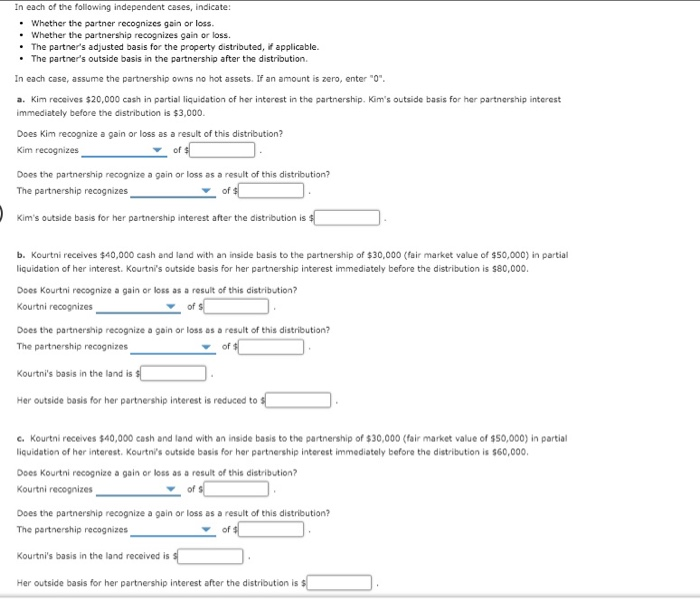

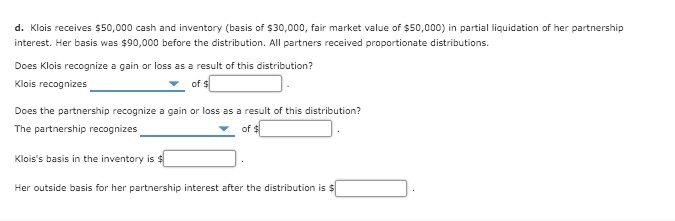

In each of the following independent cases, indicate: . Whether the partner recognizes gain or loss. Whether the partnership recognizes gain or loss. The partner's adjusted basis for the property distributed, it applicable. The partner's outside basis in the partnership after the distribution. In each case, assume the partnership owns no hot assets. If an amount is zero, enter "o". a. Kim receives $20,000 cash in partial liquidation of her interest in the partnership. Kim's outside basis for her partnership interest immediately before the distribution is $3,000. Does Kim recognize a gain or loss as a result of this distribution? Kim recognizes of Does the partnership recognize a gain or loss as a result of this distribution? The partnership recognizes Kim's outside basis for her partnership interest after the distribution is $ b. Kourtni receives $40,000 cash and land with an inside basis to the partnership of $30,000 (fair market value of $50,000) in partial liquidation of her interest. Kourtni's outside basis for her partnership interest immediately before the distribution is $80,000 Does Kourtni recognize a gain or loss as a result of this distribution? Kourtni recognizes of S Does the partnership recognize a gain or loss as a result of this distribution? The partnership recognizes Kourtni's basis in the land is s Her outside basis for her partnership interest is reduced to s c. Kourtni receives $40,000 cash and land with an inside basis to the partnership of $30,000 (fair market value of $50,000) in partial liquidation of her interest. Kourtni's outside basis for her partnership interest immediately before the distribution is $60,000, Does Kourtni recognize a gain or loss as a result of this distribution? Kourtni recognizes of Does the partnership recognize a gain or loss as a result of this distribution? The partnership recognizes Kourtni's basis in the land received iss Her outside basis for her partnership interest after the distribution is $ d. Klois receives $50,000 cash and inventory (basis of $30,000, fair market value of $50,000) in partial liquidation of her partnership interest. Her basis was $90,000 before the distribution. All partners received proportionate distributions. Does Klois recognize a gain or loss as a result of this distribution? Klois recognizes of $ Does the partnership recognize a gain or loss as a result of this distribution? The partnership recognizes of $ Klois's basis in the inventory is $ Her outside basis for her partnership interest after the distribution is $