Question

In early September 2020, the CEO of Aria Inc. asked its investment bank to initiate the sale process of the company. More than 10 potential

In early September 2020, the CEO of Aria Inc. asked its investment bank to initiate the sale process of the company. More than 10 potential strategic bidders showed interest, but after the initial non?binding offers, only two strategic bidders were retained for the final round. The

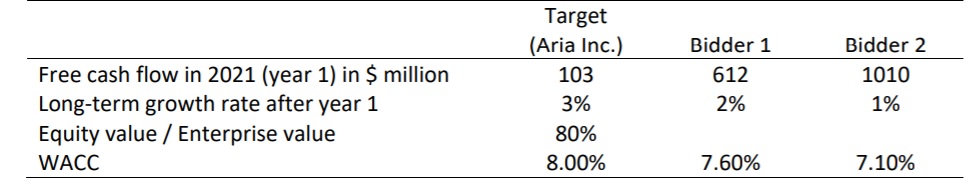

deadline of the binding offers was set to the end of 2020. The purchase agreement is expected to be signed with the winning bidder in early 2021 and announced to the market consequently. Potential synergies are bidder?specific (i.e., a given bidder does not know the synergies of the other bidder). The auction mechanism is a first?price auction (i.e., the winner is the one with the highest bid, and pays its own bid). The pre?offer stock price of the target is $75 (before the announcement of the merger agreement). Here are the characteristics of the target and companies involved in the final round:

After having integrated the target firm, Bidder 1 expects to have a long‐term growth rate of 2.45% (growth rate after year 1, and forever), while Bidder 2 expects to have a long‐term growth rate of 1.40% (growth rate after year 1, and forever). These long‐term growth rates imply that the net‐cash flow effect of the merger synergies will materialize after the first year and will be reflected in the acquiring firm's cash flows of year 2022, and onwards. The source of the synergy is the patent portfolio of Aria. (Remark: for simplicity, let's assume that the valuation is done at the end of year 2020, which is denoted year 0).

1) Which bidder is expected to win the auction and what will be the bid premium in dollar value and in percentage, if the bidders bid their highest valuation? Provide the detail of the different steps and your computation.

2) What will be the target stock price at the end of the announcement day if investors anticipate a likelihood of deal completion of 90%?

3) With the closing stock price on the announcement day computed in point 2, is there an arbitrage opportunity? If yes, what is the return in annual basis of the arbitrageur if the deal is successfully completed in four months?

Free cash flow in 2021 (year 1) in $ million Long-term growth rate after year 1 Equity value / Enterprise value WACC Target (Aria Inc.) Bidder 1 Bidder 2 103 612 1010 3% 2% 1% 80% 8.00% 7.60% 7.10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To determine which bidder is expected to win the auction and the bid premium we need to compare the valuations of the two bidders The winning bidder ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started