Answered step by step

Verified Expert Solution

Question

1 Approved Answer

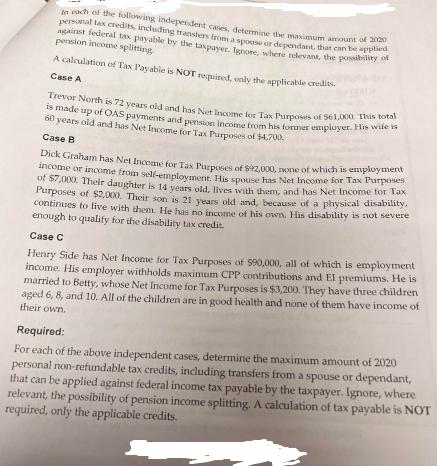

In each of the following independent cases, determine the maximum amount of 2000 personal tax credits, including transfers from a spouse or dependant, that

In each of the following independent cases, determine the maximum amount of 2000 personal tax credits, including transfers from a spouse or dependant, that can be applied against federal tax payable by the taxpayer. Ignore, where relevant, the possibility of pension income splitting A calculation of Tax Payable is NOT required, only the applicable credits. Case A Trevor North is 72 years old and has Net Income for Tax Purposes of 561,000. This is is made up of OAS payments and pension income from his former employer. His wife is 60 years old and has Net Income for Tax Purposes of $4,700. Case B Dick Graham has Net Income for Tax Purposes of $92,000, none of which is employment income or income from self-employment. His spouse has Net Income for Tax Purposes of $7,000. Their daughter is 14 years old, lives with them, and has Net Income for Tax Purposes of $2,000. Their son is 21 years old and, because of a physical disability. continues to live with them. He has no income of his own. His disability is not severe enough to qualify for the disability tax credit. Case C Henry Side has Net Income for Tax Purposes of $90,000, all of which is employment income. His employer withholds maximum CPP contributions and El premiums. He is married to Betty, whose Net Income for Tax Purposes is $3,200. They have three children aged 6, 8, and 10. All of the children are in good health and none of them have income of their own. Required: For each of the above independent cases, determine the maximum amount of 2020 personal non-refundable tax credits, including transfers from a spouse or dependant, that can be applied against federal income tax payable by the taxpayer. Ignore, where relevant, the possibility of pension income splitting. A calculation of tax payable is NOT required, only the applicable credits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure lets calculate the maximum amount of 2020 personal nonrefundable tax credits ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started