Answered step by step

Verified Expert Solution

Question

1 Approved Answer

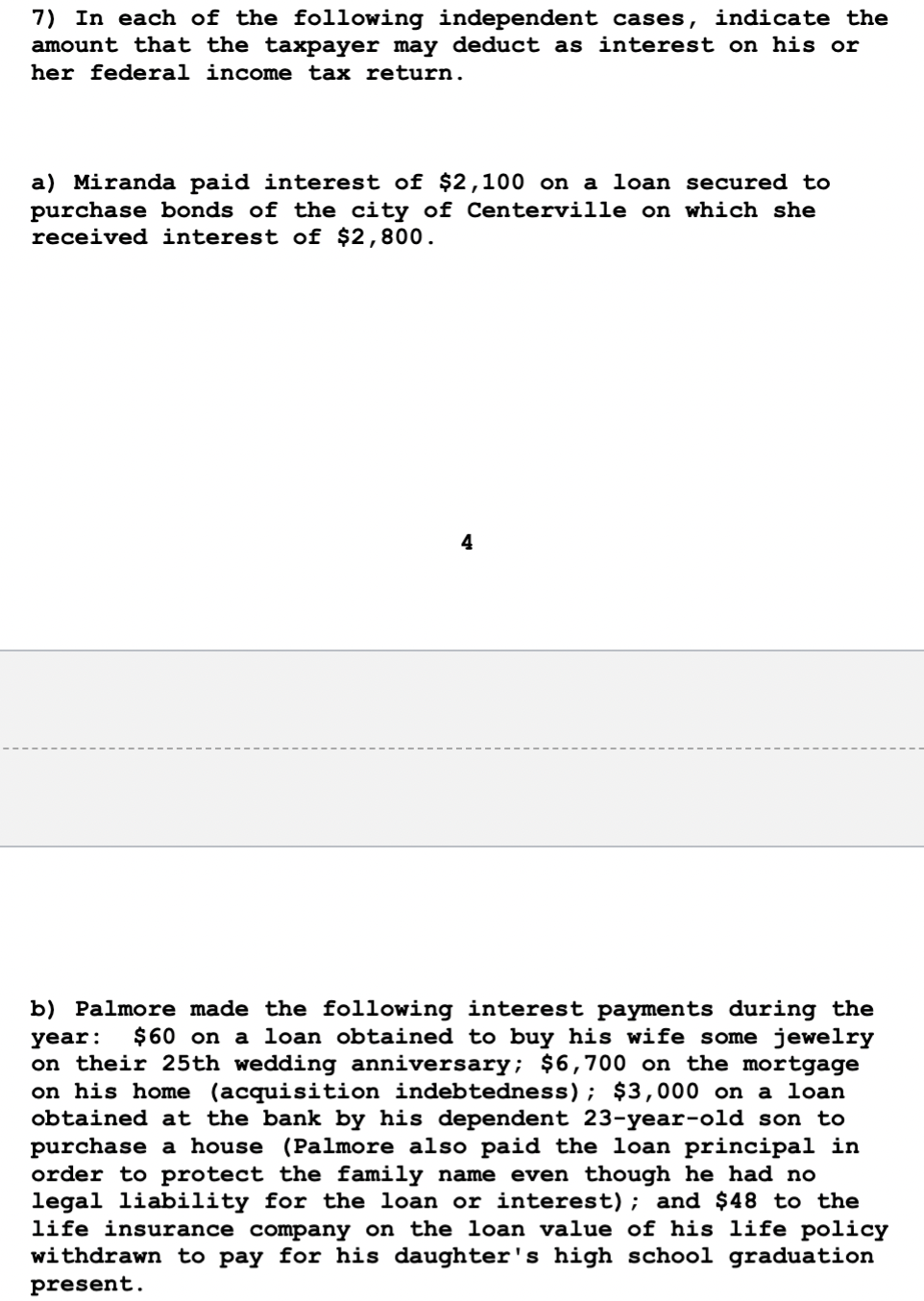

In each of the following independent cases, indicate the amount that the taxpayer may deduct as interest on his or her federal income tax return.

In each of the following independent cases, indicate the

amount that the taxpayer may deduct as interest on his or

her federal income tax return.

a Miranda paid interest of $ on a loan secured to

purchase bonds of the city of Centerville on which she

received interest of $

b Palmore made the following interest payments during the

year: $ on a loan obtained to buy his wife some jewelry

on their th wedding anniversary; $ on the mortgage

on his home acquisition indebtedness; $ on a loan

obtained at the bank by his dependent yearold son to

purchase a house Palmore also paid the loan principal in

order to protect the family name even though he had no

legal liability for the loan or interest; and $ to the

life insurance company on the loan value of his life policy

withdrawn to pay for his daughter's high school graduation

present.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started