In early 2014, Paul Bills, CFO of Harvard Business Publishing (HBP), sat down with David Wan, the companys CEO, to discuss budget preparations for the

In early 2014, Paul Bills, CFO of Harvard Business Publishing (HBP), sat down with David Wan, the company’s CEO, to discuss budget preparations for the coming year. Bills noted that the performance of Corporate Learning, one of HBP’s three business units, would be affected by a business model change for its largest product that required a change in the timing of revenue recognition. Corporate Learning was in the process of revamping its flagship product, Harvard Manage-Mentor (HMM) from version 11.0 (HMM11) to version 12.0 (HMM12). The revamped software would be hosted exclusively on HBP’s server rather than on its clients’ servers, allowing updates to take place continuously. Given the change, accounting standards required HBP to change the recognition of revenue from the date of software delivery (for HMM11) to ratable recognition over its contract life (for HMM12).

Revenue Recognition for HMM

Early in the redesign of HMM12, Bills recognized that the decision for HBP to host the software would affect how revenues were recognized from sales of the new product. For HMM11, the client hosted the software on its servers and was responsible for all maintenance and operating costs. Although HBP offered to fix any software bugs, there was no contractual obligation to provide updates/point releases. As a result, the full value of any multi-year licensing contracts was recognized as revenue when the software was delivered.

If the client chose to have HMM11 software hosted on HBP’s server, the contract specified that the client would pay HBP an upfront licensing fee and a separate hosting fee (equivalent to about 10% of the licensing fee) at the time the contract was signed. In the majority of contracts, the client paid a nonrefundable licensing fee. Some clients negotiated a Termination for Convenience (TFC) clause. Since the underlying product was not updated and clients had the option of hosting the software on their systems or on HBP systems (incurring a separate hosting fee), HBP recorded the full value of the licensing fees as revenue at the beginning of the contract period. In contrast, hosting fees were recorded as deferred revenues and recognized as revenue ratably over the life of the contract (terms were 1, 2, or 3 years).

The new business model for HMM12 eliminated the option for clients to host HMM software and introduced an ongoing obligation for HBP. Clients would continue to pay an upfront licensing fee, but since only HBP could host the software there was no separate hosting fee. The license fee gave the client access to the software, the hosting, and any future improvement releases over the contract period. Accordingly, the contract was analogous to a subscription, rather than an outright sale.

For accounting purposes, HBP was required to record the upfront license fee as deferred revenue on its balance sheet. At the end of each accounting period, it would recognize a portion of the deferred revenue as earned revenue in the income statement. For example, if a client paid $360,000 for a 3-year (i.e., 36-month) license period, at the time of the contract HBP would record the $360,000 as deferred revenue (a liability) and cash (an asset) on the balance sheet. At the end of the first quarter (i.e., 3- months), HBP would recognize $30,000 (i.e., $360,000 divided by 36 months times 3 months) as earned revenue with a corresponding $30,000 subtracted from the deferred revenue liability.

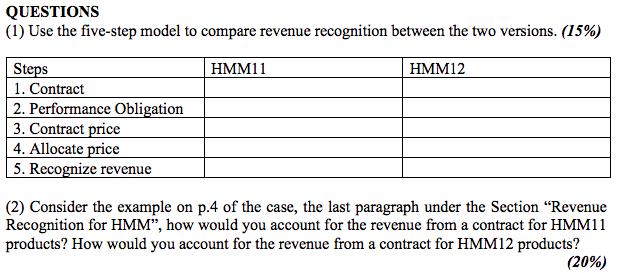

QUESTIONS (1) Use the five-step model to compare revenue recognition between the two versions. (15%) HMM12 Steps 1. Contract 2. Performance Obligation 3. Contract price 4. Allocate price 5. Recognize revenue HMM11 (2) Consider the example on p.4 of the case, the last paragraph under the Section "Revenue Recognition for HMM", how would you account for the revenue from a contract for HMM11 products? How would you account for the revenue from a contract for HMM12 products? (20%)

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1Fivestep model STEP 1CONTRACT HMM11 the client will have the option to host HMM11 on their system or HBP system client will be responsible for all maintenance and operating costs Although HBP offered ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started