Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In doing a five-year analysis of future dividends, the Dawson Corporation is considering the following two plans. The values represent dividends per share. Use Appendix

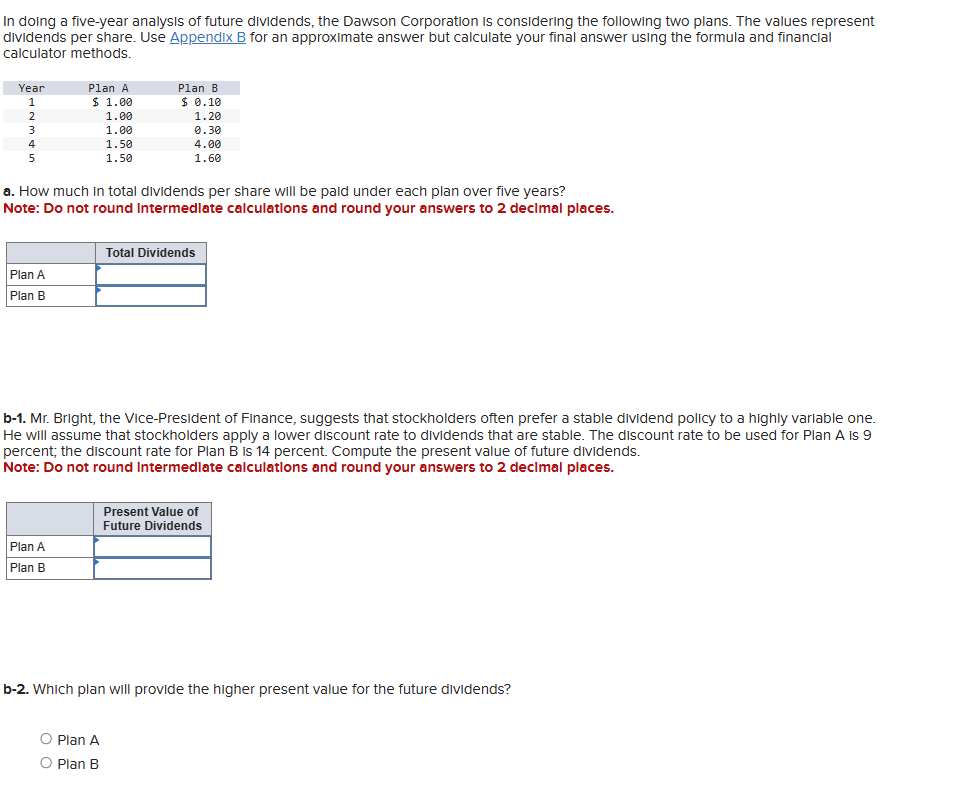

In doing a five-year analysis of future dividends, the Dawson Corporation is considering the following two plans. The values represent dividends per share. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. How much in total dividends per share will be paid under each plan over five years? Note: Do not round Intermedlate calculations and round your answers to 2 declmal places. b-1. Mr. Bright, the Vice-President of Finance, suggests that stockholders often prefer a stable dividend policy to a highly varlable one. He will assume that stockholders apply a lower discount rate to dividends that are stable. The discount rate to be used for Plan A is 9 percent; the discount rate for Plan B is 14 percent. Compute the present value of future dividends. Note: Do not round Intermedlate calculations and round your answers to 2 declmal places. b-2. Which plan will provide the higher present value for the future dividends? Plan A Plan B

In doing a five-year analysis of future dividends, the Dawson Corporation is considering the following two plans. The values represent dividends per share. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. How much in total dividends per share will be paid under each plan over five years? Note: Do not round Intermedlate calculations and round your answers to 2 declmal places. b-1. Mr. Bright, the Vice-President of Finance, suggests that stockholders often prefer a stable dividend policy to a highly varlable one. He will assume that stockholders apply a lower discount rate to dividends that are stable. The discount rate to be used for Plan A is 9 percent; the discount rate for Plan B is 14 percent. Compute the present value of future dividends. Note: Do not round Intermedlate calculations and round your answers to 2 declmal places. b-2. Which plan will provide the higher present value for the future dividends? Plan A Plan B Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started