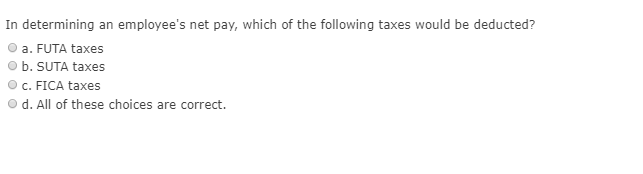

In determining an employee's net pay, which of the following taxes would be deducted? a. FUTA taxes b. SUTA taxes c. FICA taxes d.

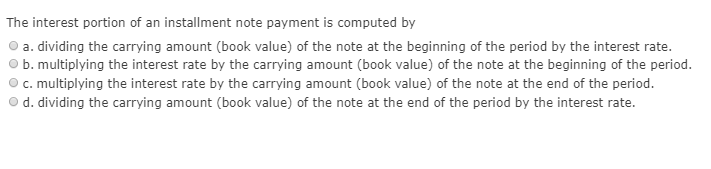

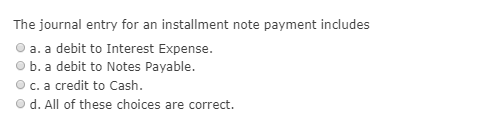

In determining an employee's net pay, which of the following taxes would be deducted? a. FUTA taxes b. SUTA taxes c. FICA taxes d. All of these choices are correct. The interest portion of an installment note payment is computed by a. dividing the carrying amount (book value) of the note at the beginning of the period by the interest rate. b. multiplying the interest rate by the carrying amount (book value) of the note at the beginning of the period. c. multiplying the interest rate by the carrying amount (book value) of the note at the end of the period. d. dividing the carrying amount (book value) of the note at the end of the period by the interest rate. The journal entry for an installment note payment includes a. a debit to Interest Expense. b. a debit to Notes Payable. c. a credit to Cash. d. All of these choices are correct.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 d All of these choices are correct Answer 2 b multiplying th...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started