Answered step by step

Verified Expert Solution

Question

1 Approved Answer

in excel answers entered as formula Calibri Cells Editing - 11 AA B. -A = Alignment Number Conditional Format as Cell Formatting Table Styles B

in excel answers entered as formula

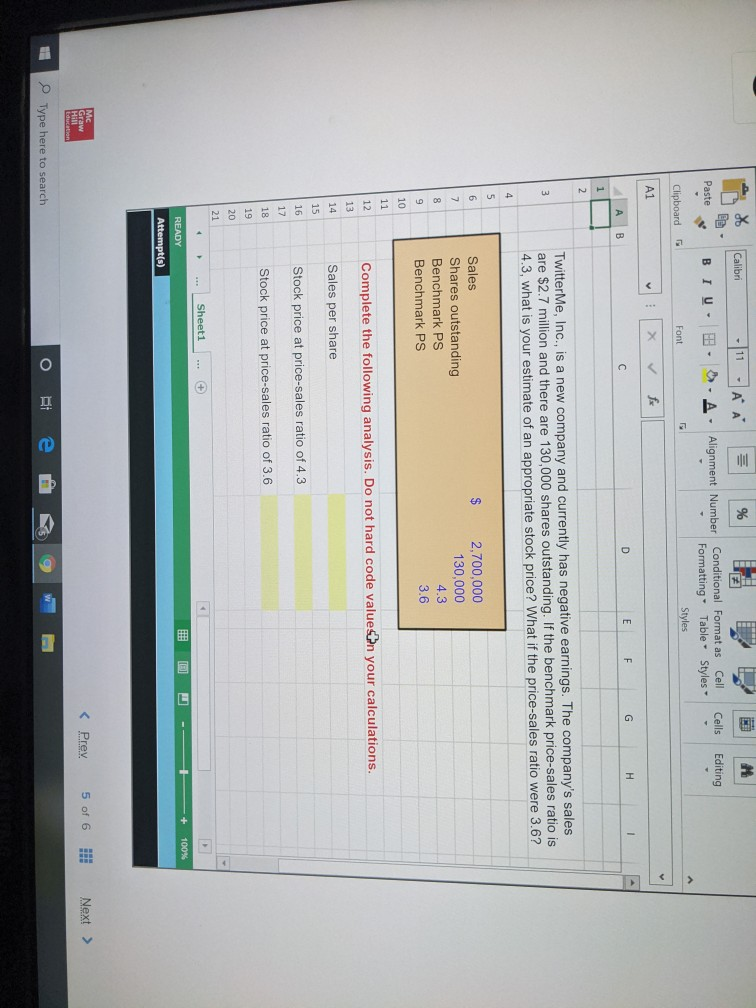

Calibri Cells Editing - 11 AA B. -A = Alignment Number Conditional Format as Cell Formatting Table Styles B Paste U. I Styles Font Clipboard H A1 E F G Twitter Me, Inc., is a new company and currently has negative earnings. The company's sales are $2.7 million and there are 130,000 shares outstanding. If the benchmark price-sales ratio is 4.3, what is your estimate of an appropriate stock price? What if the price-sales ratio were 3.6? $ Sales Shares outstanding Benchmark PS Benchmark PS 2,700,000 130,000 4.3 3.6 Complete the following analysis. Do not hard code valuestan your calculations. Sales per share Stock price at price-sales ratio of 4.3 Stock price at price-sales ratio of 3.6 Sheet1 - + READY Attempt(s) GAW ote @ R9W Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started