Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In each of the following problems, determine whether the transaction(s) constitutes a sale or a lease for federal income tax purposes. royalty in his working

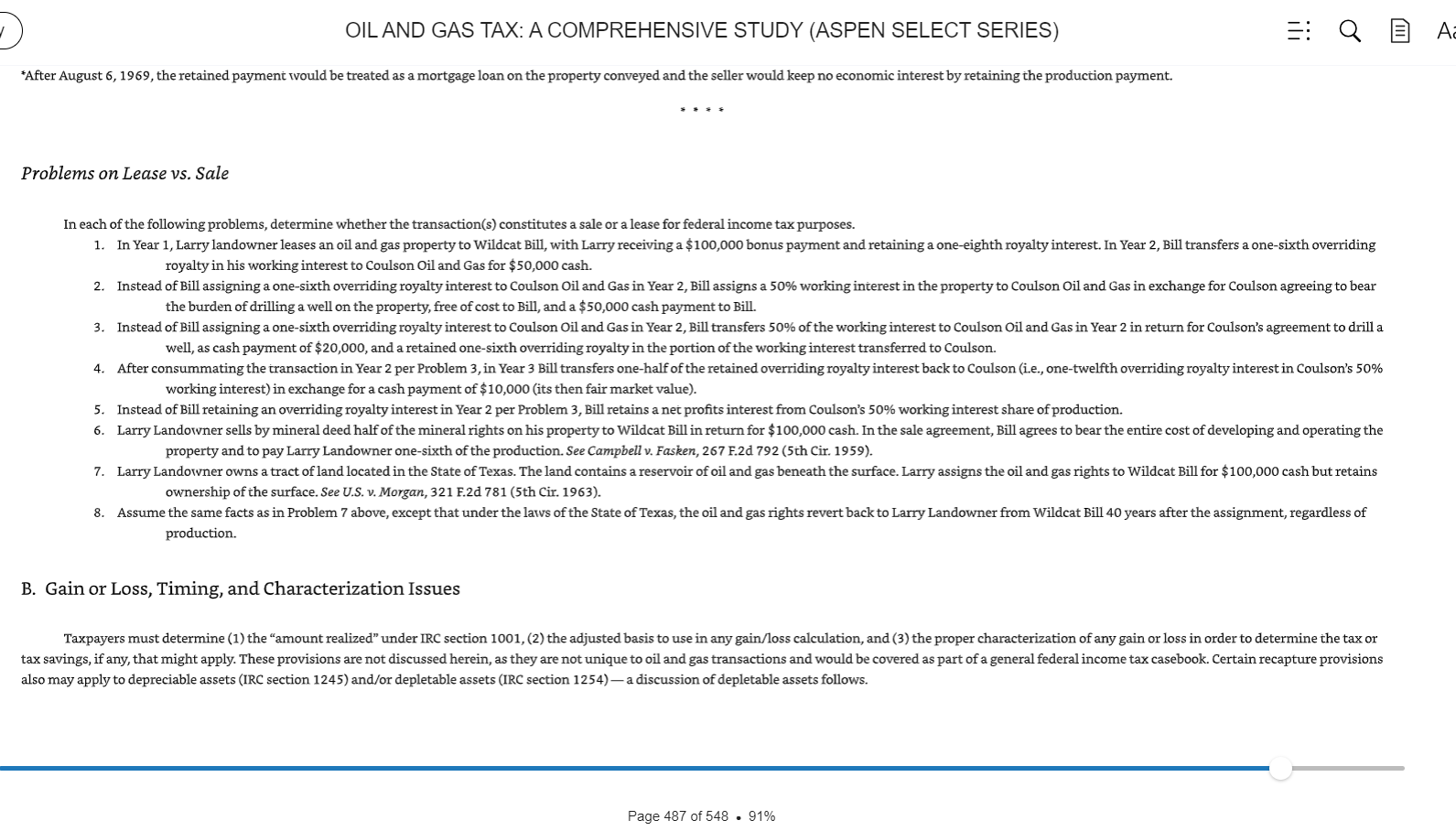

In each of the following problems, determine whether the transaction(s) constitutes a sale or a lease for federal income tax purposes. royalty in his working interest to Coulson Oil and Gas for $50,000 cash. the burden of drilling a well on the property, free of cost to Bill, and a $50,000 cash payment to Bill. well, as cash payment of $20,000, and a retained one-sixth overriding royalty in the portion of the working interest transferred to Coulson. working interest) in exchange for a cash payment of $10,000 (its then fair market value). 5. Instead of Bill retaining an overriding royalty interest in Year 2 per Problem 3, Bill retains a net profits interest from Coulson's 50% working interest share of production. property and to pay Larry Landowner one-sixth of the production. See Campbell v. Fasken, 267 F.2d 792 (5th Cir. 1959). ownership of the surface. See U.S. v. Morgan, 321 F.2d 781 (5th Cir. 1963). production. B. Gain or Loss, Timing, and Characterization Issues also may apply to depreciable assets (IRC section 1245) and/or depletable assets (IRC section 1254) a discussion of depletable assets follows

In each of the following problems, determine whether the transaction(s) constitutes a sale or a lease for federal income tax purposes. royalty in his working interest to Coulson Oil and Gas for $50,000 cash. the burden of drilling a well on the property, free of cost to Bill, and a $50,000 cash payment to Bill. well, as cash payment of $20,000, and a retained one-sixth overriding royalty in the portion of the working interest transferred to Coulson. working interest) in exchange for a cash payment of $10,000 (its then fair market value). 5. Instead of Bill retaining an overriding royalty interest in Year 2 per Problem 3, Bill retains a net profits interest from Coulson's 50% working interest share of production. property and to pay Larry Landowner one-sixth of the production. See Campbell v. Fasken, 267 F.2d 792 (5th Cir. 1959). ownership of the surface. See U.S. v. Morgan, 321 F.2d 781 (5th Cir. 1963). production. B. Gain or Loss, Timing, and Characterization Issues also may apply to depreciable assets (IRC section 1245) and/or depletable assets (IRC section 1254) a discussion of depletable assets follows Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started