds defaulting in the immediate future? Does the times-interest-earned of 5.4 apply to each bond or all of them? 2. Each bond has 20 years to maturity and is selling for its par value. What explains the differences in yields? Are these yields current yields or anticipated yields? 3. Since duration is one measure of price volatility, what is the duration of each bond? What assumptions must be made to answer this estion? Why may duration have little applicability to some of the bonds, and which ones? 4. If, after one year, interest rates are essentially unchanged and the price of the stock remains in the doldrums at $8.50, what should be the price of each bond? (4) The price of the stock is $8.50. The price of the convertible bond is Conversion value Face value or Principal Conversion price of the bond, * Price of the common stock 1,000 * 8.5 10 = $850 Thus, (Coupon + Principal) Value of debt (1 + current interest rate) (40+1,000) 850 = (1+ current interest rate) Current interest rate = 22.35%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started