Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In class we discussed the payback period method and how it should be used as an initial screen or a supplemental method due to

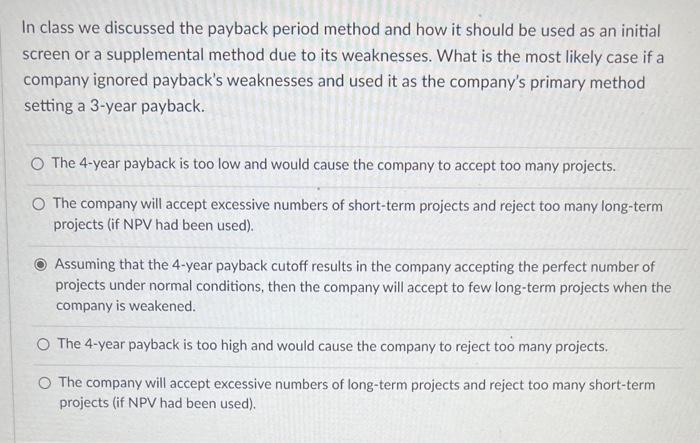

In class we discussed the payback period method and how it should be used as an initial screen or a supplemental method due to its weaknesses. What is the most likely case if a company ignored payback's weaknesses and used it as the company's primary method setting a 3-year payback. O The 4-year payback is too low and would cause the company to accept too many projects. O The company will accept excessive numbers of short-term projects and reject too many long-term projects (if NPV had been used). Assuming that the 4-year payback cutoff results in the company accepting the perfect number of projects under normal conditions, then the company will accept to few long-term projects when the company is weakened. O The 4-year payback is too high and would cause the company to reject too many projects. O The company will accept excessive numbers of long-term projects and reject too many short-term projects (if NPV had been used).

Step by Step Solution

★★★★★

3.26 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A The 4year payback is too low and would cause the company to accept too many projects The 4y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started