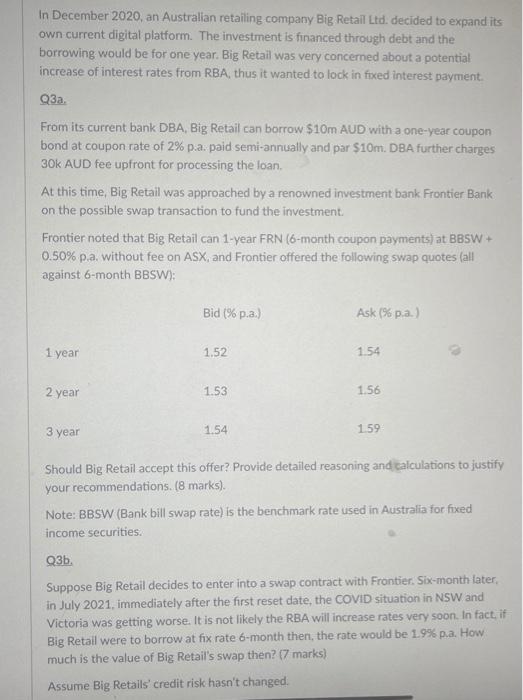

In December 2020, an Australian retailing company Big Retail Ltd. decided to expand its own current digital platform. The investment is financed through debt and the borrowing would be for one year. Big Retail was very concerned about a potential increase of interest rates from RBA, thus it wanted to lock in fixed interest payment. Q3a. From its current bank DBA, Big Retail can borrow $10m AUD with a one-year coupon bond at coupon rate of 2% p.a. paid semi-annually and par $10m. DBA further charges 30k AUD fee upfront for processing the loan At this time, Big Retail was approached by a renowned investment bank Frontier Bank on the possible swap transaction to fund the investment Frontier noted that Big Retail can 1-year FRN (6-month coupon payments) at BBSW + 0.50% pa, without fee on ASX, and Frontier offered the following swap quotes (all against 6-month BBSW): Bid (% p.a.) Ask (% p.a.) 1 year 1.52 1.54 2 year 1.53 1.56 3 year 1.54 159 Should Big Retail accept this offer? Provide detailed reasoning and calculations to justify your recommendations. (8 marks). Note: BBSW (Bank bill swap rate) is the benchmark rate used in Australia for fixed income securities. Q. Suppose Big Retail decides to enter into a swap contract with Frontier. Six-month later, in July 2021, immediately after the first reset date, the COVID situation in NSW and Victoria was getting worse. It is not likely the RBA will increase rates very soon. In fact, if Big Retail were to borrow at fix rate 6-month then, the rate would be 19% p.a. How much is the value of Big Retail's swap then? (7 marks) Assume Big Retails' credit risk hasn't changed In December 2020, an Australian retailing company Big Retail Ltd. decided to expand its own current digital platform. The investment is financed through debt and the borrowing would be for one year. Big Retail was very concerned about a potential increase of interest rates from RBA, thus it wanted to lock in fixed interest payment. Q3a. From its current bank DBA, Big Retail can borrow $10m AUD with a one-year coupon bond at coupon rate of 2% p.a. paid semi-annually and par $10m. DBA further charges 30k AUD fee upfront for processing the loan At this time, Big Retail was approached by a renowned investment bank Frontier Bank on the possible swap transaction to fund the investment Frontier noted that Big Retail can 1-year FRN (6-month coupon payments) at BBSW + 0.50% pa, without fee on ASX, and Frontier offered the following swap quotes (all against 6-month BBSW): Bid (% p.a.) Ask (% p.a.) 1 year 1.52 1.54 2 year 1.53 1.56 3 year 1.54 159 Should Big Retail accept this offer? Provide detailed reasoning and calculations to justify your recommendations. (8 marks). Note: BBSW (Bank bill swap rate) is the benchmark rate used in Australia for fixed income securities. Q. Suppose Big Retail decides to enter into a swap contract with Frontier. Six-month later, in July 2021, immediately after the first reset date, the COVID situation in NSW and Victoria was getting worse. It is not likely the RBA will increase rates very soon. In fact, if Big Retail were to borrow at fix rate 6-month then, the rate would be 19% p.a. How much is the value of Big Retail's swap then? (7 marks) Assume Big Retails' credit risk hasn't changed