Question

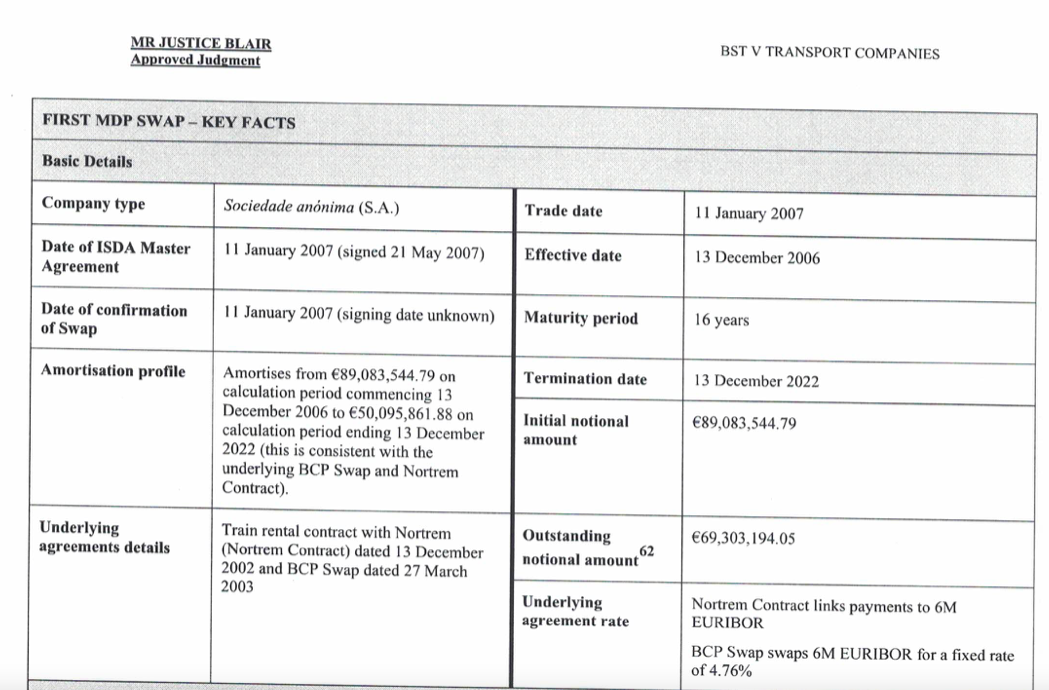

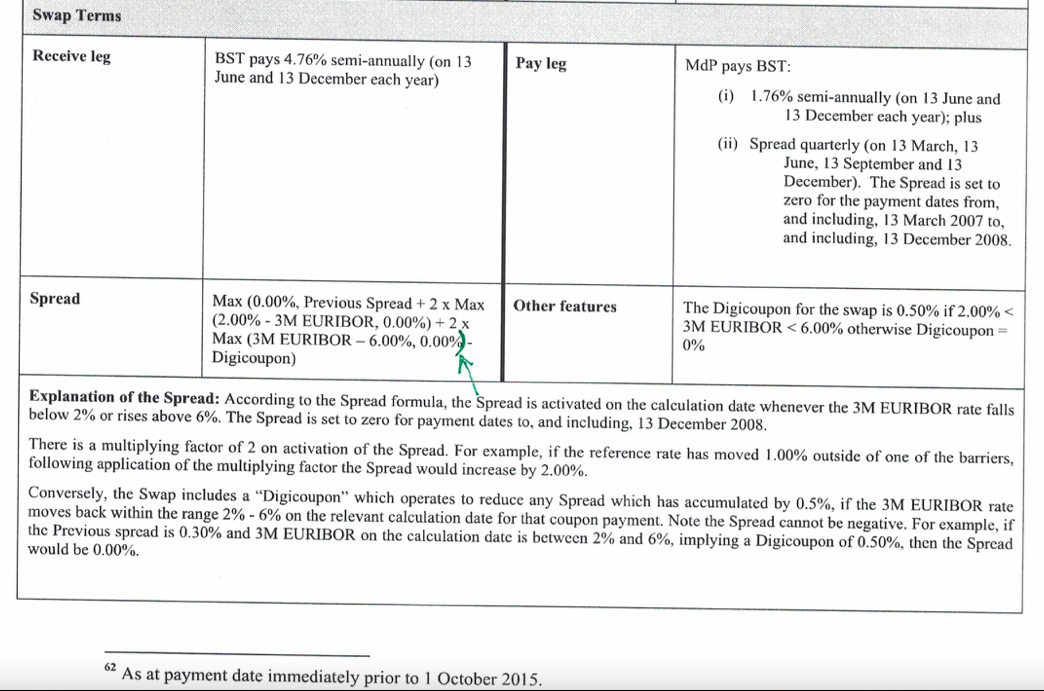

In early 2007, the publicly-owned railway in the Portugese city of Porto, Metro do Porto (MdP), entered into an exotic interest rate swap with the

In early 2007, the publicly-owned railway in the Portugese city of Porto, Metro do Porto (MdP), entered into an exotic interest rate swap with the Spanish bank, Banco Santander (BST) that came to be referred to as a snowball swap. This swap, along with similar swaps promoted by BST, would later become the subject of litigation when MdP and other counterparties defaulted on their obligations during 2013.

Refer to the Approved Judgement for precise details on the terms of MdPs swap, and in particular, how the spread on the floating rate leg was determined.

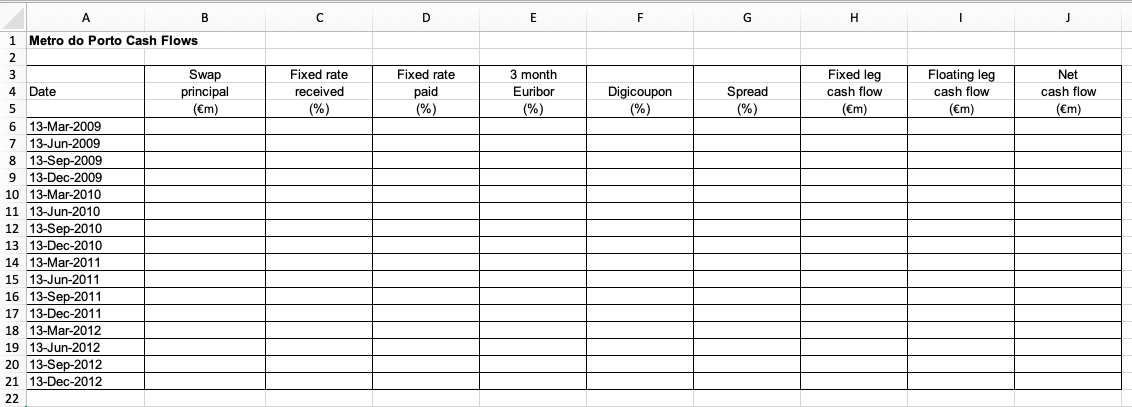

The spread on the floating rate leg of the swap was related to three-month Euribor. Historical data on the level of this benchmark interest rate at quarterly intervals between 13 March 2009 and 13 December 2012 are as follows:

| Date | 3mEuribor |

| 13 March 2009 | 2.100% |

| 13 June 2009 | 1.640% |

| 13 September 2009 | 1.268% |

| 13 December 2009 | 0.773% |

| 13 March 2010 | 0.714% |

| 13 June 2010 | 0.649% |

| 13 September 2010 | 0.719% |

| 13 December 2010 | 0.879% |

| 13 March 2011 | 1.026% |

| 13 June 2011 | 1.173% |

| 13 September 2011 | 1.471% |

| 13 December 2011 | 1.528% |

| 13I"1arch 2012 | 1.426% |

| 133une 2012 | 0.876% |

| 13 September 2012 | 0.662% |

| 13 December 2012 | 0.252% |

- Complete Template B showing the interest rates and periodic cash flowsdue to be paid and received by MdP under the swap between 13 March 2009and 13 December 2012. You should assume that the notional principal of the swap amortises on a straight-line basis between 13 December 2006 and 13 December 2022; refer to the Approved Judgement for details.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started