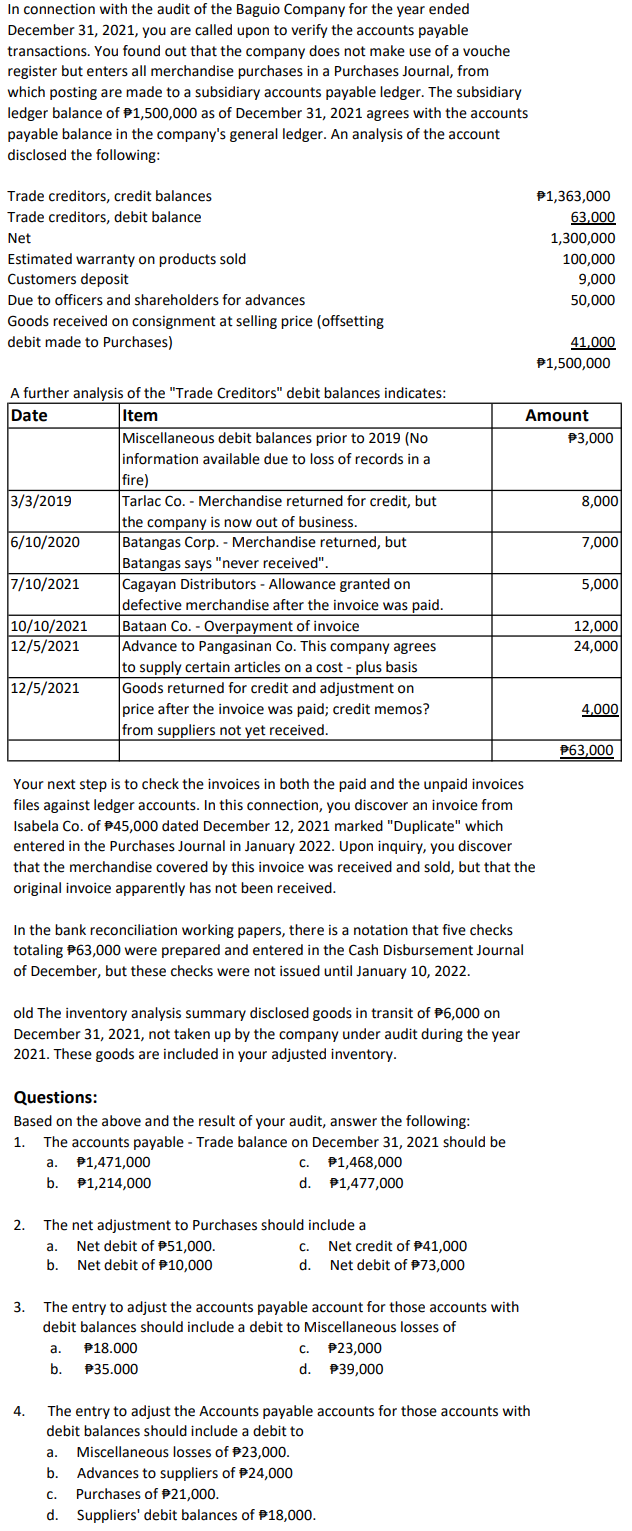

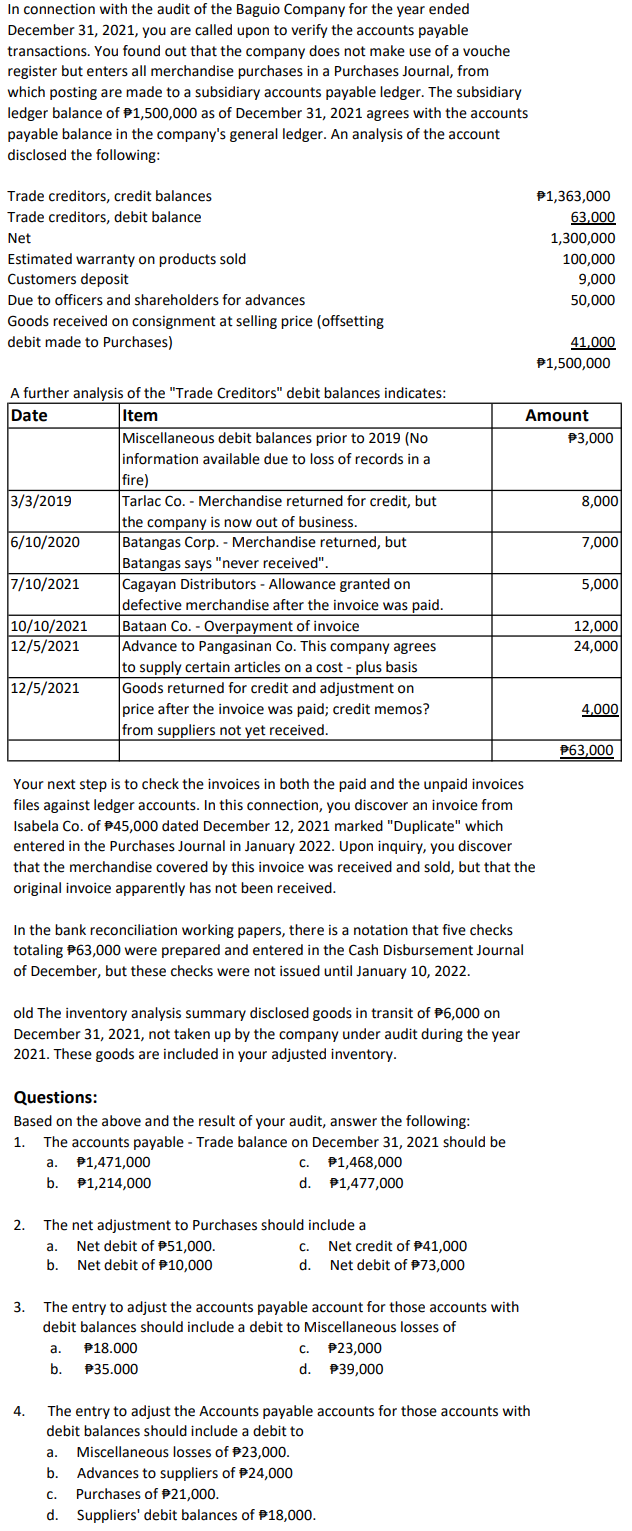

In connection with the audit of the Baguio Company for the year ended December 31, 2021, you are called upon to verify the accounts payable transactions. You found out that the company does not make use of a vouche register but enters all merchandise purchases in a Purchases Journal, from which posting are made to a subsidiary accounts payable ledger. The subsidiary ledger balance of 1,500,000 as of December 31,2021 agrees with the accounts payable balance in the company's general ledger. An analysis of the account disclosed the following: further analucic of the "Trate Croditare" dehit halanrec indiratec. Your next step is to check the invoices in both the paid and the unpaid invoices files against ledger accounts. In this connection, you discover an invoice from Isabela Co. of 45,000 dated December 12, 2021 marked "Duplicate" which entered in the Purchases Journal in January 2022. Upon inquiry, you discover that the merchandise covered by this invoice was received and sold, but that the original invoice apparently has not been received. In the bank reconciliation working papers, there is a notation that five checks totaling 63,000 were prepared and entered in the Cash Disbursement Journal of December, but these checks were not issued until January 10, 2022. old The inventory analysis summary disclosed goods in transit of 6,000 on December 31,2021 , not taken up by the company under audit during the year 2021. These goods are included in your adjusted inventory. Questions: Based on the above and the result of your audit, answer the following: 1. The accounts payable - Trade balance on December 31,2021 should be a. 1,471,000 c. 1,468,000 b. 1,214,000 d. 1,477,000 2. The net adjustment to Purchases should include a a. Net debit of 51,000. c. Net credit of 41,000 b. Net debit of 10,000 d. Net debit of 73,000 3. The entry to adjust the accounts payable account for those accounts with debit balances should include a debit to Miscellaneous losses of a. 18.000 c. 23,000 b. $35.000 d. 39,000 4. The entry to adjust the Accounts payable accounts for those accounts with debit balances should include a debit to a. Miscellaneous losses of 23,000. b. Advances to suppliers of 24,000 c. Purchases of 21,000. d. Suppliers' debit balances of 18,000