Answered step by step

Verified Expert Solution

Question

1 Approved Answer

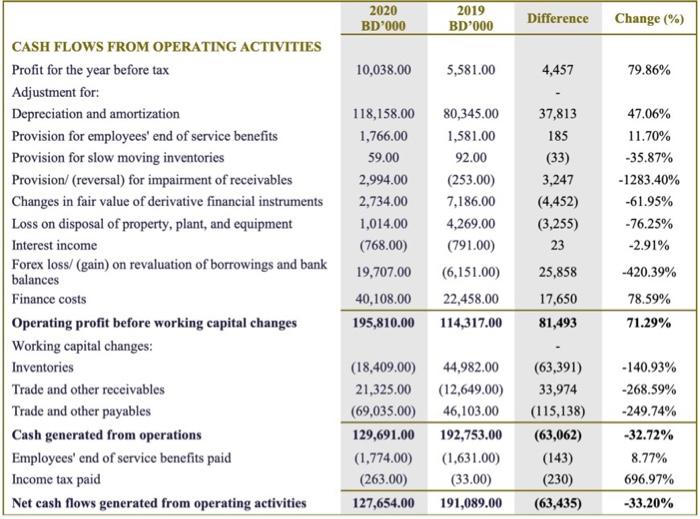

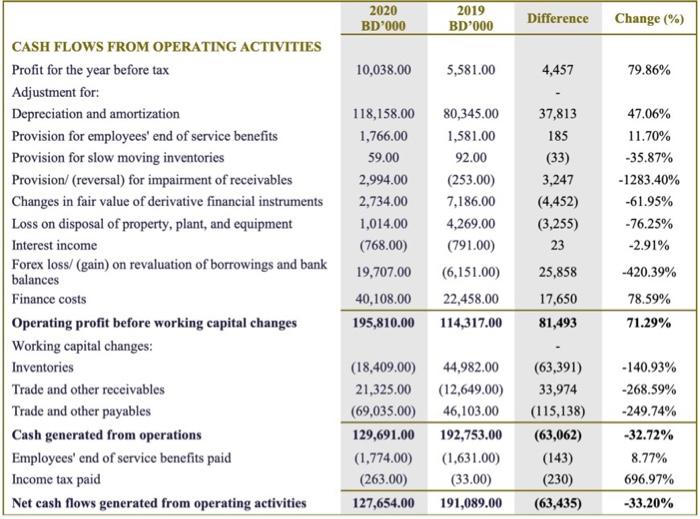

In detail, analyze and compare the cash flow statement for Company X from 2019 to 2020. CASH FLOWS FROM OPERATING ACTIVITIES Profit for the year

In detail, analyze and compare the cash flow statement for Company X from 2019 to 2020.

CASH FLOWS FROM OPERATING ACTIVITIES Profit for the year before tax Adjustment for: Depreciation and amortization Provision for employees' end of service benefits Provision for slow moving inventories Provision/ (reversal) for impairment of receivables Changes in fair value of derivative financial instruments Loss on disposal of property, plant, and equipment Interest income Forex loss/ (gain) on revaluation of borrowings and bank balances Finance costs Operating profit before working capital changes Working capital changes: Inventories Trade and other receivables Trade and other payables Cash generated from operations Employees' end of service benefits paid Income tax paid Net cash flows generated from operating activities 2020 BD'000 2019 BD'000 10,038.00 5,581.00 118,158.00 80,345.00 1,766.00 1,581.00 59.00 92.00 2,994.00 2,734.00 (253.00) 7,186.00 1,014.00 4,269.00 (768.00) (791.00) 19,707.00 (6,151.00) 40,108.00 195,810.00 22,458.00 114,317.00 Difference 4,457 37,813 185 (33) 3,247 (4,452) (3,255) 23 25,858 17,650 81,493 (18,409.00) 44,982.00 (63,391) 21,325.00 (12,649.00) 33,974 (69,035.00) 46,103.00 (115,138) 129,691.00 192,753.00 (63,062) (1,774.00) (1,631.00) (143) (263.00) (33.00) (230) 127,654.00 191,089.00 (63,435) Change (%) 79.86% 47.06% 11.70% -35.87% -1283.40% -61.95% -76.25% -2.91% -420.39% 78.59% 71.29% -140.93% -268.59% -249.74% -32.72% 8.77% 696.97% -33.20%

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

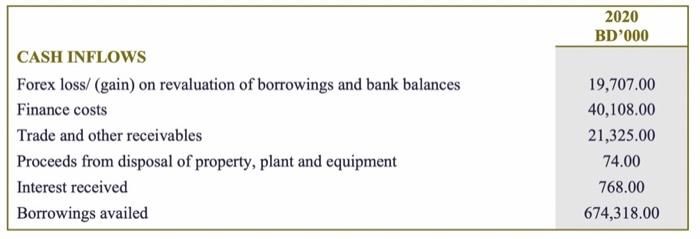

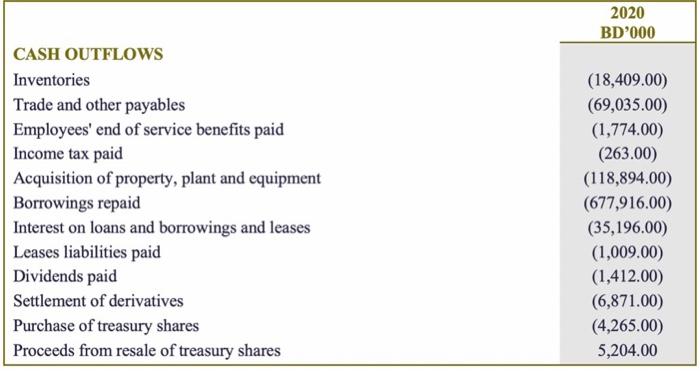

In detail analyze and compare the cash flow statement for Company X from 2019 to 2020 From the cash flow statement we can see that the companys overall cash position has improved from 2019 to 2020 The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started